Trade Analysis and Tips for the Euro

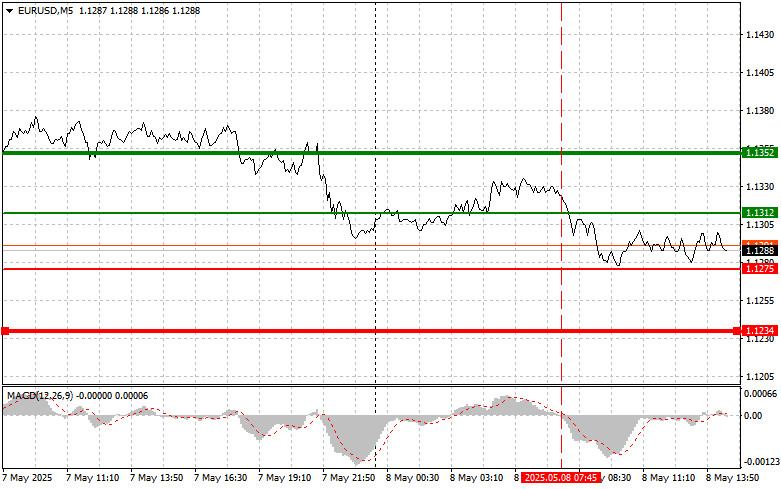

The price test at 1.1321 occurred just as the MACD indicator began moving down from the zero mark, confirming a correct entry point for selling the euro. As a result, the pair declined by more than 40 points.

Despite positive signals from the German industrial sector, where an unexpected surge surpassed expert forecasts, the euro's position remains fragile. The statistical data should have supported the single currency, but the effect was short-lived due to the dominant influence of yesterday's U.S. Federal Reserve decision. That decision strengthened support for the dollar and added pressure on the euro.

Investors are concerned about the potential monetary policy divergence between the United States and the Eurozone, which could lead to further dollar strength and euro weakness. Additionally, market sentiment is being shaped by geopolitical tensions caused by the lack of a trade agreement between the U.S. and Europe.

Today, weekly U.S. jobless claims data will be released—a key labor market indicator reflecting the number of people applying for unemployment benefits for the first time. Analysts closely monitor this figure, as a sharp rise could indicate economic deterioration, while a drop would signal improvement.

Also expected are figures on changes in nonfarm productivity and unit labor costs—key metrics of economic efficiency and inflation potential. Higher labor costs may push prices up, while a drop could ease inflation and support economic growth.

Intraday Strategy: I will focus on implementing Scenarios #1 and #2.

Buy Signal

Scenario #1: Buy the euro today when the price reaches the 1.1312 level (green line on the chart), targeting a rise toward 1.1352. At 1.1352, I plan to exit the market and sell the euro in the opposite direction, expecting a 30–35 point reversal. It will be difficult to count on a sustained rise for the euro today. Important! Before buying, make sure the MACD is above zero and just starting to rise.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1275 level while the MACD is in oversold territory. This will limit the downside and could trigger a reversal upward. The pair could then return to the 1.1312 and 1.1352 levels.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1275 level (red line on the chart). The target is 1.1234, where I'll exit and reverse the trade for a 20–25 point rebound. Selling pressure will resume if U.S. data is strong. Important! Before selling, make sure the MACD is below zero and just beginning to fall.

Scenario #2: I also plan to sell the euro after two consecutive tests of the 1.1312 level when MACD is in overbought territory. This will limit upward potential and could lead to a reversal downward. The pair could then fall to 1.1275 and 1.1234.

Chart Guide:

Important: New Forex traders should be very cautious when entering the market. It's best to stay out before major reports to avoid sharp market swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop losses, you could quickly lose your entire deposit, especially if you don't practice money management and trade with large volumes.

And remember: successful trading requires a clear trading plan—like the one presented above. Making impulsive decisions based on the current market situation is a losing strategy for any intraday trader.

SZYBKIE LINKI