In my reviews, I constantly emphasize that the news background remains highly toxic to the U.S. currency. I will not list all the factors behind the dollar's decline once again, but I will note that I am not the only one who thinks this way. Many analysts and economists share my view, including those at Bank of America.

The bank's experts believe that the dollar will soon face a very unfavorable combination of rising inflation and falling interest rates. The last time such a scenario occurred was in 2007–2008, when monetary policy easing coincided with rising inflation due to disruptions in the supply of goods and energy resources. At that time, the FOMC was cutting rates because the U.S. housing and labor markets had begun to "cool down."

Economists also expect inflation in the U.S. to continue rising. First, Donald Trump's tariffs will keep driving prices higher. Second, the rate cut itself will stimulate further inflationary growth. However, the Federal Reserve's top priority is now to support the labor market, while Trump will, in any case, continue to raise tariffs and introduce new ones, making the rise in the consumer price index almost inevitable.

Based on this, Bank of America considers it reasonable to buy the euro and the pound. The bank's economists forecast that EUR/USD will reach 1.20 by the end of the year. In my view, this is a very realistic target. Once it is reached, the dollar's outlook may improve. Of course, everything will continue to depend on Trump's policies, and he still has at least 3.5 years left in office. However, around the 1.20 level, the formation of global upward wave 3 may come to an end. Consequently, the pair will move into building wave 4, which implies a correction lasting several months. It is unlikely that within these few months the dollar will significantly improve its position, but in the current situation, any growth would already be something.

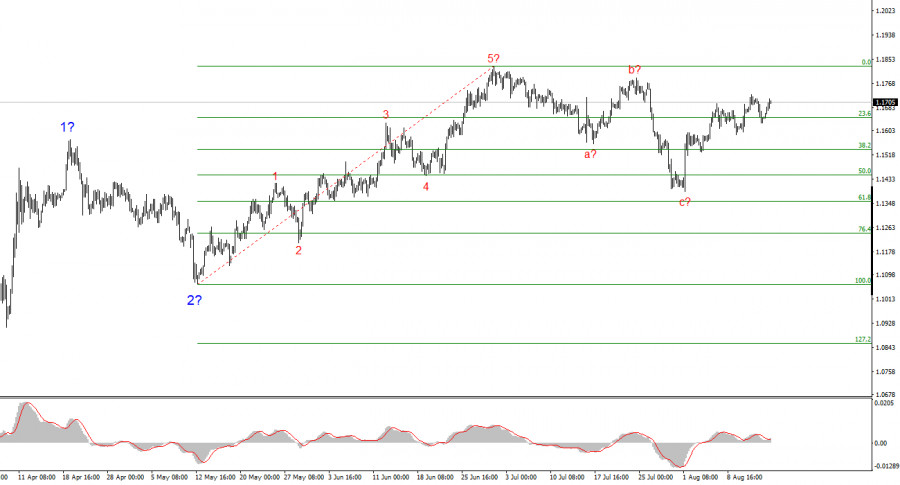

Based on the analysis of EUR/USD, I conclude that the instrument continues forming an upward segment of the trend. The wave structure still entirely depends on the news background connected with Trump's decisions and U.S. foreign policy. The targets for this trend segment may extend as far as the 25th figure. Therefore, I continue to consider buying with targets around 1.1875, which corresponds to 161.8% Fibonacci, and above. I assume that the construction of wave 4 has been completed. Accordingly, now is a good time to buy.

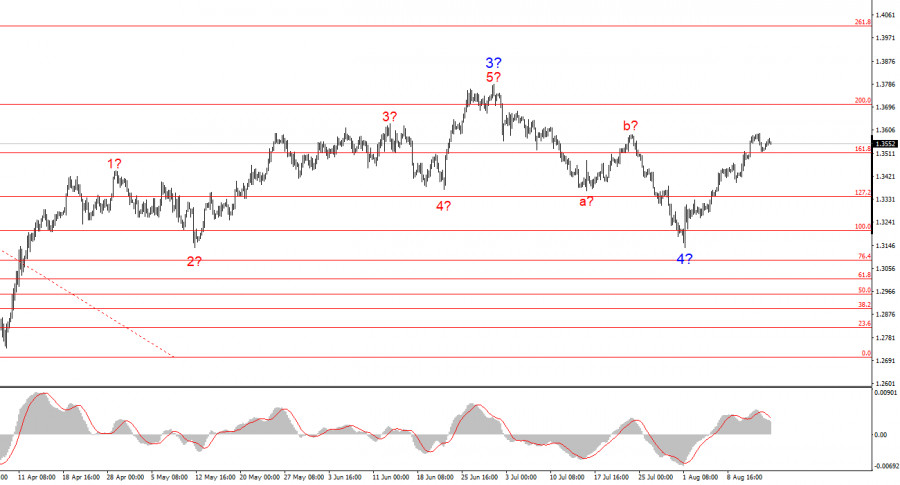

The wave structure of GBP/USD remains unchanged. We are dealing with an upward, impulsive trend segment. Under Trump, the markets may still face a large number of shocks and reversals, which could significantly affect the wave structure, but at present, the working scenario remains intact. The targets of the upward trend segment are now located near 1.4017. At the moment, I assume that the formation of downward wave 4 has been completed. Therefore, I recommend buying with a target of 1.4017.

RÁPIDOS ENLACES