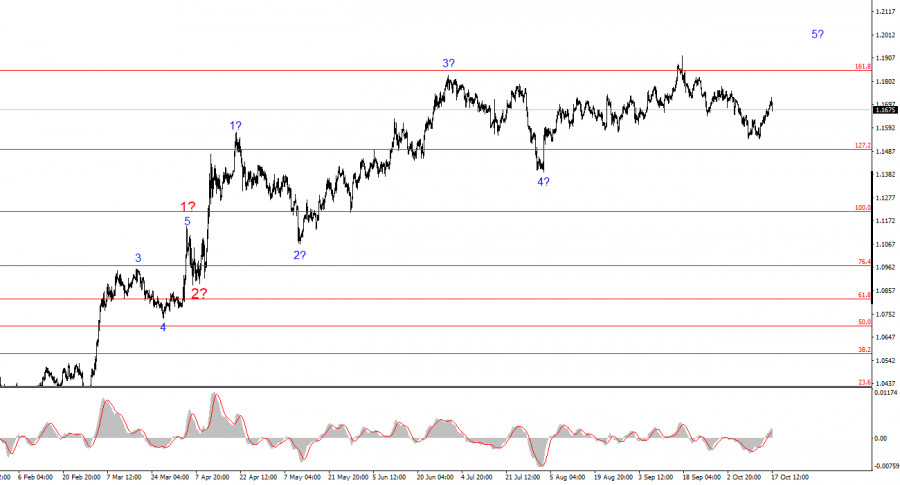

The wave pattern on the 4-hour chart of the EUR/USD instrument has been updated. It is still too early to draw conclusions about the cancellation of the upward trend section, but the recent decline in the euro has made it necessary to clarify the wave pattern. Thus, we now see a series of three-wave structures a-b-c. It can be assumed that these are part of the larger wave 4 of the upward trend section. In this case, wave 4 has taken on an unnaturally extended form, but overall the wave structure remains coherent.

The formation of the upward trend section continues, and the news background continues to support, for the most part, not the dollar. The trade war initiated by Donald Trump goes on. The confrontation with the Fed continues. The market's "dovish" expectations for Fed rates are increasing. The U.S. government "shutdown" continues. The market's assessment of Donald Trump's performance in the first 7–8 months remains quite low, even though economic growth in the second quarter was nearly 4%.

In my opinion, the formation of the upward trend section is not yet complete. Its targets extend up to the 1.25 level. Based on this, the euro may continue to decline for some time without any real justification (as in the past three weeks). However, the wave pattern will still remain intact.

The EUR/USD pair fell by 20 basis points on Friday, which cannot be considered a major change. Today, the news background was entirely political — and entirely about the United States. The government "shutdown" continues, and many analysts have started talking about a new record duration of the government and public sector closure, even though just a week ago they were confident it would last "a couple of weeks." However, Donald Trump continues to stand his ground, and the Democrats theirs. Voting on the budget in the U.S. Senate is beginning to resemble a casino, where a player bets on a certain number hoping that this time luck will be on their side. Similarly, Republicans keep initiating new votes, hoping that luck will eventually favor them.

The Democrats continue to insist on preserving all healthcare and social programs for low-income Americans, which Donald Trump has significantly cut under his "One Big, Beautiful Law." Trump and his team continue to hold their position — first the budget must be approved, then negotiations on subsidies can begin. However, trusting Trump is like believing in the arrival of extraterrestrials. Time and again, the world witnesses new promises from the U.S. president that are never fulfilled — and then Trump simply says he was misunderstood or that he was joking. By the end of the week, the dollar slightly improved its position, but at this point, a new upward wave series may already be forming.

Based on the EUR/USD analysis, I conclude that the instrument continues to form an upward trend section. The wave pattern still entirely depends on the news background — specifically, decisions made by Trump and the domestic and foreign policies of the new White House administration. The targets for the current trend section may extend up to the 1.25 level. At this time, we can observe the formation of corrective wave 4, which is nearing completion but has taken a very complex and extended form. Therefore, in the near term, I still only consider buying positions. By the end of the year, I expect the euro to rise to 1.2245, which corresponds to 200.0% on the Fibonacci scale.

At a smaller scale, the entire upward trend section is visible. The wave pattern is not the most standard, since the corrective waves vary in size. For example, the larger wave 2 is smaller than the internal wave 2 within wave 3. However, this also happens. I would remind you that it is best to identify clear and understandable structures on the charts, rather than try to account for every wave. At present, the upward structure leaves little room for doubt.

Key Principles of My Analysis:

PAUTAN SEGERA