Indická centrální banka výrazně snížila svou základní úrokovou sazbu z 6 % na 5,5 %, což je nejnižší úroveň od srpna 2022.

Jedná se také o třetí snížení sazeb v řadě od února a výsledek je nižší než medián odhadů 5,75 % v průzkumu agentury Reuters.

Rozhodnutí bylo přijato po lepších než očekávaných údajích o růstu HDP za čtvrté fiskální čtvrtletí, kdy ekonomika meziročně vzrostla o 7,4 %, zatímco ekonomové oslovení agenturou Reuters odhadovali růst ve výši 6,7 %.

The headline consumer price inflation rate in January fell slightly to 2.3% year-on-year, one tenth below economists' forecasts. The core index slowed even more, from 2.8% to 2.6%, and the median inflation gauge tracked by the Bank of Canada moved noticeably below the 2% target, yet the market barely reacted to the slowdown in inflation.

Compared with prices during the tax holidays introduced in mid-December 2024, prices have risen noticeably in categories affected by the temporary VAT relief. Recent monthly trends point to further price declines, and Canadian bond yields fell after the release. At the same time, it should be remembered that the mechanical effect of the VAT increase on year-on-year inflation will fade next month, after which the removal of the consumer portion of the carbon tax will push prices up. This may be why the market's reaction was muted: traders appear to view the published index as not fully representative and not likely to prompt a decisive response from the Bank of Canada.

Meanwhile, the US durable goods orders report for September came in better than expected, registering a 1.4% decline versus a forecasted -2%, and, notably, showed the first signs that the non-tech sector has finally begun to recover. Production of high-technology goods, including computers, telecommunications equipment, and semiconductors, rose almost 9% as of January, while production of non-energy goods excluding those components grew just 2.2%. We may be seeing early signs of a shift in the real sector under the new Trump policy aimed at supporting domestic manufacturing: last year's import growth was driven mainly by high-tech equipment, and non-tech import categories have since lost momentum.

Overall, the durable goods report can be viewed as positive for the dollar, which made another attempt to recover some losses, but in the long run, nothing has changed yet. It will be necessary to wait for Friday's PCE report to gauge domestic demand dynamics, which so far look resilient; that report will largely determine how the dollar closes out the week.

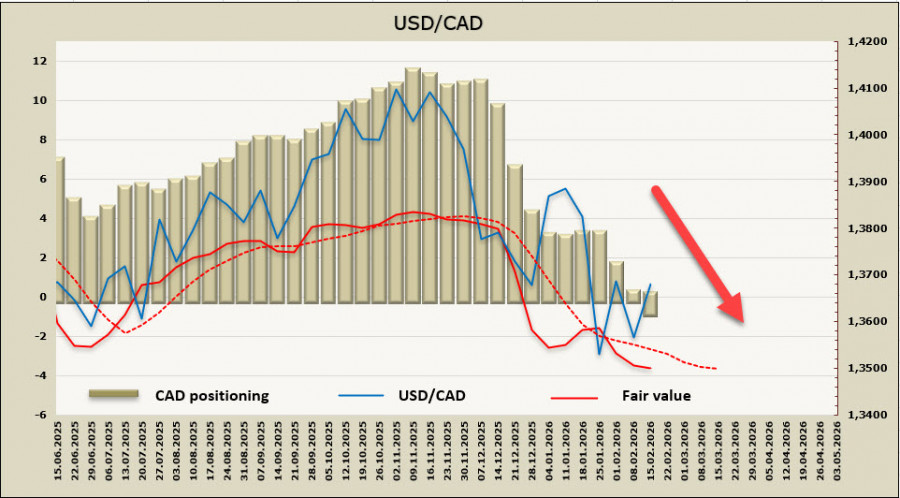

Speculative positioning in CAD is close to neutral with a slight bullish tilt: over the week, net long positioning rose by $0.8 billion to $1.0 billion. The implied price remains below the long-term average and is trending downward.

A week ago, we noted an increased probability of a resumption of the move to the downside, but the correction has extended. Resistance at 1.3722 held. If the pair trades below that level, any upside should be considered corrective, and we assume the resistance will not be breached. We expect a resumption of the decline toward 1.3419.

PAUTAN SEGERA