Only the pound was traded today using the Mean Reversion strategy. I did not trade anything through Momentum.

Despite weak German data, the euro had no issues continuing its rise against the dollar. Eurozone GDP also brought no surprises, remaining unrevised.

Next come key U.S. labor market figures, which will significantly influence trader sentiment and the future path of the Federal Reserve's monetary policy. In focus will be changes in nonfarm payrolls, the unemployment rate, as well as average hourly earnings and private-sector employment data.

Analysts forecast a slowdown in job growth in the nonfarm sector, and only job growth above expectations could help convince traders of the strength of the U.S. economy and reinforce the Fed's stance on interest rates. On the other hand, a drop in this figure combined with a rise in unemployment is a direct signal for the Fed to cut rates, to which the dollar would respond with a decline.

Changes in average hourly earnings are an important indicator of inflationary pressure in the labor market. Accelerating wage growth could push inflation higher.

In the case of strong data, I will rely on Momentum strategy. If the market does not react to the figures, I will continue using the Mean Reversion strategy.

Momentum strategy (breakout) for the second half of the day:

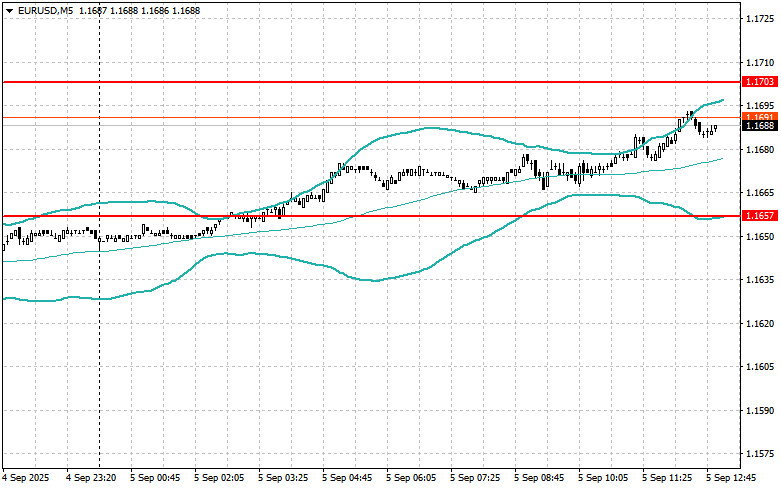

EUR/USD

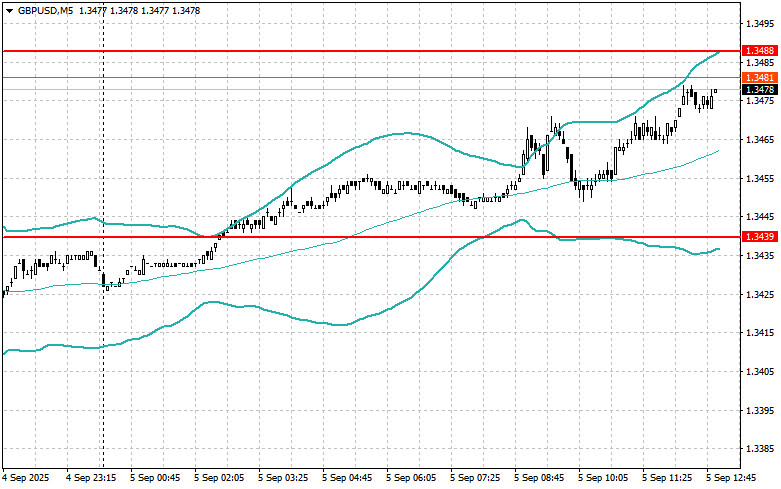

GBP/USD

USD/JPY

Mean Reversion strategy (reversal) for the second half of the day:

EUR/USD

GBP/USD

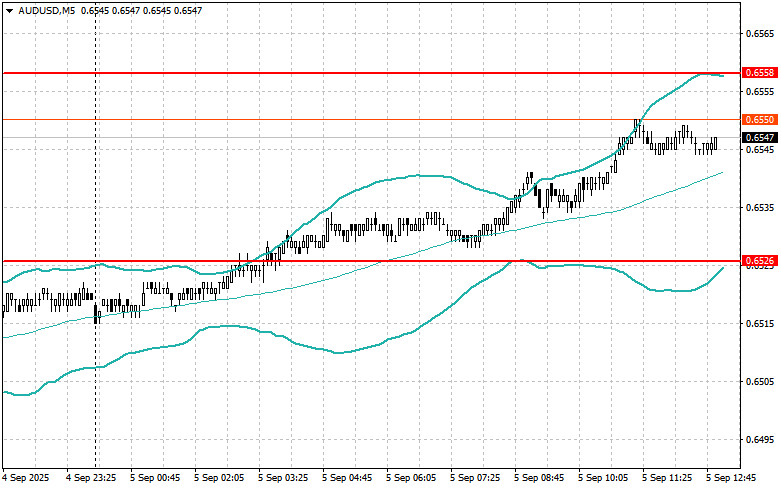

AUD/USD

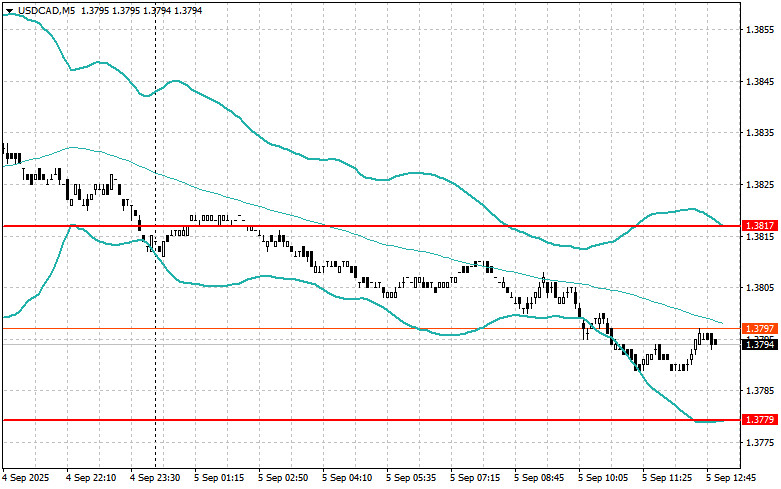

USD/CAD

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-09-06 09:04:11 IP: 216.73.216.111