Canada's GDP fell by 1.6% quarter-on-quarter in Q2, which was significantly worse than forecasts. Preliminary data for July show a growth of 0.1%, suggesting that weak dynamics will persist going forward.

At the same time, the details of the report are far from straightforward. Exports fell sharply by 27%, which is a direct consequence of new tariffs. Imports decreased by 5.1%. However, it is essential to note a significant increase in consumer spending by 4.5% year-on-year. Domestic demand is strong, and the negative overall dynamics are primarily determined by external trade.

Strong demand was supported mainly because businesses built up large inventories in Q1 due to tariff uncertainty, so even a noticeable drop in imports did not impact demand volumes. Industrial performance is weak: productivity fell by 1.0%, and output declined for the first time in seven months.

The Bank of Canada cut rates rather aggressively, bringing them down to 2.75%. Will they continue to cut? For now, there is no clarity; more information will become available on Friday, when Canadian and US labor market data is released. In any case, the latest data suggests the Canadian dollar has no real grounds for strengthening. The publication of these labor reports is not only the key event of the week, but, in fact, the market will form its expectations for the Bank of Canada and Fed meetings on September 17.

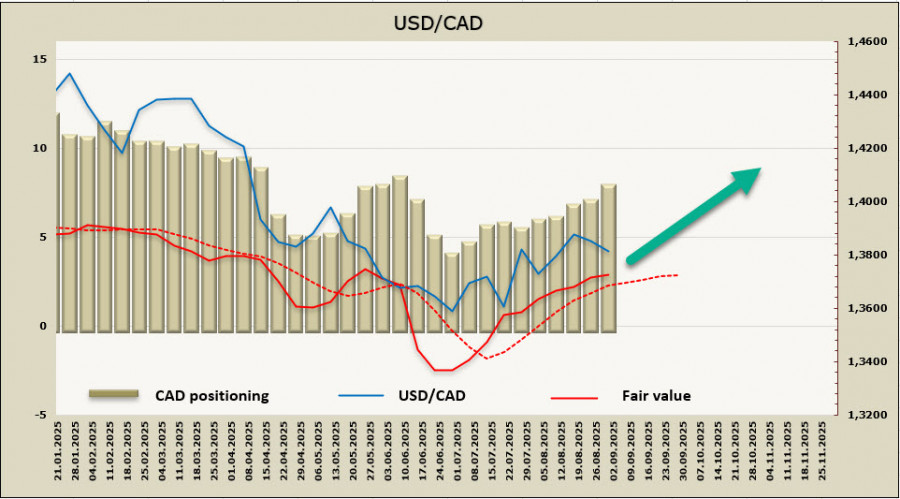

The net long position in CAD increased by $877 million over the reporting week to -$7.59 billion; speculative positioning remains steadily bearish, and the calculated price is above the long-term average and showing an upward trend.

USD/CAD is trading in an upward channel after a fairly steep decline in the first half of the year; we expect it to remain within this channel for the coming week. The short-term momentum is bullish, and we expect movement toward the upper boundary of the channel, where there is a strong resistance zone at 1.3980/4020.

QUICK LINKS