The price test of 1.1532 occurred when the MACD indicator had just begun moving down from the zero mark, confirming a valid entry point for selling the euro. As a result, the pair declined by 20 points.

The Eurozone manufacturing PMI matched economists' forecasts exactly, giving euro buyers no advantage. However, a closer look at the data reveals nuances that could influence future currency market dynamics. Despite matching overall expectations, individual index components—such as new orders and employment levels—showed mixed trends. A decline in new orders may indicate a slowdown in growth in the coming quarters, while rising employment, on the contrary, signals the continued resilience of the labor market. The euro's exchange rate will depend on the broader macroeconomic picture and the European Central Bank's rhetoric.

In the second half of the day, attention should be on the release of the ISM Manufacturing Index in the United States, which reflects the state of the manufacturing sector, as well as on the scheduled speeches of FOMC members Mary Daly and Lisa D. Cook. The ISM index release will be a key moment for assessing current market sentiment. The indicator is expected to remain below 50 points, indicating weakness in the manufacturing sector. If the actual figures come in above expectations, this may support the U.S. dollar; weaker data, on the other hand, may put pressure on it. The speeches by Mary Daly and Lisa D. Cook are also of significant interest—particularly their assessments of inflation dynamics, labor market conditions, and economic outlooks. A shift in rhetoric toward monetary easing could weaken the dollar, while a hawkish stance could strengthen it.

As for the intraday strategy, I will rely primarily on Scenarios No. 1 and No. 2.

Buy Signal

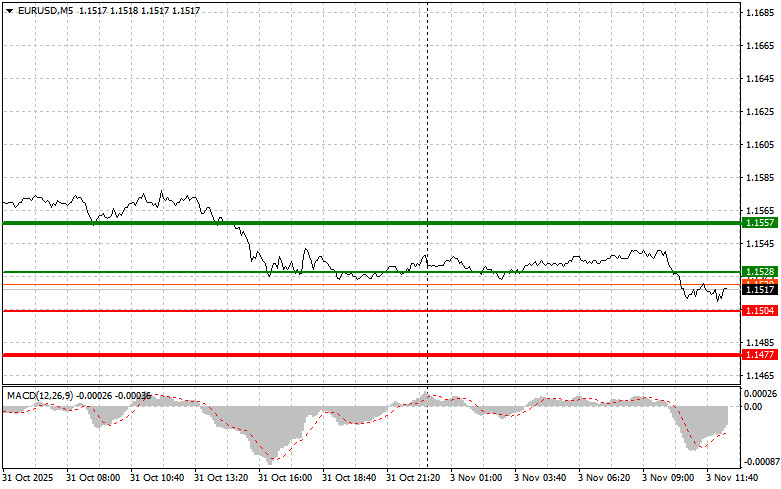

Scenario No. 1: Buy the euro at around 1.1528 (green line on the chart) with a target of 1.1557. At 1.1557, I plan to exit the market and open a sell position in the opposite direction, aiming for a 30–35 point move from the entry point. Expect euro growth today only as part of a correction.Important: Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario No. 2: I will also buy the euro if the price tests 1.1504 twice in a row, while the MACD is in the oversold zone. This will limit the pair's downward potential and trigger a reversal upward. Expect growth toward the opposite levels of 1.1528 and 1.1557.

Sell Signal

Scenario No. 1: I plan to sell the euro after reaching 1.1504 (red line on the chart). The target will be 1.1477, where I intend to exit and open a buy position in the opposite direction (aiming for a 20–25 point move back from the level). Selling pressure on the pair may return at any moment today.Important: Before selling, make sure the MACD is below the zero mark and just beginning to decline from it.

Scenario No. 2: I will also sell the euro if the price tests 1.1528 twice in a row while the MACD is in the overbought zone. This will limit the pair's upward potential and trigger a market reversal downward. Expect a decline toward the opposite levels of 1.1504 and 1.1477.

Chart Explanation

Important Notes for Beginner Forex Traders

Beginner traders should be extremely cautious when deciding to enter the market. Before the release of key fundamental reports, it is best to stay out of the market to avoid being caught in sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss protection, you can quickly lose your entire deposit—especially if you ignore money management and trade with large volumes.

And remember: For successful trading, you must have a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.

RÁPIDOS ENLACES