The GBP/USD pair also traded higher on Wednesday, though there were few compelling reasons for the move. The only significant macroeconomic report of the day (durable goods orders in the U.S.) was positive (and prompted a rise in the dollar), while the publication of the final budget draft for 2026 in the UK cannot clearly be described as positive (though it's possible to find a silver lining in any barrel of tar). Nevertheless, by the end of the day, the British pound appreciated. We have repeatedly warned that much of the GBP/USD pair's decline over the past two months has been illogical. In other words, a total decline that was half as much would have been considerably more reasonable. The pound has fallen for various reasons, and even without them. The U.S. dollar has not gained any new reasons to rise in the medium term over the past two months. Furthermore, the upward trend remains on the daily timeframe, so we were expecting growth in any event. It may be that the moment for resuming the global trend has arrived.

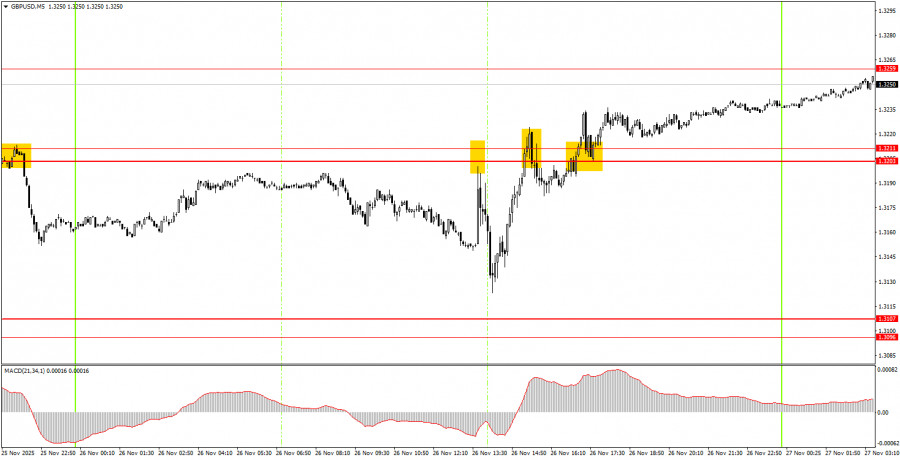

On the 5-minute timeframe, several trading signals were generated yesterday, but none of them left much to be desired, as the macroeconomic and fundamental backdrop led to price fluctuations in various directions. The price bounced twice from the 1.3203-1.3211 area, with the second bounce proving false, and then broke above it. Essentially, only the third trading signal was profitable, while the first trade closed at breakeven.

On the hourly timeframe, the GBP/USD pair has completed another downward trend. An upward movement has begun, and we hope it won't end as quickly as all the previous trends on the hourly timeframe. As we've noted, there are no global grounds for a prolonged dollar growth, so in the medium term, we expect movement only to the upside. The correction/flat on the daily timeframe may not be over yet, but any local trend on the hourly timeframe is potentially a resumption of the global trend.

On Thursday, beginner traders can expect new trading signals to form around the 1.3259 level. A bounce from this level would allow for short positions targeting 1.3211, while consolidation above it would support long positions with targets at 1.3329-1.3331.

On the 5-minute timeframe, trading can currently be done at levels: 1.2913, 1.2980-1.2993, 1.3043, 1.3096-1.3107, 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, 1.3574-1.3590. On Thursday, there are no significant events or reports scheduled in the UK or the U.S. Thus, market movements today may be weak, but if the global trend has resumed, the British pound could continue to appreciate.

Important announcements and reports (always available in the news calendar) can significantly impact the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or to exit the market to avoid sharp reversals against the preceding movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is key to long-term success in trading.

SZYBKIE LINKI