The demand for gold remains strong amid growing expectations of a U.S. rate cut this December.

Expectations of a more accommodative monetary policy from the U.S. Federal Reserve are boosting investor interest in gold, a traditionally safe-haven asset during times of economic uncertainty and declining interest rates. Gold, which does not yield interest income, becomes more attractive relative to alternative investments such as bonds when their yields fall. Additionally, the current weakness of the U.S. dollar makes gold more accessible to buyers using other currencies, further boosting demand. However, it is important to note that the dynamics of gold prices are influenced by numerous factors, and expectations of rate cuts in the U.S. are just one of them.

Platinum also rose after the Chinese exchange launched futures contracts for the metal, boosting optimism about demand in the country. Spot prices in London rose by 3.8%, reaching almost $1,650 per ounce, the highest level in over a month. In China, June delivery futures increased by 12% but then experienced a slight decline.

In a statement, the exchange said that the new contracts with physical settlements are aimed at both institutional and retail investors, broadening the pool of participants. The exchange will also publish daily inventory data, providing a rare opportunity to assess the current situation in one of the largest markets for this metal.

Ahead of the launch, China imported 10.2 tons of platinum in October, more than double the volume for the same month last year. This year, platinum has risen by more than 70%, overall following silver's dynamics but significantly outperforming gold. The market is preparing for the third annual deficit amid supply disruptions in South Africa, the largest producer. Additionally, there are rumors that the U.S. may impose tariffs on this metal, attracting ounces to the country and tightening conditions in other countries.

Regarding other metals, silver fell by 1% after Wednesday's 3.7% rise, approaching record levels. Palladium also decreased in price.

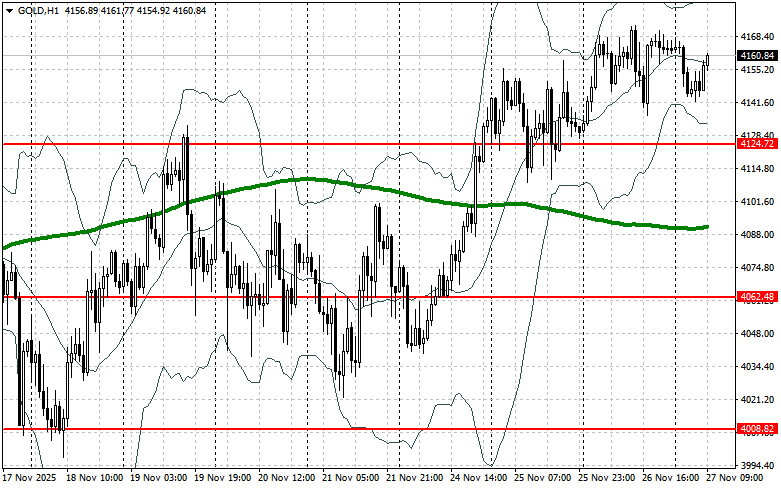

In terms of the current technical picture for gold, buyers need to break through the nearest resistance at $4,186. This will set the target at $4,249, above which it will be quite challenging to penetrate. The furthest target will be the area around $4,304. In the event of a decline in gold, bears will attempt to gain control over $4,124. If successful, a breakout of this range will deal a serious blow to the positions of bulls and push gold down to a minimum of $4,062, with the potential to approach $4,008.

QUICK LINKS