Tchajwanská společnost TSMC v úterý uvedla, že americká cla mají určitý dopad na společnost a že o nich již jednala s Washingtonem, ale poptávka po umělé inteligenci (AI) zůstává silná a nadále převyšuje nabídku.

Generální ředitel C.C. Wei na výroční valné hromadě akcionářů TSMC v severotchajwanském městě Hsinchu uvedl, že společnost nezaznamenala žádné změny v chování zákazníků v důsledku nejistoty ohledně cel a že situace by se mohla v příštích měsících vyjasnit.

„Cla mají na TSMC určitý dopad, ale ne přímo. Cla se totiž ukládají dovozcům, nikoli vývozcům. TSMC je vývozce. Cla však mohou vést k mírnému zvýšení cen, a když ceny stoupnou, může klesnout poptávka,“ uvedl.

*) see also: InstaForex Trading Indicators for XAU/USD

This week's investor focus is on the ADP jobs report for the US private sector in January, which is particularly significant given current conditions. Due to the partial shutdown of the US government, the publication of the official Non-Farm Payrolls (NFP) report has been delayed, making ADP data the primary benchmark for assessing the labor market.

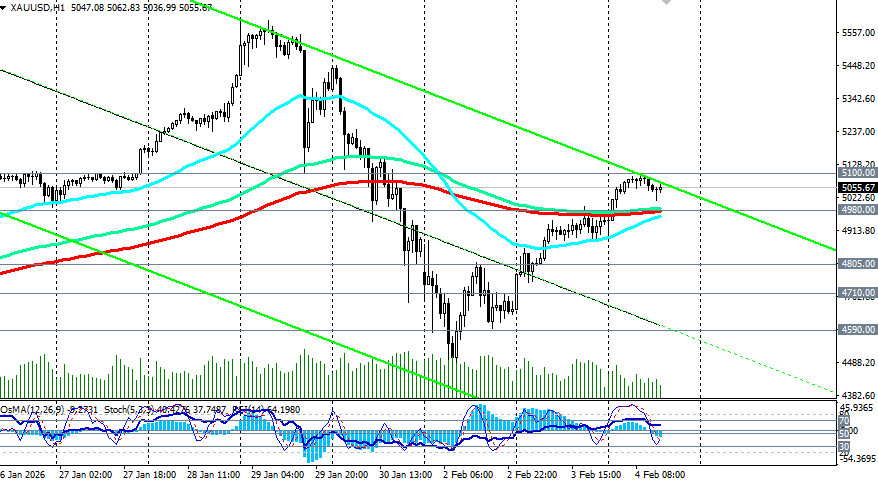

The XAU/USD pair continues to trade above the round number of 5000.00, moving within the range of 4980.00 (200 EMA on the 1-hour chart) – 5100.00 (the round number).

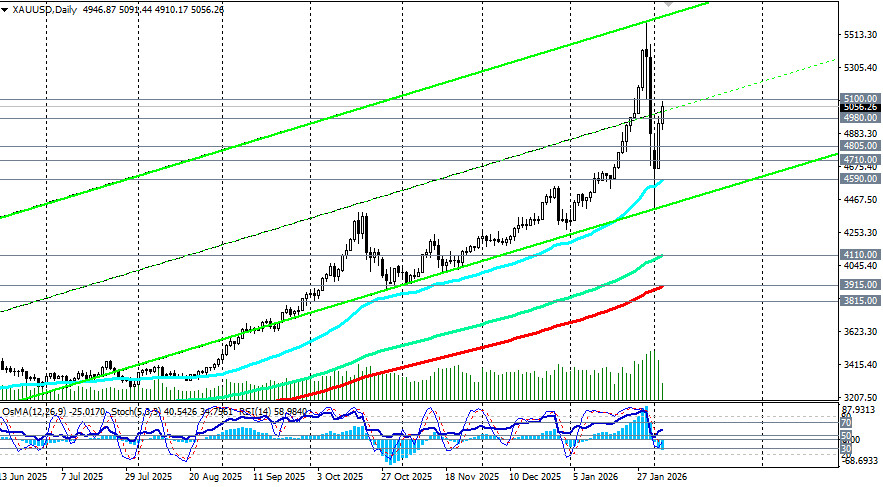

After a historical rally and the subsequent sharp correction, gold is showing signs of strength again. The XAU/USD pair has stabilized above the key level of 5000.00 per troy ounce and is preparing for a new stage of growth.

Among the reasons for the correction, the following can be noted:

At the same time, despite January's sell-off of more than 10% from the peak above 5590.00, the fundamental drivers for the "yellow metal" have not disappeared, and the interest of major players confirms a long-term bullish outlook: physical demand remains stable (investment flows into physical gold and ETFs have not shown massive outflows; the correction was primarily related to speculative futures positions), trading volumes have not decreased (CME Group data shows that interest in gold contracts remains high, indicating strategic holding of positions by institutional players), and geopolitics has returned to the focus of investors (the incident involving the downed Iranian drone in the Arabian Sea reminded investors of ongoing risks, boosting demand for safe assets).

If we highlight key drivers for potential growth, the following points can be noted:

Nearest Support: 4980.00 (200-period moving average on the 1-hour chart) and the psychological level of 5000.00. Holding these levels is critical for bulls.Nearest Resistance: The level of 5100.00. Breaking through this level will open the way for retesting January highs.

Economists' forecasts indicate a year-end target of around 6000.00. The January peak was merely a precursor. Technically, the correction appears complete. The absence of mass capital outflows from gold into bonds (with 10-year Treasury yields stable around 4.300%) confirms that the sell-off was tactical rather than strategic.

Gold has undergone a necessary and healthy correction after a record rally. The current stabilization above 5000.00 indicates that major players are not rushing to exit the market, as they see long-term value in it. The upward trend remains intact. Short-term volatility will depend on US employment and inflation data, but strategic prospects remain favorable. The combination of an expected shift in the Fed's monetary policy, geopolitical risks, and gold's role as insurance against instability is building a foundation for price growth. Investors should view current levels as an opportunity for strategic accumulation with long-term targets above 5600.00. The immediate task for bulls is to break and hold above 5100.00, which will signal the resumption of substantial growth.

فوری رابطے