A test of the 1.3425 level occurred at a time when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downside potential. For this reason, I did not sell the pound. A rebound buy at 1.3394, which I mentioned in my forecast for the second half of the day, yielded about 25 pips of profit.

No economic data is expected from the UK today, meaning GBP/USD retains the potential for further growth. However, traders should pay close attention to global factors influencing currency pair dynamics. In particular, investor attention will be focused on news from the United States. Additionally, the geopolitical landscape continues to significantly influence markets. Any signs of escalating conflicts or tightening of sanctions may lead to heightened volatility and a reassessment of risk.

In terms of technical analysis, GBP/USD is showing signs of consolidation near current levels. A breakout above key resistance levels may pave the way for further growth, while a break below support levels could trigger a correction.

For intraday strategy, I will mainly rely on the implementation of Scenarios 1 and 2.

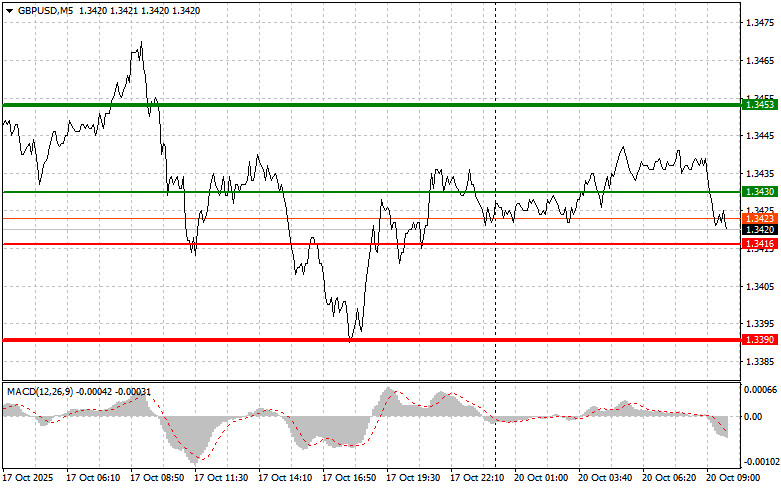

Scenario 1: I plan to buy the pound today upon reaching the entry point around 1.3430 (green line on the chart), with a target at 1.3453 (thick green line on the chart). At 1.3453, I plan to exit long positions and open shorts in the opposite direction, aiming for a 30–35 pip move from that level. Buying the pound today should only be considered in continuation of the current uptrend. Note: Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario 2: I also plan to buy the pound today if there are two consecutive tests of the 1.3416 level while MACD is in the oversold zone. This setup limits the pair's downside potential and could trigger a reversal upward. Expected targets are 1.3430 and 1.3453.

Scenario 1: I will look to sell the pound after a breakout below 1.3416 (red line on the chart), which may cause a rapid decline in the pair. The key target for sellers will be 1.3390, where I plan to exit shorts and immediately open long trades in the opposite direction, aiming for a 20–25 pip rebound. Pound sellers are likely to act cautiously. Note: Before selling, confirm that the MACD is below the zero mark and just beginning to move downward.

Scenario 2: I also plan to sell the pound today if there are two consecutive tests of the 1.3430 level while the MACD is in the overbought zone. This setup limits the pair's upward potential and could lead to a market reversal downward. Expected downside targets are 1.3416 and 1.3390.

Important Notice for Beginner Traders:

Beginner Forex traders must be extremely cautious when entering the market. It is best to stay out of the market before the release of important fundamental reports to avoid sharp price moves. If you choose to trade during news events, always place stop-loss orders to minimize losses. Without stop-loss protection, you risk quickly losing your entire deposit—especially if you lack proper money management and use large trade volumes.

Always remember that successful trading requires a clear trading plan, such as the one presented above. Making spontaneous trading decisions based on the current market situation is a losing strategy for intraday traders.

RÁPIDOS ENLACES