A lot will depend on the U.S. dollar this week. Essentially, market participants will once again be trading the dollar itself. And depending on whether they decide to buy or sell it, the euro and pound will either rise or fall. In my view, last week's events are sufficient to trigger a decline in demand for the U.S. currency, even without new data. The probability of a Federal Open Market Committee (FOMC) rate cut surged on Friday, and it's no longer based on mere hopes that the Federal Reserve should lower rates. Now these expectations have a very concrete basis: over the past three months, only around 100 jobs have been created in the U.S. This is a very weak figure that completely outweighs the positive sentiment generated by the recent GDP report.

This week will also feature the important ISM Services PMI. Let me remind you that the ISM Manufacturing Index released on Friday was also very weak. First, it declined—contrary to expectations of an increase. Second, it remains below the 50.0 mark, below which any reading is considered negative.

In June, the ISM Services PMI stood at 50.8 points. This is not a strong number, but it is still better than the manufacturing sector's performance. In July, markets are expecting growth to 51.5 points—but they also expected an increase in manufacturing. No other major U.S. events are scheduled for this week, so the only potential news could come from Donald Trump, who may well discover countries on the world map against which he hasn't yet imposed tariffs. In my opinion, a few trade deals do not solve the broader problem of the trade war.

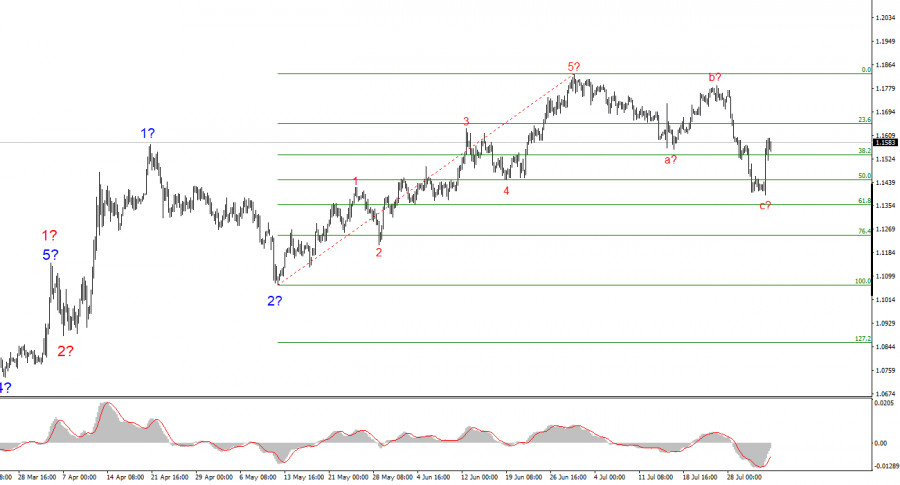

Based on the EUR/USD analysis, I conclude that the pair continues forming an upward trend segment. The wave structure remains entirely dependent on the news background related to Trump's decisions and U.S. foreign policy. The targets for this trend segment may extend up to the 1.25 level. Therefore, I continue to consider buying opportunities with targets around 1.1875, which corresponds to 161.8% Fibonacci, and higher. Presumably, wave 4 has been completed. Therefore, this is a good time to buy.

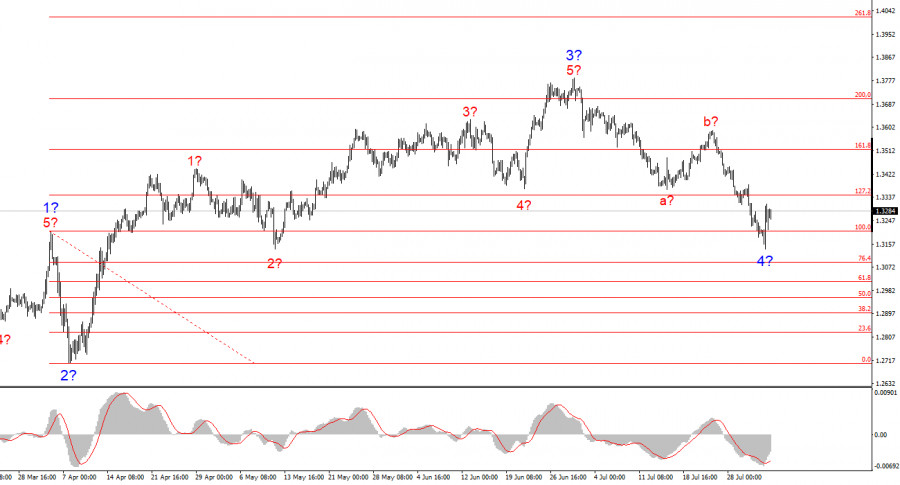

The wave picture for GBP/USD remains unchanged. We are dealing with an upward, impulsive segment of the trend. Under Donald Trump, markets could still face many shocks and reversals, which may significantly affect the wave pattern, but at this point, the working scenario remains intact. The targets for the upward segment of the trend are now located around 1.4017. Currently, I assume that the construction of the corrective wave 4 has been completed. Therefore, I expect the upward wave sequence to resume, and I am considering long positions.

RÁPIDOS ENLACES