Meanwhile, serious concerns are brewing in Congress over Trump's actions aimed at forming a new FOMC lineup. Most lawmakers are openly speaking about Donald Trump pressuring the central bank. Without a doubt, this comes mainly from Democrats—who are in the minority in both chambers—but I suspect Republicans also fully understand Trump's true motives. According to Democrats, the Fed could lose its independence, threatening the trust of businesses and consumers in the central bank. In this case, the public may stop believing in the Fed's ability to contain inflation, which could spark even higher price growth. A chain reaction could begin, with businesses raising prices simply in fear of further future increases.

Trump practically states openly that inflation doesn't concern him. Despite rising inflation over the past three months, the president continues to claim there is no inflation. What he means is extremely hard to understand. No inflation at all? Or does he mean a low rate of price growth? But the official data show the opposite. And the onset of the inflation acceleration "paradoxically" matches the timing of Trump's tariffs kicking in at full strength.

Moreover, Steven Mirran—almost certain to be confirmed by the Senate in his new role—does not intend to leave his other post in the White House, which by itself is absurd. Essentially, Mirran would be pursuing the goals of both the White House and the Fed, which are absolutely incompatible. The Fed's independence is written into law to prevent any political influence on central bank decisions. FOMC members are supposed to make decisions based solely on economic analysis, which is simply impossible if a Fed governor continues to serve as Trump's adviser.

In my opinion, Trump will not abandon his ideas and goals. Following Powell, Kugler, and Cook, there will be new accusations and new dismissals. Trump will litigate to the bitter end because he simply has no other choice. Why back down in a confrontation with the Fed? Trump certainly would gain nothing from that. The same goes for the trade tariffs, which two courts have already blocked. Only the Supreme Court's verdict remains.

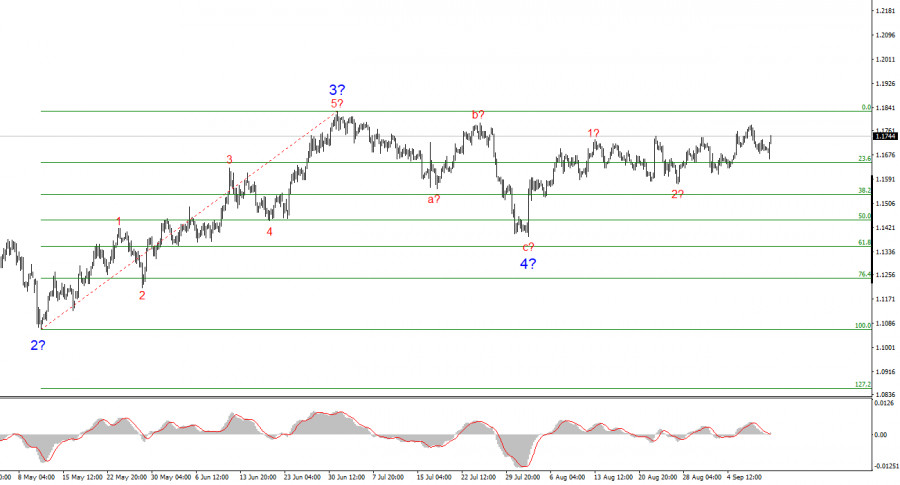

Based on my analysis of EUR/USD, the instrument continues to build a bullish trend segment. The wave structure still entirely depends on the news background related to Trump's decisions, as well as the internal and external politics of the new Administration. The objectives of the trend segment could extend to the 1.2500 area. Therefore, I continue to consider buying the pair with initial targets near 1.1875, which coincides with the 161.8% Fibonacci level, and above.

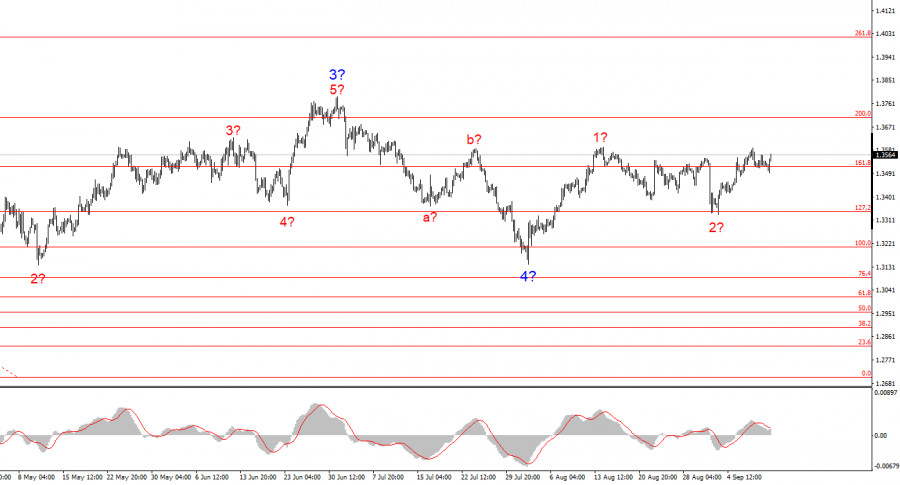

The wave structure of the GBP/USD instrument remains unchanged. We are dealing with a rising, impulsive trend segment. Under Trump, the markets can expect a significant number of shocks and reversals, which may have a substantial impact on the wave picture. However, at the moment, the working scenario remains intact, and Trump's policy is unchanged. The objectives for the bullish trend segment are near the 261.8% Fibonacci level. At this time, I believe the corrective wave 2 in 5 has ended. Thus, I still advise buying with a target of 1.4017.

SZYBKIE LINKI