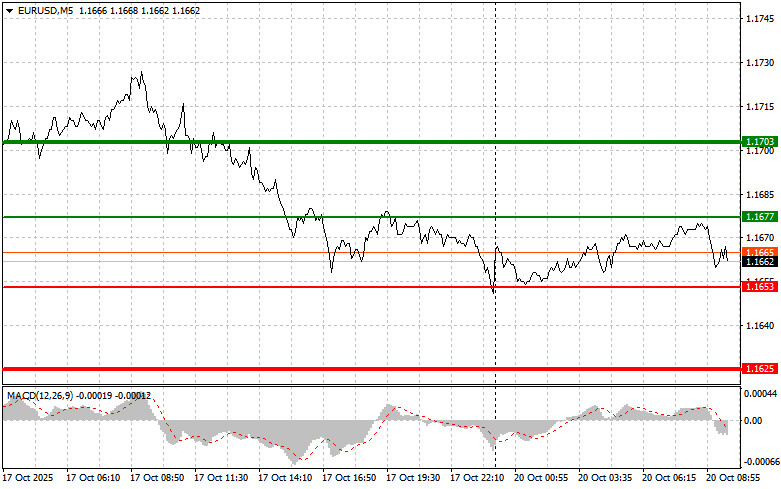

The price test at 1.1684 occurred when the MACD indicator had already deviated significantly below the zero mark, which limited the pair's downside potential. For this reason, I did not sell the euro. A bounce buy at 1.1658 allowed me to secure around 15 pips of profit.

Friday's eurozone inflation data did not significantly aid the euro's growth. Focus now shifts to Germany's Producer Price Index and the European Central Bank current account balance. In addition, a speech by Germany's central bank president, Joachim Nagel, is scheduled.

An increase in German producer prices often precedes a rise in consumer prices, which in turn affects the ECB's monetary policy. These figures are expected to provide insight into the state of Germany's manufacturing sector and future inflation dynamics.

The ECB's current account balance reflects the difference between incoming and outgoing financial flows from the eurozone's current transactions. A positive balance indicates stronger exports and investment inflows. This data helps evaluate the eurozone's competitiveness and its structural strengths or imbalances. Weak data may temporarily pressure the euro.

A speech by Bundesbank President Joachim Nagel traditionally draws market attention. His remarks on current economic conditions, inflation expectations, and ECB monetary policy can significantly influence the euro's exchange rate and trader sentiment. Market participants will closely analyze any hints of upcoming policy changes based on fresh economic reports.

Regarding intraday strategy, I plan to follow primarily Scenarios 1 and 2.

Scenario 1: I will consider buying the euro at around 1.1677 (green line on the chart) with a target of 1.1703. I plan to exit the market near 1.1703 and initiate a short position in the opposite direction, expecting a 30–35 pip correction from the entry point. Note: Before buying, ensure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario 2: I'll also buy the euro if there are two consecutive tests of the 1.1653 level, while MACD is in the oversold zone. This setup limits the euro's downside potential and may trigger an upward reversal. Target levels are 1.1677 and 1.1703.

Scenario 1: I plan to sell the euro once it reaches the 1.1653 level (red line on the chart), aiming for a decline to 1.1625. I'll then look to buy again at that level, expecting a reverse movement of 20–25 pips. Weak data could renew pressure on the pair. Note: Before selling, confirm the MACD is below zero and just beginning its downward move.

Scenario 2: I will also sell in case of two consecutive tests of the 1.1677 level while the MACD is in the overbought zone. This limits upside potential and could signal a reversal downward. Expected downside levels are 1.1653 and 1.1625.

Important Notice for Beginner Traders:

Beginner Forex traders must be extremely cautious when entering the market. It is best to stay out of the market before the release of important fundamental reports to avoid sharp price moves. If you choose to trade during news events, always place stop-loss orders to minimize losses. Without stop-loss protection, you risk quickly losing your entire deposit—especially if you lack proper money management and use large trade volumes.

Always remember that successful trading requires a clear trading plan, such as the one presented above. Making spontaneous trading decisions based on the current market situation is a losing strategy for intraday traders.

PAUTAN SEGERA