Gold has been declining for the third consecutive day amid weakening expectations of U.S. Federal Reserve interest rate cuts. New data, after 43 days of silence, is expected to shed light on a clearer picture of the U.S. economy.

The price of gold fell by 0.8%, after losing over 2% in the previous session. Traders continue to lose confidence in a potential rate cut in December, as Federal Reserve officials do not exhibit much confidence in the need to lower borrowing costs. Lower interest rates typically make non-yielding precious metals more attractive to investors.

As mentioned earlier, before making any significant moves, investors and policymakers are waiting for a flood of data amid the longest government shutdown in U.S. history. This forced pause in data flow has led to a noticeable shift in the rhetoric of Fed officials. The confidence previously shown in the inevitability of further monetary easing has significantly faltered. High-ranking officials are now speaking more cautiously about the prospects of a rate cut, highlighting the need for confirmation from renewed economic reviews.

The impact of this prolonged uncertainty has also spread to the gold market. Investors, accustomed to a steady stream of economic data for calibrating their strategies, are now experiencing fluctuations before taking any serious steps. The lack of a clear understanding of the U.S. economy encourages a wait-and-see approach, with many preferring to stay on the sidelines until a clearer picture emerges.

This year, gold is still showing a growth of 55% and is striving to achieve the best annual performance since 1979. The rapid rise to record highs above $4,380 last month was supported by active purchases from central banks, while investors also turned to precious metals as a hedge against increasing fiscal instability.

Despite the current pullback, the medium- and long-term trend for gold remains intact, buoyed by dovish expectations for the dollar and investors' preferences for safe assets, as both short-term and long-term prospects remain unclear.

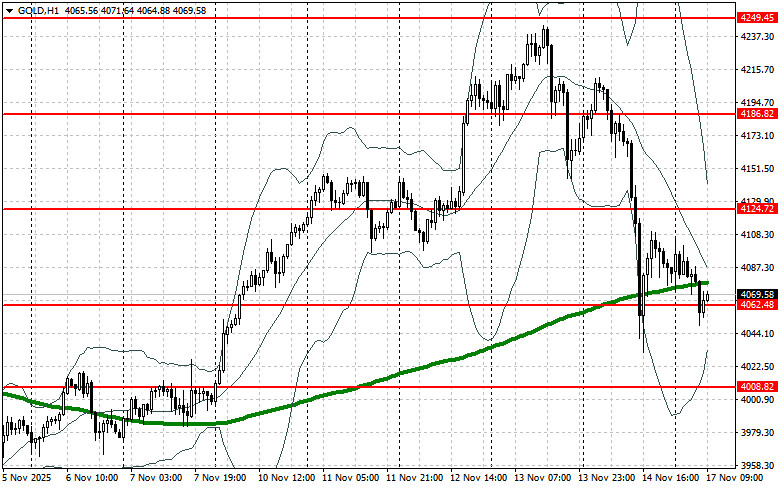

Regarding the current technical picture for gold, buyers need to surpass the nearest resistance at $4,124. This will allow for targeting $4,186, above which it will be quite challenging to break through. The furthest target will be around $4,249. If gold falls, bears will attempt to seize control at $4,062. If they succeed, a breakout below this range will deal a significant blow to the bulls' positions and push gold down to a low of $4,008 with the potential to reach $3,954.

RÁPIDOS ENLACES