The test of the 148.52 price level coincided with the moment when the MACD indicator had just begun moving downward from the zero line, confirming the correct entry point for selling the dollar. As a result, the pair dropped by 80 points.

During his speech in Jackson Hole, Federal Reserve Chair Jerome Powell hinted that he may lower interest rates in September this year. The market's reaction was predictable: the yen, traditionally seen as a "safe haven," instantly gained popularity among investors. The yen's strengthening reflects risk aversion and a reassessment of market outlook. While the Fed's rate cuts are aimed at stimulating U.S. economic growth, they also carry numerous side effects. A weaker dollar makes American goods more competitive globally but simultaneously raises the cost of imports and potentially inflation — something the Fed has long been wary of, which is why it resisted cutting borrowing costs until now. For Japan, a stronger yen creates its own challenges: Japanese exports become more expensive, which can hurt the country's competitiveness.

In any case, for the yen to strengthen more confidently against the dollar, stronger steps from the Bank of Japan toward monetary tightening are needed. Without that, a sustained bull market for the yen is unlikely.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

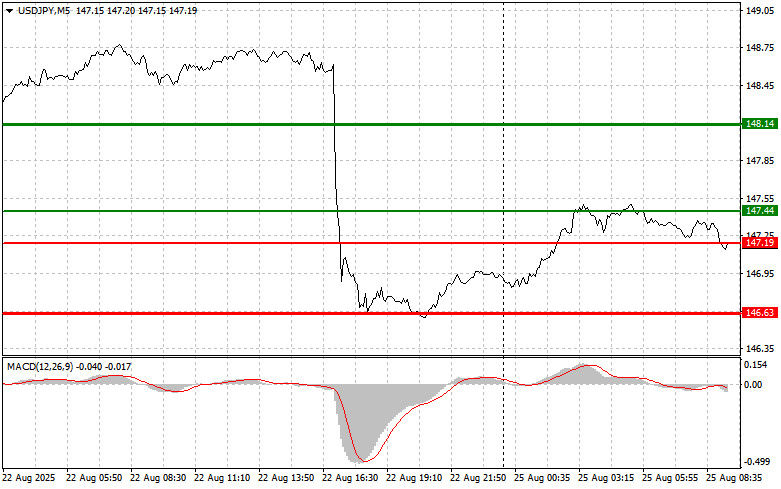

Scenario No. 1: I plan to buy USD/JPY today at the entry point around 147.44 (green line on the chart) with a target of 148.14 (thicker green line on the chart). Around 148.14, I plan to exit long positions and immediately open shorts in the opposite direction (expecting a 30–35 point pullback). The best opportunities to buy the pair come during corrections or deeper pullbacks in USD/JPY.

Important! Before buying, ensure the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today in the event of two consecutive tests of the 147.19 price level when the MACD indicator is in oversold territory. This will limit the pair's downside potential and trigger a reversal upward. Growth toward the opposite levels of 147.44 and 148.14 can be expected.

Scenario No. 1: I plan to sell USD/JPY today only after a break below 147.19 (red line on the chart), which would lead to a sharp decline in the pair. The key target for sellers will be 146.63, where I plan to exit shorts and immediately open longs in the opposite direction (expecting a 20–25 point rebound). It is best to sell from as high a level as possible.

Important! Before selling, ensure the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today in the event of two consecutive tests of the 147.44 price level when the MACD indicator is in overbought territory. This will limit the pair's upside potential and trigger a reversal downward. A decline toward the opposite levels of 147.19 and 146.63 can be expected.

SZYBKIE LINKI