Skupina Seven & I Holdings, majitel sítě 7-Eleven, uvedla, že bude muset přehodnotit svůj dodavatelský řetězec a snížit náklady, protože američtí spotřebitelé čelí dopadu celních opatření USA.

„Domnívám se, že nás čeká náročnější maloobchodní prostředí,“ uvedl nastupující generální ředitel Stephen Dacus na tiskové konferenci.

Cla, která americký prezident Donald Trump zavedl nebo plánuje, výrazně zvyšují ceny, což je těžkou zkouškou pro maloobchodní řetězce. Důvěra amerických spotřebitelů se v dubnu propadla a 12měsíční inflační očekávání dosáhla nejvyšší úrovně od roku 1981.

Dacus, který se ujme vedení příští měsíc, dodal, že největší dopad cel nebude přímo na dodavatele, ale na chování spotřebitelů.

„V takovém prostředí je třeba se důkladně podívat na celý dodavatelský řetězec a utáhnout náklady, mít je pod naprostou kontrolou,“ zdůraznil.

Společnost momentálně čelí nevyžádané nabídce na převzetí ve výši 47 miliard USD od kanadské společnosti Alimentation Couche-Tard a snaží se zvýšit svou hodnotu. Klíčem k tomu má být zlepšení výsledků americké divize s více než 12 000 pobočkami.

Severní Amerika tvoří 73 % celkových tržeb skupiny Seven & I.

Společnost stále plánuje vstup své severoamerické divize na burzu ve druhé polovině roku 2026, avšak podle Dacuse záleží na vývoji tržních podmínek a nelze vyloučit odklad.

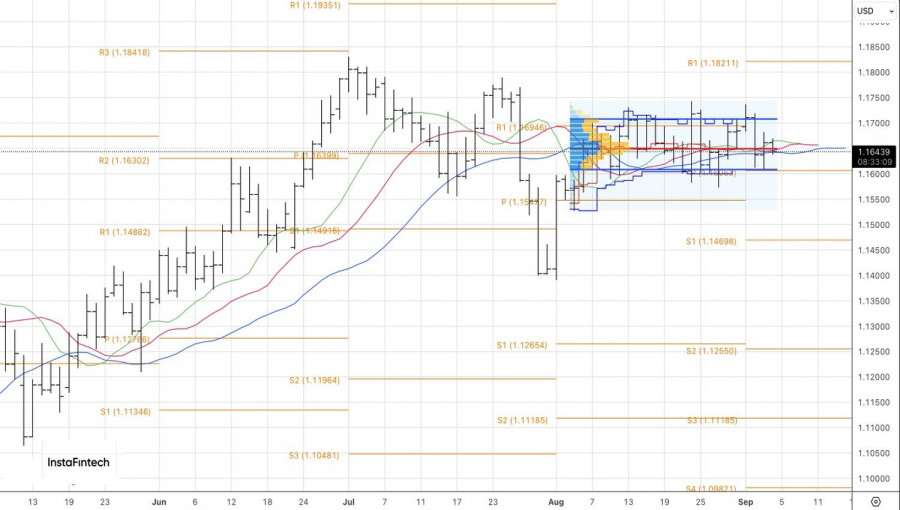

The euro could have sunk due to the political crisis in France and surging European bond yields. The US dollar is experiencing pressure due to Donald Trump's tariffs being declared illegal, the need to return funds, and the White House pressuring the Federal Reserve. However, it will be the US August jobs report that puts the final word on the fate of EUR/USD. In all respects, the current consolidation in the main currency pair seems logical. But it can't last forever. Are we waiting for a breakout!?

As the date for the non-farm payrolls release approaches, EUR/USD volatility is rising sharply. Hedging against US dollar weakness is becoming ever more expensive. That's to be expected, as Bloomberg experts forecast a fourth consecutive month of job growth under 100,000 in August. If realized, this would mark the longest weak streak since the COVID-19 pandemic.

Despite the political crisis, investors are hopeful. The French bond auction was successful. There's hope that snap elections for the National Assembly will be avoided, let alone the resignation of President Emmanuel Macron.

Upside risks for the euro are mounting. MUFG has raised its EUR/USD forecasts to 1.20 by the end of 2025 and 1.25 by the end of the first half of 2026. The bank expects dollar pressure to continue, fueled by expectations of an accelerated Fed easing cycle and White House interference in central bank independence. The eurozone economy, MUFG argues, is likely more resilient to Trump's tariffs than currently assumed.

Markets are bracing for the US jobs report for August, but the second week of September will also be action-packed. US inflation data and the European Central Bank meeting are drawing increased investor attention and driving further euro volatility.

While the ECB isn't expected to raise the deposit rate above its current level of 2%, markets are watching for hints that the monetary easing cycle is truly over. If that's confirmed, it would be a positive signal for EUR/USD. However, any signs of ECB intervention in the eurozone debt markets would be clearly negative. Christine Lagarde has previously expressed concern over French bond movements, but that doesn't necessarily mean the ECB will act to stabilize the situation.

Thus, EUR/USD is stuck in a narrow trading range awaiting key events – US jobs and inflation data and the ECB meeting. Any of these could set the euro free from its "cage."

On the daily EUR/USD chart, a "Spike and Ledge" pattern is observed. A breakout above the upper boundary near 1.1730 would be a signal to buy; a breakout below 1.1590 would be grounds for selling. A more aggressive strategy involves going long from 1.1705 or entering short from 1.1605.

LINKS RÁPIDOS