For a long time, markets have operated in a tug-of-war mode: signs of US economic weakness have pulled the S&P 500 down, but expectations of Federal Reserve rate cuts and faith in artificial intelligence technology have tipped the balance in the other direction. The broad equity index repeatedly hit record highs. However, by the end of September, everything seemed to turn upside down. A three-day decline became its longest losing streak in a month.

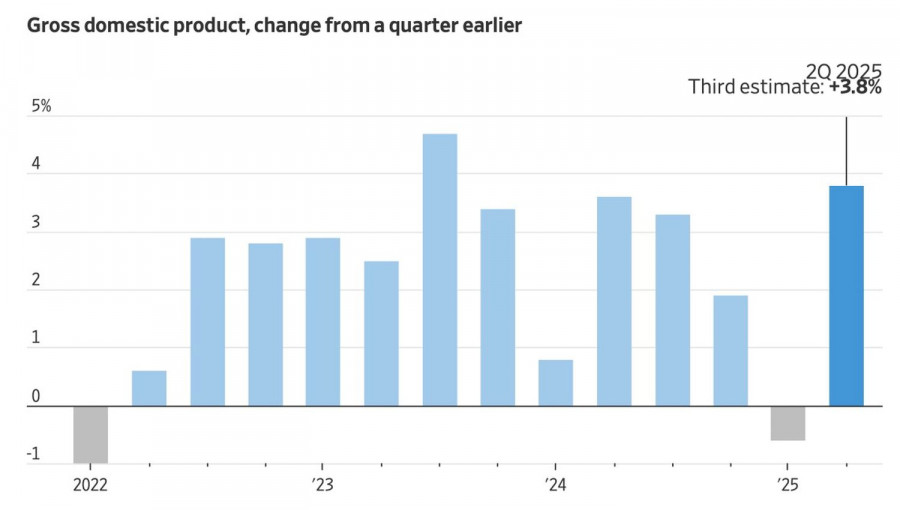

It's as if the actors switched roles. Impressive data on GDP, jobless claims, and durable goods orders did not help the S&P 500 "bulls." Meanwhile, the odds of a Fed rate cut in October only fell slightly—from 94% to 89%. This combination of a resilient economy and continued faith in monetary easing suggests that the main reason for the broader market's pullback has been the impact of artificial intelligence.

Over the past three years, tech giants have invested as much money in AI as was spent over forty years building the US interstate highway system. Nobody knows when these investments will pay off. According to Sequoia, it would require $800 billion in lifetime chip revenues. For most chips, that lifespan is about 3–5 years.

According to research by Morgan Stanley, revenue from AI products in 2024 reached $45 billion. Companies have profited mainly via two channels: subscription fees for chatbots and usage fees for data centers. When the tech sector will be able to close the gap is a trillion-dollar question.

The situation is painfully reminiscent of the turn of the 21st century, when companies poured huge amounts of money into internet technologies, inflating the dotcom bubble. When it burst, it was the tech sector that suffered the most.

Investors are increasingly paying attention to the elevated valuation of the S&P 500. Currently, the broad market index is trading at nearly 23 times expected earnings over the next 12 months. This is only the third time the P/E ratio has been so high, with the previous two occurring during the dotcom crisis and the COVID-19 pandemic.

Still, if the US economy remains on a solid footing and the Fed does indeed cut rates, the idea of buying the dip in US stocks seems viable. After all, there is no panic about artificial intelligence—just doubts.

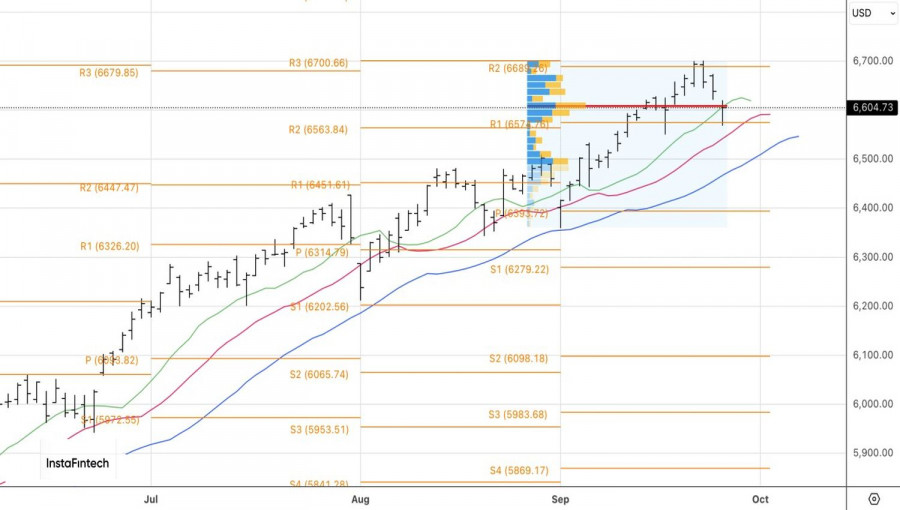

Technical Picture: On the S&P 500 daily chart, there was a rebound from support at the pivot level near 6570, with a doji bar forming with a long lower shadow. As a result, long positions were opened. The opportunity to increase those positions will arise if the high of the doji bar, near 6620, is broken.

RÁPIDOS ENLACES