The price of gold has once again exceeded $4900 per ounce, as buyers who took advantage of the decline have been actively purchasing the metal following a two-day drop.

Gold rose by 1.3% against a backdrop of low trading activity, as most Asian markets were closed for the celebration of the Lunar New Year. In the previous two trading sessions, when the US dollar strengthened, the metal lost more than 3%.

At the end of January, gold prices rose to a record high, exceeding $5595 per ounce, but after a spike in speculative purchases, the market overheated and fell almost to $4400 over two trading sessions. Although the metal has regained almost half of those losses, trading remains unstable after the crash.

Many leading financial institutions, including giants such as BNP Paribas SA, Deutsche Bank AG, and Goldman Sachs Group Inc., agree on the likelihood of a renewed, sustainable upward trend in gold prices. Experts assert that the fundamental factors that previously contributed to the stable rise in the value of the precious metal have not disappeared and continue to exert their influence, creating a favorable environment for further price increases.

Among these defining factors that ensure the previous dynamics persist, the first and foremost is the growing geopolitical tension. An unstable international situation, accompanied by conflicts, political crises, and trade disputes, traditionally drives investors to seek safe assets, of which gold is undoubtedly one. Its ability to retain real value in uncertain conditions makes it an attractive portfolio diversification tool.

Additionally, there is a trend towards abandoning traditional government bonds and national currencies as reliable tools for capital preservation. This is tied to inflation, instability in the fiscal policies of some countries, and a general decline in trust in classical financial instruments. In such a situation, gold serves as an alternative, offering investors more predictable dynamics and less susceptibility to systemic risks.

Concerns about the independence of the US Federal Reserve also play a special role. Any doubts about its ability to conduct an independent monetary policy, especially amid political pressure, could undermine confidence in the dollar and other assets denominated in US currency.

Today, the publication of the minutes from the recent Federal Reserve meeting is expected, which may somewhat influence the precious metals market. Investors will also monitor comments from Fed representatives to gain insight into the US monetary policy. A desire to lower rates would be a favorable factor for non-yielding precious metals.

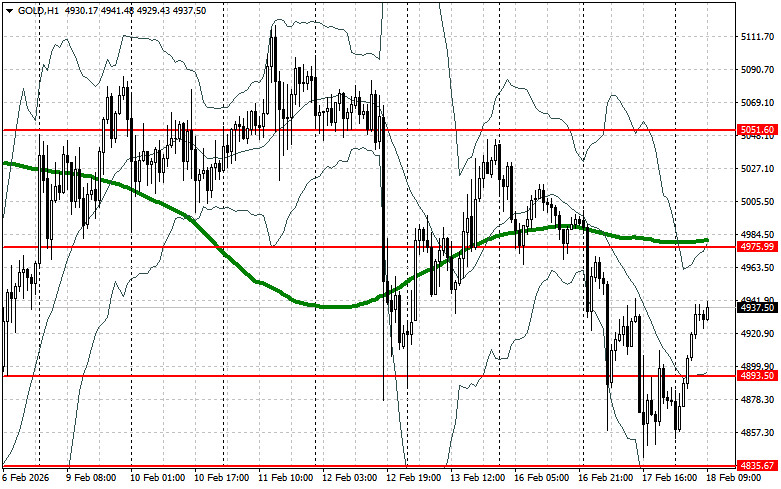

As for the current technical picture of gold, buyers need to overcome the nearest resistance at $4975. This would allow them to target $5051, above which it would be quite challenging to break through. The furthest target would be around $5137. In the event of a gold price decline, bears will attempt to take control of $4893. If they succeed, a breakout from this range would deal a serious blow to the bulls' positions and push gold to a low of $4835, with the prospect of a drop to $4771.

فوری رابطے