Futures na americké akciové indexy v pondělí večer během svátečního obchodování mírně vzrostly, přičemž investoři zůstávají v napětí kvůli vyhlídkám na další obchodní cla a dlouhodobě vysoké úrokové sazby.

Objemy obchodů byly omezené kvůli svátku na amerických trzích, což také způsobilo, že na Wall Street bylo málo čerstvých signálů. Pozornost se nadále soustředila na plány prezidenta Donalda Trumpa ohledně dalších obchodních cel a také na vývoj úrokových sazeb v návaznosti na lepkavé inflační výtisky z minulého týdne.

Futures na index S&P 500 vzrostly o 0,2 % na 6 141,0 bodu, zatímco futures na index Nasdaq 100 vzrostly do 18:55 SEČ (23:55 h GMT) o 0,1 % na 22 220,0 bodu. Dow Jones Futures vzrostly o 0,2 % na 44 712,0 bodu.

Trump zopakoval plány na reciproční cla

Trump v pondělí zopakoval své plány na zavedení recipročních cel vůči zemím obchodujícím s USA a uvedl, že cla budou odpovídat jakýmkoli clům uvaleným na americký vývoz.

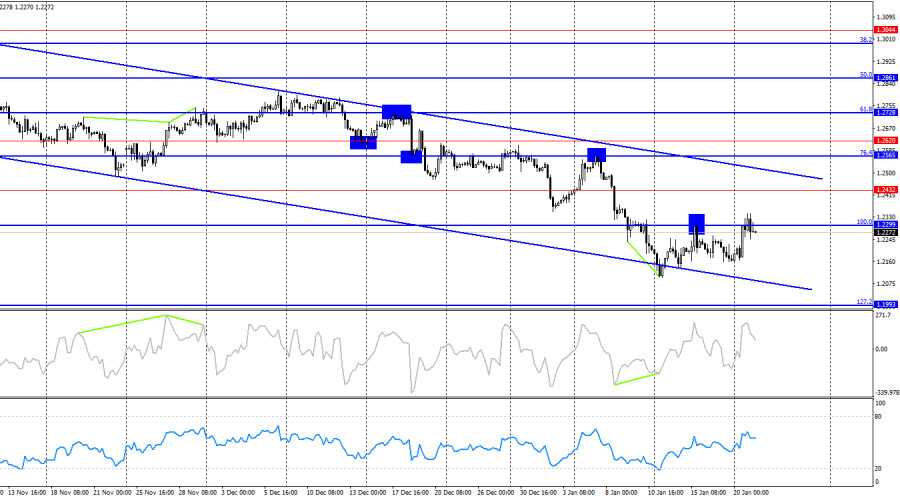

On the hourly chart, the GBP/USD pair on Monday rose above the corrective level of 261.8% at 1.2303. However, a close below this level suggests a reversal in favor of the US dollar and the beginning of a new decline toward the 1.2191 level. I would not look for buying signals near 1.2191 or 1.2303, as these levels have been repeatedly ignored by traders.

The wave situation is entirely clear. The last completed downward wave broke the low of the previous wave, while the most recent upward wave failed to approach the previous peak. Thus, a bearish trend continues to form, and there is no doubt about it. For this trend to end, the pound would need to rise to at least 1.2569 and close confidently above it. Such a scenario is unlikely to unfold in the near term.

On Monday, bullish traders slightly improved their position, partly thanks to Donald Trump. However, I believe this was not due to Trump's direct actions but rather market speculation about the future of the US dollar under the new president. In other words, I don't think Monday's decline in the dollar will stretch over several weeks or months.

This morning, key reports from the UK revealed the concerning state of the British economy. Unemployment rose to 4.4% in November, while wages (with and without bonuses) accelerated to 5.6%. This could lead to higher inflation in the near future, even though the most recent report indicated a slowdown. Rising wages may encourage more consumer spending, which in turn could drive prices higher.

For the pound, this scenario could be somewhat positive, as it may prompt the Bank of England to slow the pace of interest rate cuts in 2025 compared to a low-inflation environment. However, the BoE also faces the pressing issue of the broader economic condition, meaning rate reductions will likely proceed as planned.

On the 4-hour chart, the pair may see a second consecutive rebound from the 100.0% Fibonacci corrective level at 1.2299, enabling further declines toward the 127.2% Fibonacci level at 1.1993. The downward trend channel signals the dominance of bears, which they are unlikely to relinquish anytime soon. Only a breakout above the channel could signal a strong rise in the pound.

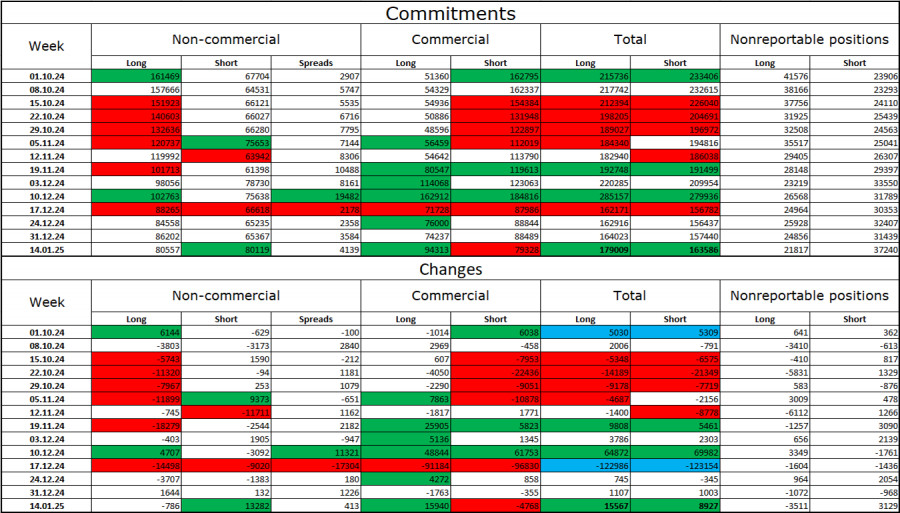

The sentiment among "Non-commercial" traders became significantly more bearish last week. The number of long positions held by speculators fell by 786, while short positions rose by 13,282. Bulls have entirely lost their advantage in the market—a process that has unfolded over several months. Currently, long and short positions are balanced at 80,000 each.

In my view, the pound still faces downside potential, with COT reports signaling growing bearish momentum almost every week. Over the past three months, long positions have decreased from 161,000 to 80,000, while short positions have risen from 67,000 to 80,000. I expect professional players to continue reducing long positions or increasing shorts, as all plausible factors for buying the pound have already played out. Graphical analysis further supports the pound's decline.

Tuesday's economic calendar features three significant UK data points, all of which have already been released. The impact of the news on market sentiment is expected to be limited for the rest of the day.

Fibonacci levels:

RÁPIDOS ENLACES