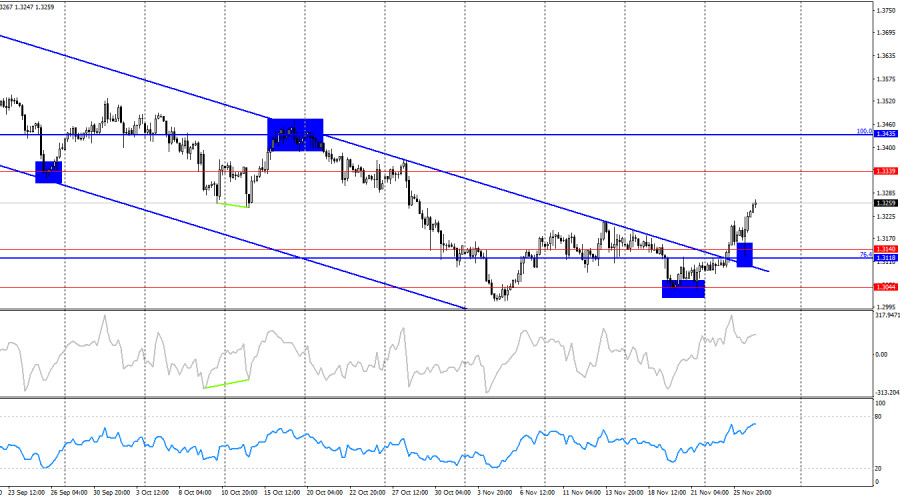

On the hourly chart, the GBP/USD pair bounced yesterday from the support level of 1.3119–1.3139 and resumed its upward movement. As of Thursday morning, the pair has consolidated above the 50.0% corrective level at 1.3240. Thus, the upward movement may continue today toward the next Fibonacci level of 61.8% – 1.3294. Consolidation of the quotes below 1.3240 will work in favor of the US dollar and a slight decline toward the 38.2% corrective level at 1.3186.

The wave situation has turned "bullish." The last downward wave did not break the previous low, while the new upward wave broke the previous high. Thus, the trend is officially "bullish" at this time. The fundamental background for the pound was weak in recent weeks, but the bears fully priced it in, and the fundamental backdrop in the US also leaves much to be desired.

The news background on Wednesday offered strong support to the bulls and the British pound. The key event of the day was the publication of the UK budget for the next financial year, which appeared online two hours ahead of schedule. Therefore, the pound was caught in a "storm of events" earlier than traders expected. To summarize briefly: many taxes will be increased. And those that will not be raised explicitly will still be raised implicitly (income tax). Thus, the UK government has found a way to patch the "budget hole" and even stay in surplus. London plans to raise more than £30 billion per year from tax increases. By raising taxes, the UK government created a £21.7 billion safety cushion. Markets reacted positively to the resolution of the budget issue. The yield on 10-year government bonds dropped to 4.45%, and the pound rose by roughly 100 pips. I also want to note that in recent weeks the pound had been falling precisely due to expectations of the new budget and tax increases. Since this factor had already been priced in by the time of publication, the only remaining direction for the pound was upward.

On the 4-hour chart, the pair consolidated above the descending trend channel and above the 1.3118–1.3140 level. Thus, the upward movement may continue toward the 1.3339 level, and the bulls may start forming a trend. No emerging divergences are seen today in any indicator. A rebound of the quotes from 1.3339 will work in favor of the dollar and a slight decline in the pair.

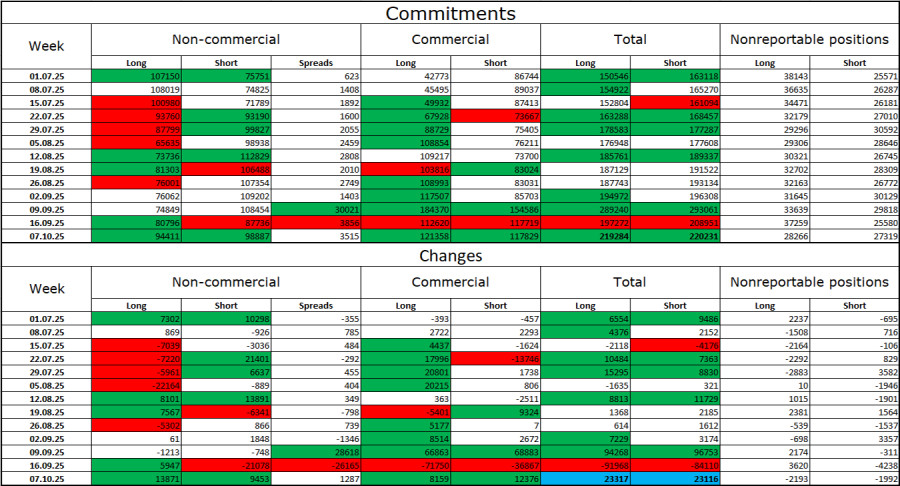

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became more "bullish" in the latest reporting week, but this reporting week was from one and a half months ago — October 7. The number of long positions held by speculators increased by 13,871, and the number of short positions increased by 9,453. The gap between long and short positions is roughly: 94,000 vs. 98,000. Practically equal.

In my opinion, the pound still looks less "dangerous" than the dollar. In the short term, the US currency enjoys demand in the market, but I believe this is temporary. Donald Trump's policies led to a sharp weakening of the labor market, and the Federal Reserve is forced to ease monetary policy to stop rising unemployment and stimulate job creation. Thus, if the Bank of England can cut the rate one more time, the FOMC may continue easing throughout 2026. The dollar significantly weakened in 2025, and 2026 may be no better for it.

News calendar for the US and UK:

On November 27, the economic calendar contains no significant entries. The news background will not influence market sentiment on Thursday.

GBP/USD Forecast and Trading Tips:

Selling the pair is possible today if the quotes rebound from the 1.3294 level on the hourly chart, with targets at 1.3240 and 1.3214. Buying could have been opened yesterday after the price consolidated above 1.3214, with targets at 1.3240 and 1.3294, or after a rebound from the 1.3119–1.3139 level with the same targets. Today, long positions can be kept open until the price closes below 1.3240.

Fibonacci grids are built from 1.3470–1.3010 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

RÁPIDOS ENLACES