Praha – Čistý zisk Komerční banky (KB) v letošním prvním čtvrtletí stoupl meziročně o 49,3 procenta na 4,2 miliardy korun. Celkové výnosy se meziročně zvýšily o 3,5 procenta na 9,1 miliardy korun. Banka, jejímž většinovým vlastníkem je francouzská Société Générale, dnes neauditované konsolidované výsledky zveřejnila na webu.

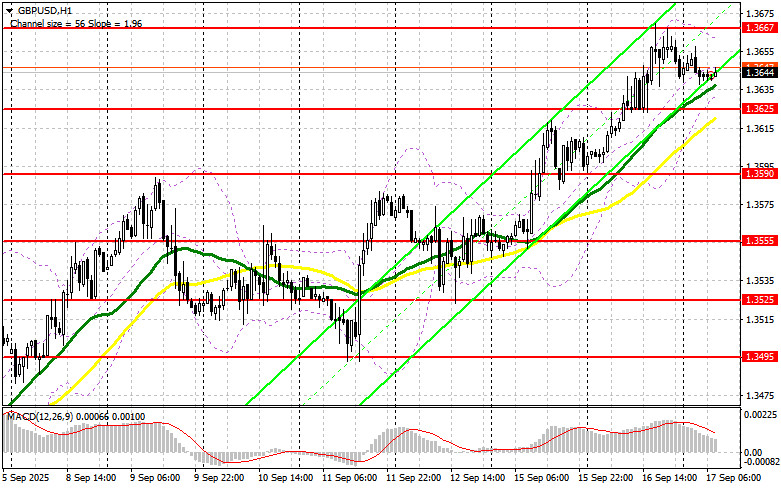

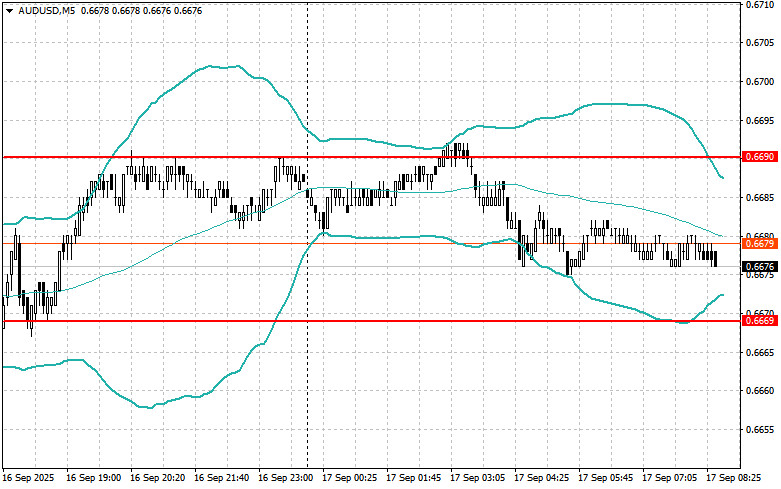

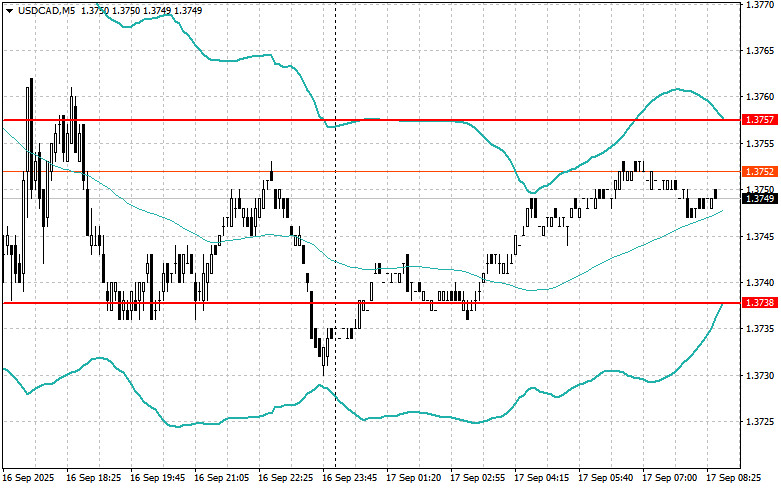

The US dollar continued to lose ground actively—a development that's easy to explain. There is growing talk in the market that the Fed will be forced to act more dovish, especially after the latest fundamental data from the US, which hardly gives dollar bulls any confidence.

Yesterday, strong data from Germany's ZEW institute, which indicated improving economic sentiment in the eurozone, led to a stronger euro. Investors saw this as a signal of potential regional economic stabilization, increasing interest in the European currency. However, the key factor influencing the FX market in the second half of the day was a shift in expectations around future Federal Reserve policy. This weakened dollar appeal, since lower interest rates make the currency less attractive to investors seeking higher yields. The dollar's decline, in turn, further strengthened the euro, pound, and other risk assets.

Today promises to be packed with events that could significantly impact FX trends. CPI reports for both the eurozone and the UK will be in focus, providing crucial insights into inflation dynamics. These figures will be key for assessing the monetary policy outlook of both the European Central Bank and the Bank of England.

Investors and analysts will be watching closely to see how the actual CPI results match expectations. If the readings beat forecasts, pressure on the ECB to halt further rate cuts will intensify, likely strengthening the euro. Conversely, lower-than-expected results could trigger the opposite reaction, weakening the euro.

An upside surprise in the UK CPI is likely to increase pressure on the BoE to take a more cautious approach—this may strengthen the pound, as the prospect of higher yields on sterling assets enhances their investment appeal. On the other hand, weaker-than-forecast inflation could relieve pressure on the BoE and lead to a lower pound.

Thus, today's inflation data will be a key factor in defining the next trajectory for both the euro and the pound. Traders and investors are advised to pay close attention to these releases and be ready to react swiftly to any significant deviations from forecasts.

If the data matches economists' expectations, it's best to use a Mean Reversion strategy. If the data comes in much higher or lower than expected, a Momentum strategy is most appropriate.

QUICK LINKS