Praha – Česká spořitelna (ČS) vykázala letos v prvním čtvrtletí čistý zisk 5,7 miliardy korun, meziročně je o 0,3 procenta vyšší. Provozní zisk stoupl o 3,9 procenta na 7,8 miliardy korun, podle banky to bylo zásluhou vyšších provozních výnosů, které vzrostly o 4,9 procenta. Neauditované konsolidované výsledky oznámila ČS v tiskové zprávě.

The EUR/USD currency pair on Tuesday clearly showed what traders expect in the near future. Despite a very weak macroeconomic backdrop, the euro rose all day and broke above the July 1 high, which was also the highest value in the last three years. For us, there's really nothing surprising here, as we've said many times: the dollar has no chance to grow, except for technical corrections. Over the last five weeks, upward movement has been quite weak, but the euro keeps climbing, not the dollar. The dollar more or less corrected for about a month, and now the decline has resumed. Granted, this is no longer a collapse like in the first half of 2025—but it's still a decline.

Today, the US will announce the results of the Fed meeting, the sixth this year. Only three meetings remain before year-end—all of which could bring rate cuts. At least, for traders, this is now the base case they believe in. However, it's worth noting that in recent years, the market has always expected the "dovish" actions from the Fed and has never quite gotten them. So, we seriously doubt we'll see all three cuts by year-end.

Jerome Powell keeps repeating the same thing: monetary policy will depend entirely on macroeconomic data. Yes, the labor market has been weakening for four months in a row, so it seems obvious to everyone that aid is needed. And that's probably true. But what if the labor market starts recovering as soon as September? And if it continues in October? Would three rate cuts still be needed this year?

We believe the most important thing now isn't really medium-term outlooks or expectations, but rather the actual results of the September meeting—even if the decision is already made and announced. The market will focus closely on the FOMC vote. Not all voting details may be made public, but some information will certainly leak to the media. The market reaction will depend on how many FOMC officials lean "dovish." The market is not worried about a rate cut in September (which it's expected all year and thus has been fully priced in). The real concern is that at some point, the Fed rate could drop like a stone if Trump manages to sway most of the Monetary Committee—or fire those he can't persuade. That's what spooks the market, and what will send traders fleeing the dollar.

Thus, the more signals we get about a growing "dovish" sentiment within the FOMC, the higher the chances of a new, strong, and prolonged dollar slide. And don't forget: the trade war, the main factor in the dollar's fall in the first half of 2025, hasn't gone anywhere—it's neither ended nor paused. There's a slight chance the US Supreme Court will block Trump's tariffs entirely, but we won't know until November at the earliest.

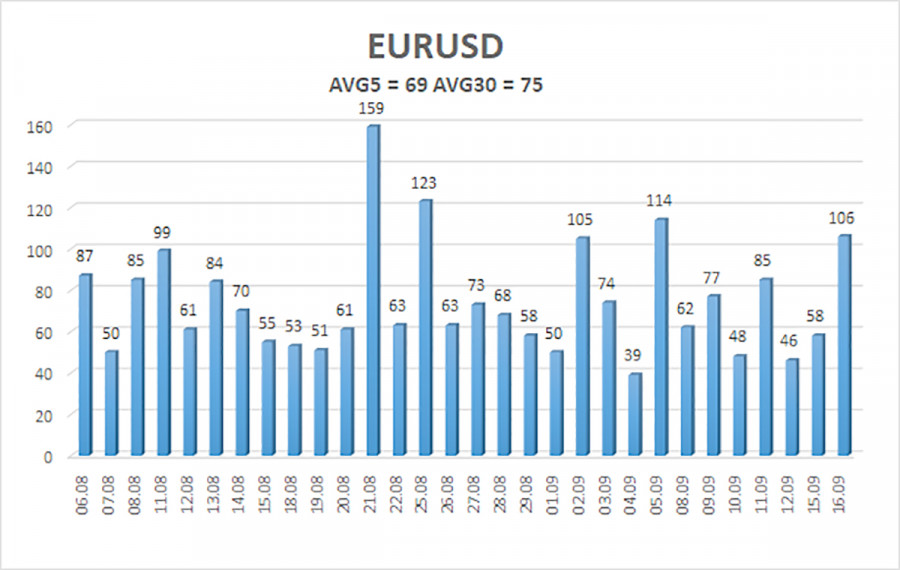

The average EUR/USD volatility over the last five trading days as of September 17 is 69 pips, classed as "average." On Wednesday, we expect movement between 1.1776 and 1.1914. The linear regression channel's upper band is still pointed upward, indicating an ongoing uptrend. The CCI indicator has entered the oversold zone three times, signaling the uptrend's resumption. A bullish divergence has formed—another early warning of growth. Now the indicator is in the overbought area, but during an uptrend, this only hints at a correction, not a reversal.

S1 – 1.1841

S2 – 1.1780

S3 – 1.1719

The EUR/USD pair may resume its uptrend. The US dollar is still under significant pressure from Donald Trump's policies, and he "isn't stopping here." The dollar grew as much as it could (not for long), but now seems set for a new leg of prolonged decline. If the price is below the moving average, small shorts can be considered toward 1.1658 on purely corrective grounds. Above the moving average, long positions aiming for 1.1914 remain relevant with the trend.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-09-17 03:20:19 IP: 216.73.216.144