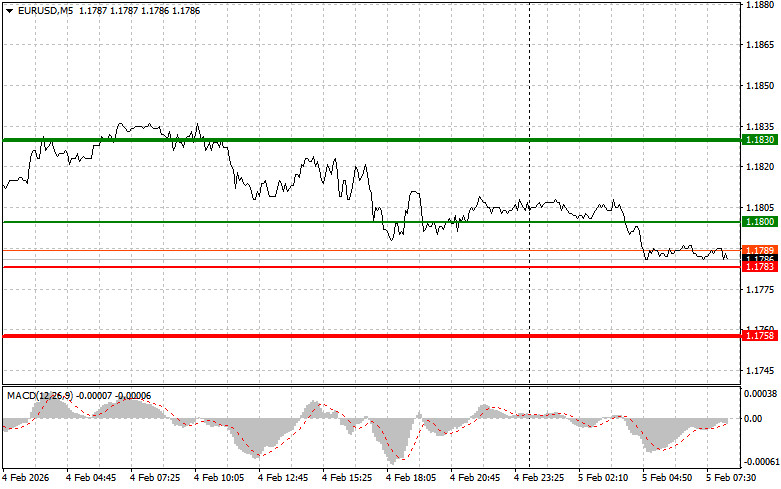

The test of the price at 1.1805 coincided with the moment when the MACD indicator was beginning its downward movement from the zero mark, confirming a valid entry point for selling the euro. As a result, the pair decreased by 13 pips.

Positive dynamics in the US services sector balanced disappointing figures from the ADP report on the US labor market. The currency market reacted calmly to these economic indicators, and the US dollar remained stable.

Today, ahead of the European Central Bank meeting, there is some tension in the financial markets, which is putting pressure on the euro. In the context of sharply declining inflation and favorable economic indicators, the ECB faces a rather straightforward task. Likely, rates will remain unchanged, as will the forecasts regarding future economic prospects. Special attention will be given to Christine Lagarde's press conference. Analysts and investors will closely scrutinize her statements to understand how decisive the ECB will be and whether it is ready to make concessions to support economic growth.

Regarding the intraday strategy, I will rely more on implementing scenarios No. 1 and No. 2.

Scenario #1: Today, buying euros can be considered when the price reaches around 1.1800 (green line on the chart) with a target growth to the level of 1.1830. At 1.1830, I plan to exit the market and sell the euro in the opposite direction, expecting a movement of 30-35 pips from the entry point. Growth in the euro can only be anticipated today following strong data. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy euros today if there are two consecutive tests of 1.1783 when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. Growth can be expected towards the opposite levels of 1.1800 and 1.1830.

Scenario #1: I plan to sell euros today once the price reaches 1.1783 (red line on the chart). The target will be the level of 1.1758, where I plan to exit the market and buy immediately in the opposite direction (expecting a movement of 20-25 pips in the opposite direction from the level). Pressure on the pair today will return with weak data. Important! Before selling, ensure that the MACD indicator is below the zero mark and just beginning its descent from it.

Scenario #2: I also plan to sell euros today if there are two consecutive tests of 1.1800 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected towards the opposite levels of 1.1783 and 1.1758.

The thin green line represents the entry price at which one can buy the trading instrument;

The thick green line represents the approximate price where one can set Take Profit or secure profits, as further growth above this level is unlikely;

The thin red line represents the entry price at which one can sell the trading instrument;

The thick red line represents the approximate price where one can set Take Profit or secure profits, as further decline below this level is unlikely;

The MACD indicator: when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders in the Forex market should be very careful when making entry decisions. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.

LINKS RÁPIDOS