Be careful what you wish for. Markets expect that weak US nonfarm payroll data will force the Federal Reserve to cut rates. However, if the data turns out to be much worse than Bloomberg's forecast of +75K, the impression may arise that the central bank is falling behind the curve and the US economy needs urgent rescue. This would be bad news for the S&P 500.

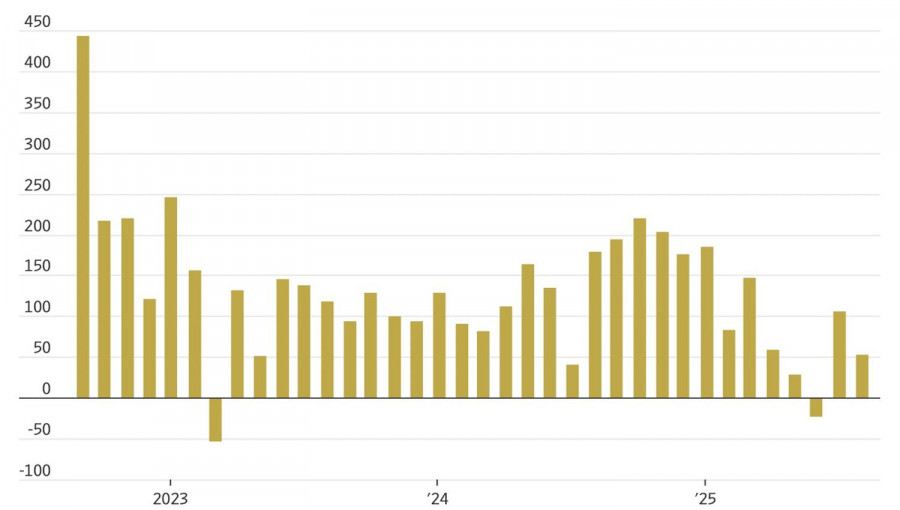

Bad news for the economy has become good news for the US stock market. That's what happened with the job opening numbers. Disappointing jobless claims and weak ADP private sector employment data confirmed this pattern. The S&P 500 hit a new record ahead of the critical August US labor market statistics.

Investors are buying the rumor that a slowdown in nonfarm payrolls and rising unemployment to the highest level since 2021 will force the Fed to cut rates. Derivatives markets price in more than a 99% probability of a federal funds rate cut in September. They are 49% sure we'll see three episodes of monetary easing by year-end.

If the economy is still growing, albeit at a slower pace, and inflation is under Fed control, the US equity market enters the so-called "Goldilocks" regime. Add to this strong corporate earnings, advances in AI technology, tax cuts, and large promised foreign investments. The result is a potent mix that suggests the S&P 500's upside potential is far from exhausted.

However, a significant deviation of nonfarm payrolls from projections risks ruining this picture. Employment near zero would renew recession fears. Conversely, a jump above 150–200K would suggest stagflation. Both scenarios are bad for the broad equity index. Investors should be careful what they wish for.

Bulls' optimism in the S&P 500 is bolstered by Donald Trump's firm intention to throw the market a lifeline via rate cuts. The President is pushing his people into the FOMC to gain a majority and ensure monetary easing. Meanwhile, Steven Miran has no intention of leaving the White House team, even from his post as a Fed Board Governor; he explains to Congress that his new position is only temporary.

Trump's drive for aggressive rate cuts would help the economy, but would also spur inflation. Treasuries would respond with higher yields, which would weigh on the broad market index. Still, this is a long process. For now, the market is betting on a renewed cycle and buying stocks.

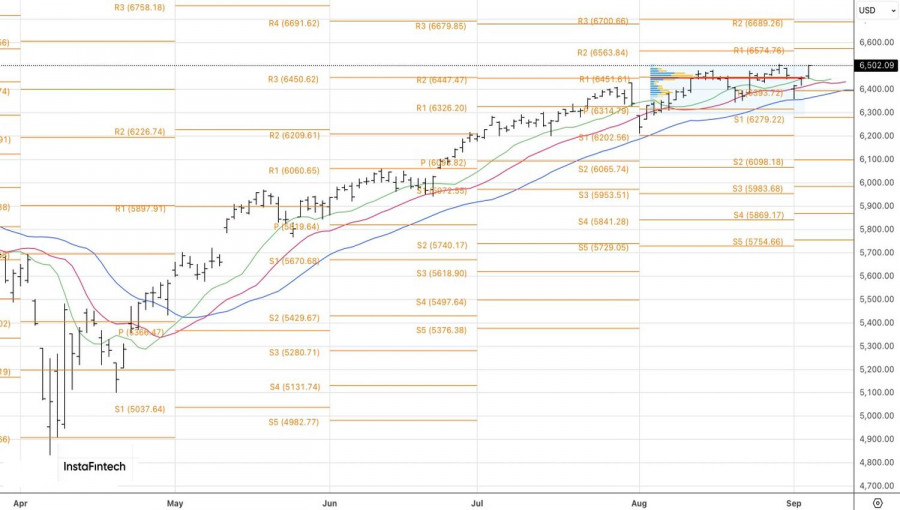

On the daily S&P 500 chart, the uptrend has resumed. Longs opened from 6415 should be held and added to as long as prices remain above 6450.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-09-08 11:33:07 IP: 216.73.216.111