The dollar once again faced difficulties, failing to receive the necessary support following the US Federal Reserve's meeting. Many traders had hoped that Powell would raise concerns about the rapidly weakening dollar, but this did not happen. Everything proceeded rather predictably: the Fed left interest rates unchanged at 3.75%. This decision, anticipated by most analysts, was met with a cautious response from the markets.

In its statement, the Fed emphasized that inflation is coming under control and that economic growth remains moderate, albeit steady. In the central bank's view, these factors do not require immediate intervention in monetary policy. However, the Fed remains vigilant and ready to act if economic conditions change. The Fed will continue to pay close attention to the labor market. While the unemployment rate has decreased last month, it is essential to keep a "pulse check," which does not necessitate any intervention.

Today, the first half of the day will bring data on private-sector lending in the Eurozone and on changes in the M3 money supply aggregate. The current resilience of the euro is attributed to several fundamental factors, including, first and foremost, growing confidence in the recovery of the Eurozone economy. Additionally, the European Central Bank's policy plays an important role. The ECB no longer intends to lower interest rates, and the central bank's latest rhetoric clearly indicates that everything is going reasonably well, which provides indirect support for the euro.

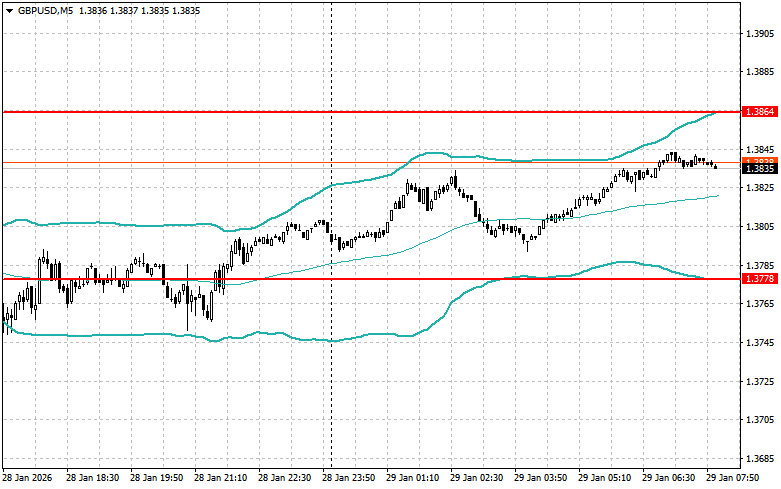

As for the British pound, the development of a bullish market for GBP/USD continues. Given the lack of important fundamental data, it is unlikely that anyone will want to open short positions on the pair, so it is best to continue acting within the trend, taking advantage of small corrections, as was done yesterday.

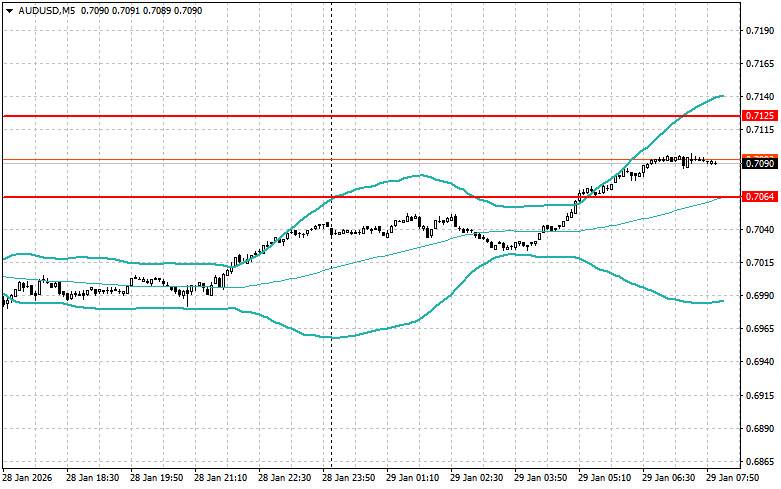

If the data aligns with economists' expectations, it is better to act based on the Mean Reversion strategy. If the data is significantly above or below economists' expectations, the best approach is to use the Momentum strategy.

RÁPIDOS ENLACES