The GBP/USD pair also traded higher on Thursday, which makes little sense. Recall that the British currency had been declining for more than a month and was falling more sharply than the euro, often without any justification. However, yesterday, following the Bank of England's meeting, which surprised traders, the pound sterling rose. The British central bank left the key rate unchanged, but this decision was not unanimous among the bank officials. We could even say it was "on the edge." Four members of the Monetary Policy Committee voted for a rate cut while five voted to keep it unchanged. Thus, literally one vote could have led to a rate cut. This event indicates a more "dovish" stance from the central bank than was anticipated. Therefore, the British currency had every reason to continue its decline yesterday. However, as we mentioned, there is currently no connection between the movements of the pair and events/reports, which is why we saw a rise within the prevailing downward trend on the hourly timeframe and within a correction/flat on the daily timeframe.

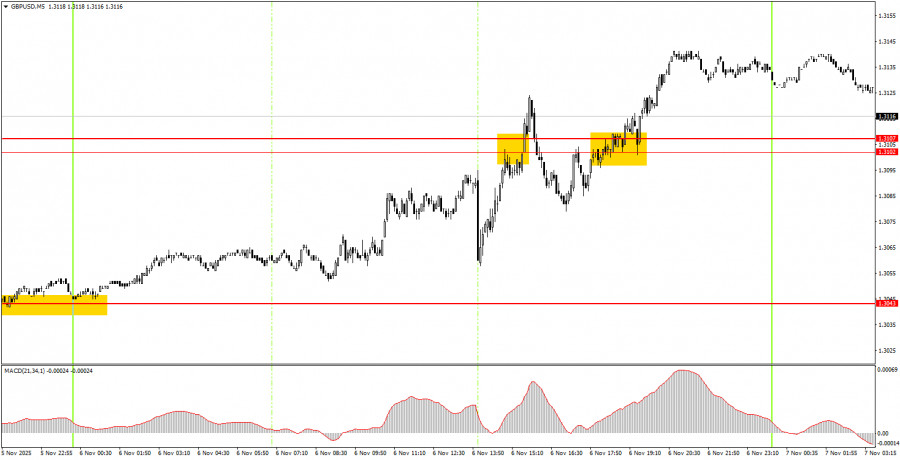

On the 5-minute timeframe, several trade signals were formed throughout Thursday, although the pair traded chaotically due to the significance of the Bank of England meeting. However, the best buy signal was formed earlier in the night. The price breached the 1.3043 level, after which, during the American session, it approached the area of 1.3102-1.3107, where profits could already have been taken. Later, two more trade signals were formed: one for a sale (false) and one for a buy (true).

On the hourly timeframe, the GBP/USD pair continues to form a new downward trend. The pound sterling is once again declining for absolutely any reasons. As we have already stated, there are no grounds for prolonged dollar growth, so we expect movement only to the north in the medium term. However, the flat factor continues to pull the pair down in the long term, which is an absolutely illogical development.

On Friday, novice traders may remain in long positions after breaching the 1.3102-1.3107 area, targeting 1.3203. If the pair establishes itself below this area today, short positions with a target of 1.3043 will become relevant.

On the 5-minute timeframe, you can currently trade at the following levels: 1.2913, 1.2980-1.2993, 1.3043, 1.3102-1.3107, 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, and 1.3574-1.3590. No significant events or reports are scheduled for Friday in the UK, while in the U.S., only the consumer sentiment index will be released, instead of Non-Farm Payrolls and the unemployment rate.

Important announcements and reports (always available in the news calendar) can significantly impact the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or to exit the market to avoid sharp reversals against the preceding movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is key to long-term success in trading.

RYCHLÉ ODKAZY