I regularly monitor three central banks, each representing an almost entirely different approach to monetary policy. On Thursday, the Bank of England cut interest rates, citing concerns over slowing economic growth. At the same time, the UK economy has been showing extremely low growth rates for quite a while, so it's hard to say this issue suddenly appeared with Trump's tariffs. The BoE has also spent the last year worrying about high inflation, and Andrew Bailey expected worse outcomes in the second half of 2024 and the first half of 2025. Nevertheless, the May meeting resulted in a second rate cut this year.

This means the BoE is trying to balance curbing inflation and supporting economic growth. By contrast, the Federal Reserve is only concerned about inflation and doesn't see economic weakness as a major threat. Meanwhile, the European Central Bank has stopped paying attention to inflation and is doing everything possible to stimulate the eurozone economy.

What does all of this mean?

The ECB will likely continue easing monetary policy — possibly even pushing rates below the "neutral mark." The Bank of England will have to balance the need to control inflation with the need to stimulate the economy. The Fed will only cut rates again if the economy starts slipping into recession and the labor market shows signs of cooling. At any other time, such a firm stance by the Fed would be a huge tailwind for the dollar. But not right now.

However, Trump can't keep raising tariffs forever. When the market realizes that this escalation phase is over, it might quickly remember all the underlying factors that previously supported — and still support — the U.S. dollar. In the current situation, paradoxically, the dollar doesn't look hopeless in the long term, but it does appear weak in the short term. I believe that once the market understands that no new escalation in the trade war is coming, demand for the U.S. currency will slowly recover. Even after gaining 14 cents, the euro still looks weak — after all, the ECB's rate is now half that of the Fed's. The pound is somewhere in the middle.

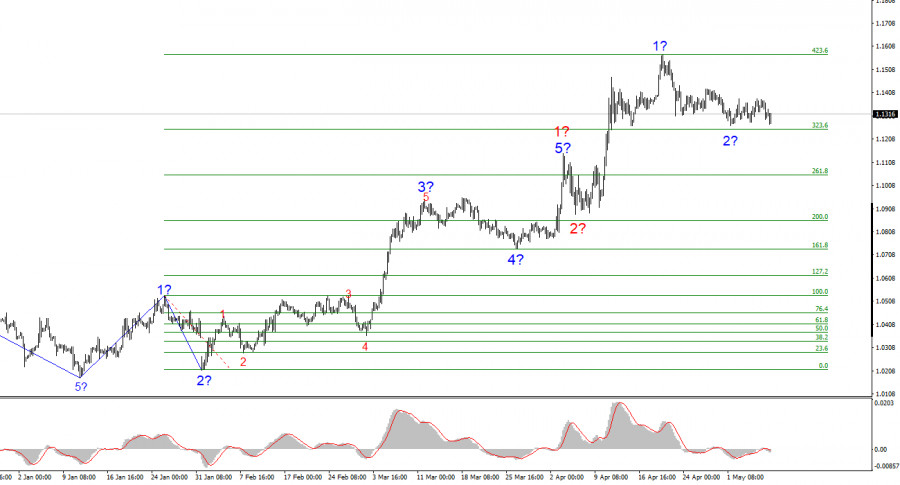

Based on my analysis, the EUR/USD pair continues building a bullish trend segment. The wave pattern in the near term will entirely depend on the U.S. president's stance and actions. This must always be taken into consideration. Wave 3 of the bullish trend segment is forming, and its targets may extend up to the 1.25 area. Reaching that level will depend entirely on Trump's policy. At this stage, wave 2 in 3 is likely near completion. Therefore, I'm considering long positions with targets above 1.1572, corresponding to the 423.6% Fibonacci extension.

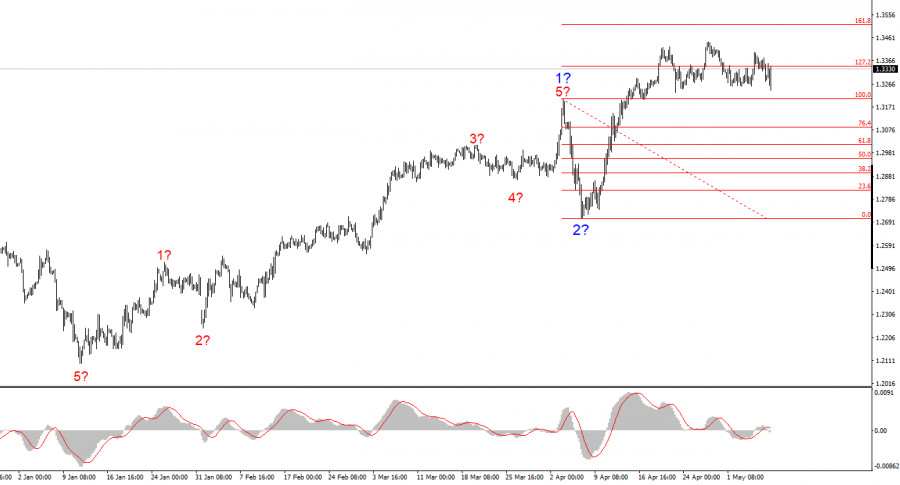

The wave pattern of GBP/USD has shifted. We are now looking at a bullish impulse wave segment. Unfortunately, under Trump, the markets could face many shocks and reversals that defy wave structure or any technical analysis. The formation of upward wave 3 continues, with immediate targets at 1.3541 and 1.3714. Admittedly, it would be ideal to see a corrective wave 2 in 3 — but it appears the dollar can no longer afford that luxury.

RÁPIDOS ENLACES