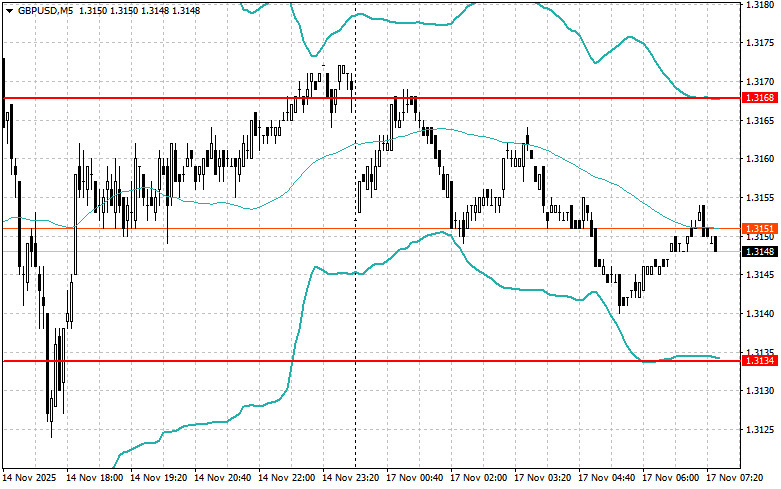

The euro has pulled back, while the pound continues to trade within a sideways channel against the U.S. dollar.

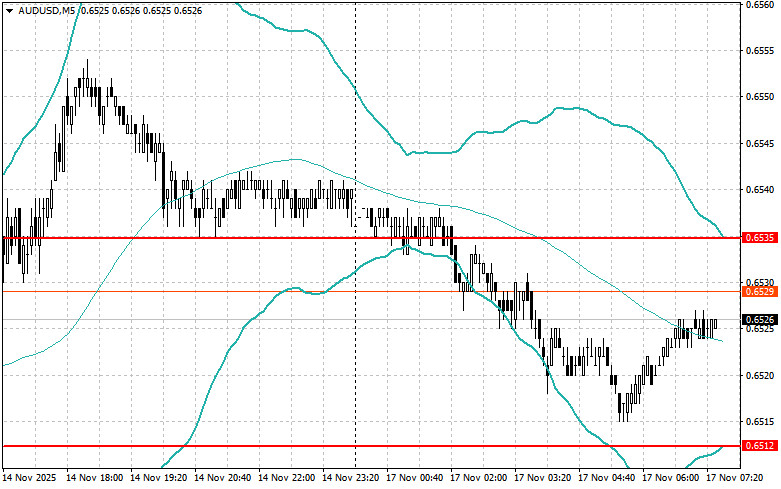

Recent statements from Federal Reserve representatives on the complexity of the interest rate situation and the emphasis that much will depend on the data they receive in the near future have led to a slight weakening of the dollar's position. Traders who previously anticipated a more aggressive policy from the central bank are now revising their forecasts, putting pressure on the U.S. currency. The market reacts to every word and hint from Fed officials, as any change in rhetoric could signal a shift in monetary policy.

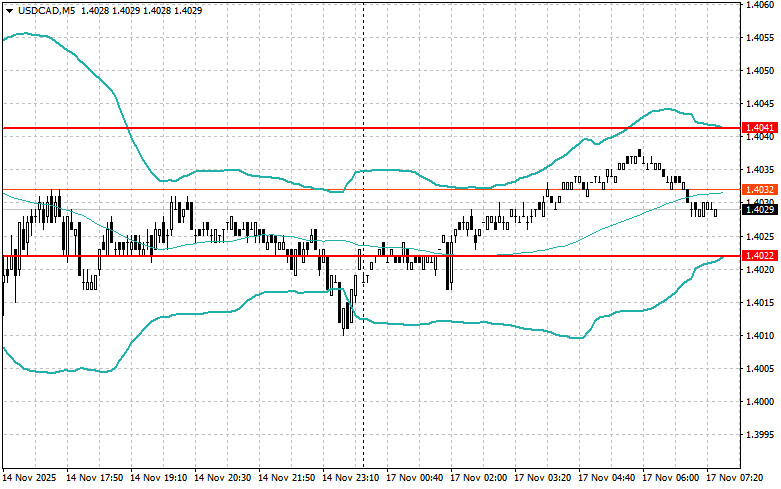

Today, the only data expected in the first half of the day are the consumer price index for Italy and the European Commission's economic outlook. The impact of Italian inflation on the overall European picture remains significant, especially in the context of the current ECB policy. Any deviation from expected values could provoke volatility in the currency markets, particularly in the EUR/USD pair.

The European Commission's forecast represents a comprehensive assessment of the economic development prospects for the entire European region. It covers a wide range of macroeconomic indicators, including GDP, inflation, employment, and government debt. Special attention will be given to forecasts for major economies, such as Germany and France, as well as countries experiencing economic difficulties.

As for the pound, there are no UK data today, so all attention will be on the speech by Bank of England Monetary Policy Committee member Catherine L. Mann. Her remarks may provide some clarity regarding the regulator's plans concerning monetary policy. Particular attention will be paid to Mann's comments regarding inflation. While recent data demonstrates a moderate decrease in inflationary pressure, the key question is whether the Bank of England sees this as a sustainable trend or merely a temporary phenomenon.

If the data aligns with economists' expectations, it may be best to act based on the Mean Reversion strategy. If the data is significantly above or below economists' expectations, the Momentum strategy is preferable.

LINKS RÁPIDOS