The test of the 1.1430 price level coincided with the MACD indicator just beginning to rise from the zero line, which confirmed a valid entry point for buying the euro and led to a gain of over 40 pips.

Disappointing U.S. Nonfarm Payrolls data for July triggered a sharp decline in the dollar. The report showed that employment increased by only 73,000 in July, while the median forecast among economists was 104,000. Additionally, data for the previous two months were revised downward by nearly 260,000, bringing the three-month average to just 35,000 — the lowest since the pandemic in 2020. The unemployment rate rose to 4.2% from 4.1%.

Today, the eurozone's Sentix Investor Confidence Index is set to be published. Positive results could allow buyers to extend the upward trend that began at the end of last week. This momentum may further support the euro against the U.S. dollar and other major currencies. However, technical factors must also be considered. Reaching certain resistance levels may trigger profit-taking and, consequently, a correction. Therefore, even with favorable news flow, caution is advised, and excessive optimism should be avoided.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

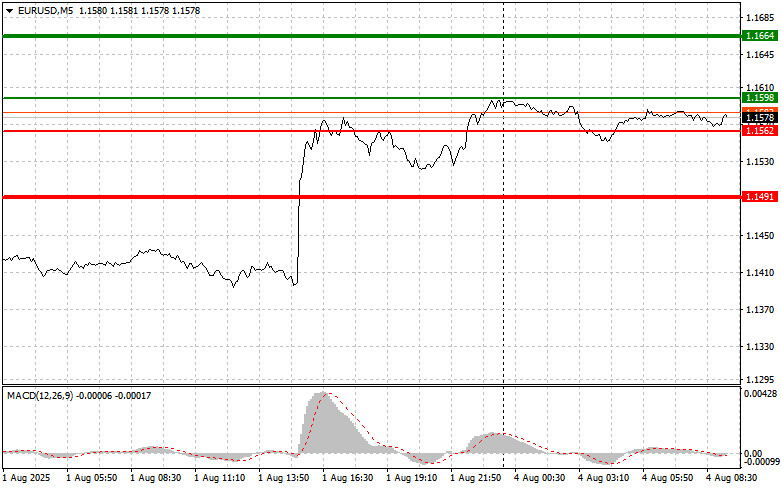

Scenario #1: Today, I plan to buy the euro upon reaching the area around 1.1598 (green line on the chart) with a target of rising to 1.1664. At 1.1664, I plan to exit the market and open a sell position in the opposite direction, targeting a 30–35 pip pullback. A euro rally is only realistic if strong data is released. Important! Before buying, ensure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1562 level while the MACD indicator is in oversold territory. This would limit the downside potential and trigger a market reversal to the upside. Growth could be expected toward the opposite levels of 1.1598 and 1.1664.

Scenario #1: I plan to sell the euro after it reaches 1.1562 (red line on the chart). The target will be 1.1491, where I intend to exit and immediately open a buy position in the opposite direction, aiming for a 20–25 pip rebound. Significant pressure on the pair is unlikely to return today. Important! Before selling, ensure the MACD indicator is below the zero line and just starting to move down from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1598 level while the MACD indicator is in overbought territory. This would limit the pair's upside potential and lead to a downward reversal. A decline to 1.1562 and 1.1491 may be expected.

SZYBKIE LINKI