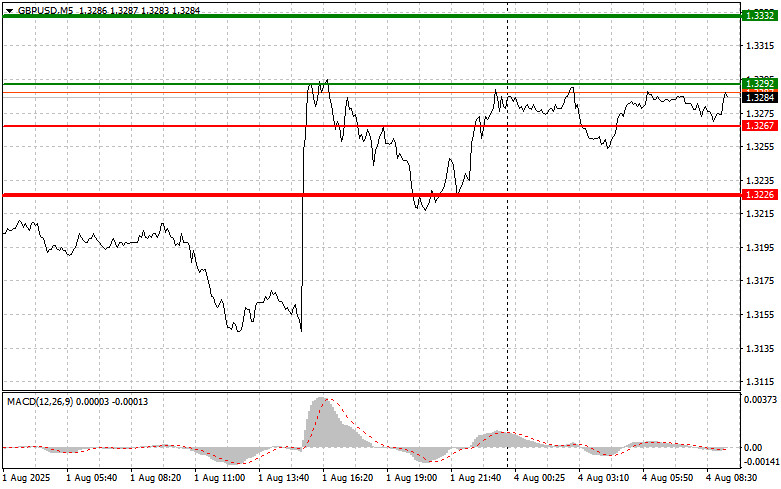

The test of the 1.3182 price level coincided with the MACD indicator just beginning to rise from the zero line, which confirmed a valid entry point for buying the pound and resulted in a gain of over 100 pips.

Weak U.S. Nonfarm payroll data for July led to a sharp drop in the dollar and a strengthening of the British pound. Investors reacted to the unexpectedly low employment figures as a sign of a slowdown in the U.S. economy—especially since previous data was also revised downward. The British pound, in turn, benefited from the dollar's weakness. Expectations that the Bank of England will continue to gradually cut interest rates to combat inflation—which remains above target—also supported the pound. However, this strengthening may prove short-lived. The UK economy faces serious challenges, including high inflation and recession risks. These factors could limit the pound's growth potential and eventually lead to its weakening.

There are no UK data scheduled for today, so Friday's bullish momentum may support further GBP/USD recovery. The lack of new macroeconomic data leaves traders relying solely on already released information and prevailing market sentiment. The weakening U.S. dollar likely fueled Friday's optimism amid disappointing employment data, and this momentum may persist, supporting further gains in the pound against the U.S. currency.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: Today, I plan to buy the pound upon reaching the entry point around 1.3292 (green line on the chart), targeting a rise to 1.3332 (thicker green line). Around 1.3332, I plan to exit long positions and open a short trade in the opposite direction, aiming for a 30–35 pip pullback. A rise in the pound today can be expected within a new short-term bullish wave. Important! Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3267 level while the MACD indicator is in oversold territory. This would limit the pair's downside potential and lead to an upward market reversal. Growth toward the opposite levels of 1.3292 and 1.3332 can be expected.

Scenario #1: I plan to sell the pound today after a breakout below 1.3267 (red line on the chart), which would likely trigger a rapid decline. The key target for sellers will be 1.3226, where I plan to exit short positions and immediately open long trades in the opposite direction, aiming for a 20–25 pip rebound. Selling the pound today is advisable only around major resistance areas. Important! Before selling, ensure the MACD indicator is below the zero line and just starting to move down from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3292 level while the MACD indicator is in overbought territory. This would limit the pair's upside potential and lead to a downward reversal. A decline to the opposite levels of 1.3267 and 1.3226 can be expected.

RÁPIDOS ENLACES