As of Wednesday, the USD/CHF pair showed a slight decline of 0.10%, trading near 0.7955 at the time of writing, after recovering from the 0.7900 level reached earlier in the week. Throughout the current week, the U.S. dollar has remained stable in relation to the Swiss franc.

Markets are displaying caution ahead of upcoming U.S. economic data releases and next week's Federal Reserve policy decision.

Investor sentiment has improved following news of a planned meeting between U.S. President Donald Trump and Chinese President Xi Jinping later this month, aimed at reducing trade tensions. This rise in optimism has modestly reduced demand for safe-haven assets, applying pressure to the Swiss franc while offering moderate support to the U.S. dollar.

However, the dollar's upside potential remains limited as markets continue to price in a 25-basis-point rate cut by the Fed next week, with the possibility of further easing in December. Concerns about a gradual weakening in the U.S. labor market are offsetting inflationary fears stemming from trade tariffs.

In Switzerland, the Swiss franc remains relatively weak despite a slight improvement in the trade balance, data for which was released earlier this week. Consumer prices continue to reflect a deflationary trend, putting pressure on the Swiss National Bank (SNB) to consider further cuts to already negative interest rates in order to stimulate growth and prevent excessive franc appreciation.

Overall, the USD/CHF pair continues to consolidate, with traders adopting a wait-and-see approach ahead of major central bank decisions and inflation data releases in both the U.S. and Switzerland.

From a technical perspective, oscillators on the daily chart remain in negative territory, supporting a bearish outlook. If prices manage to break through near-term resistance levels at 0.7975 and 0.7990 — and firmly establish above the psychological level of 0.8000 — bulls may gain room for further upside.

For now, however, bears retain the upper hand.

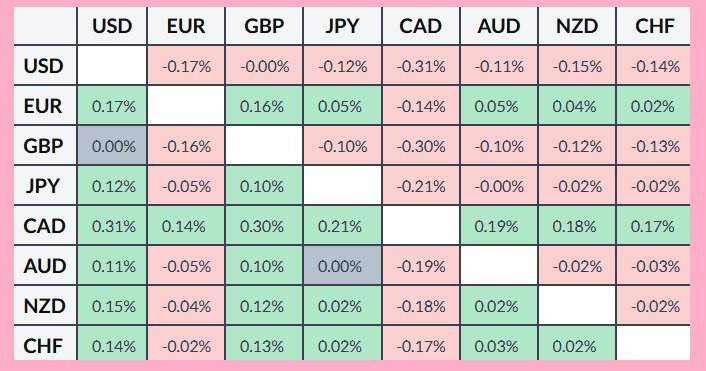

The table below shows the percentage change in the U.S. dollar relative to major currencies for the day. The dollar showed its strongest performance against the British pound.

SZYBKIE LINKI