Markets continue their upward sprint as worst-case scenarios fail to materialize. Donald Trump threatened Japan and the EU with 30% tariffs - they got 15%. With China, talks reached 145% but Beijing pays 30-50%. The devil proved less frightening than painted. The S&P 500 has rallied 32% from April lows and continues printing record highs.

The US-EU deal became another confirmation of trade conflict de-escalation, further boosting global risk appetite. Brussels received 15% import duties, including auto shipments to the US. In return, it committed to purchase $750 billion in American energy products and invest an additional $600 billion. This is excellent news for the US economy and equity indices.

For investors, fixed 15% tariffs prove preferable to 10% tariffs with potential near-term increases. Reduced trade uncertainty combined with strong US corporate earnings creates powerful tailwinds for the S&P 500. Currently, 83% of reporting index constituents beat estimates, marking the highest level since 2021.

Dynamics of positive earnings surprises among S&P 500 companies

The US economy is not plunging off a cliff, and inflation shows no signs of accelerating due to tariffs. The artificial intelligence theme continues to excite market imagination, fueling further gains. The S&P 500 holds plenty of strong cards. Yet to sustain its rally, the broad market index must navigate an event-packed calendar, spanning corporate earnings, macroeconomic data, trade disputes, and agreements.

August 1 marks the deadline for payments under new US tariffs. Major players already know their import duties, while most nations have received payment notices. Thus, the worst appears behind us, though surprises remain possible. August 12 concludes the US-China trade truce, so failure to extend it risks reigniting trade war tensions.

S&P 500 earnings dynamics

The week through August 1 features earnings from market titans Microsoft, Meta, Apple, and Amazon, coinciding with key US GDP, inflation, and jobs data. The Fed meeting carries particular weight. Although ING dismisses it as a "non-event," growing FOMC divisions could fuel rate cut speculation and boost demand for the S&P 500.

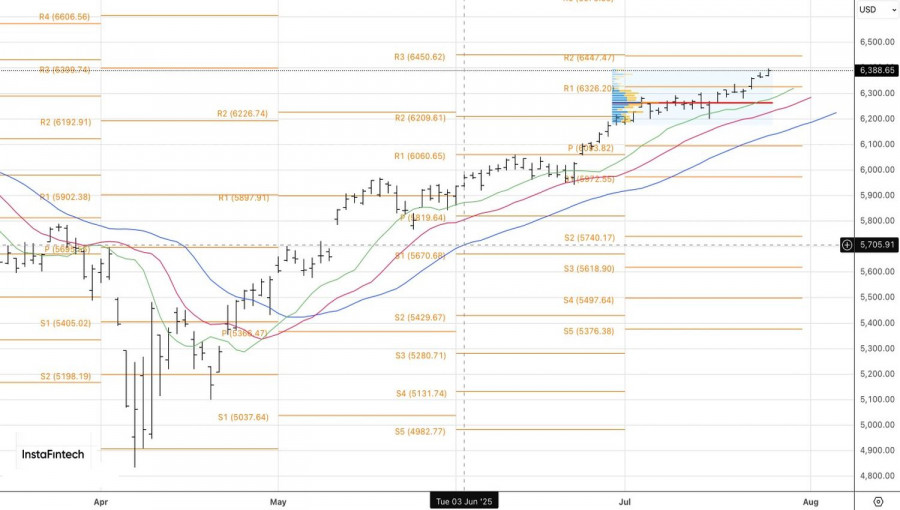

Technically, the index has nearly reached our 6,450 long target on the daily chart. While the S&P 500 holds above the 6,325 pivot, buyers maintain control.

RÁPIDOS ENLACES