Gold has stabilized after its largest weekly gain, as traders assessed the prospects for U.S. interest rates following the release of private-sector employment data.

The price of gold holds just above $3,980 per ounce after an increase of 1.2% on Wednesday. The ADP Research data indicated that the number of jobs grew by 42,000 after two months of decline. While this modest growth alleviates concerns about a more rapid deterioration in the labor situation, it aligns with the overall decline in labor demand.

The rise in gold prices, traditionally considered a safe-haven asset, reflects ongoing uncertainty in the global economy. Although the labor market data showed some positive signs, they are not strong enough to dispel concerns regarding a recession. Traders seeking protection from volatility are directing capital into gold, supporting its price. One factor affecting gold is the dynamics of the U.S. dollar. Expectations regarding the Federal Reserve's future policies and their impact on interest rates put pressure on both the dollar and gold. If the Fed returns to a dovish monetary policy, gold may continue to rise.

Yesterday, Fed Chair Stephen Miran called the increase in employment last month a pleasant surprise but reiterated the need for rate cuts. Miran, considered a protege of Trump, has repeatedly called for a softer policy, advocating a 0.5 percentage-point cut in the Fed's key rate.

The Fed's Open Market Committee, responsible for setting interest rates, is scheduled to meet next month, its last meeting of 2025. Currently, due to the longest government shutdown in U.S. history, key official data is being delayed, significantly complicating the assessment of the situation in the world's largest economy, which also ties the hands of the central bank.

This year, gold has risen more than 50%, reaching a record high in October before slightly retracing after a rapid rally. The U.S. Central Bank's rate cuts have helped sustain prices, which have also been supported by the influx of funds into exchange-traded funds backed by precious metals.

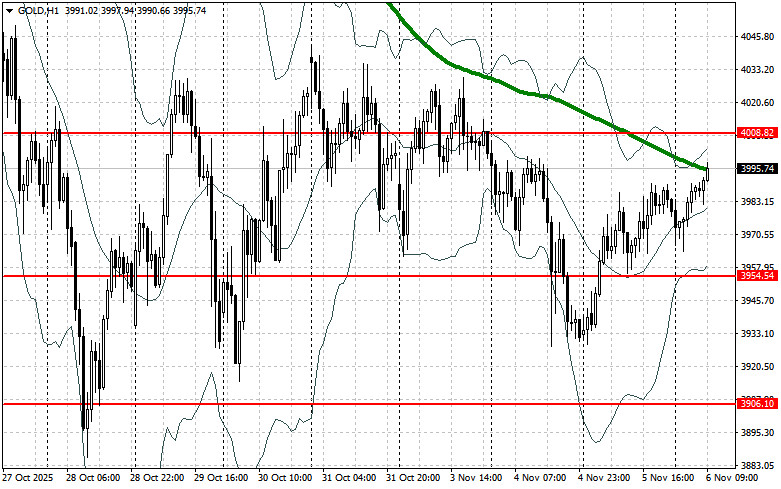

In the near term, the metal is expected to remain within a range.

Buyers need to overcome the nearest resistance at $4,008. This will allow them to target $4,062, above which it will be quite challenging to break through. The furthest target will be around $4,124. If gold falls, bears will attempt to take control over $3,954. If they succeed, breaking below this range would deal a serious blow to the bulls' positions, pushing gold down to a low of $3,906 with the prospect of reaching $3,849.

RÁPIDOS ENLACES