The economy remains strong, and U.S. trade deals with other countries are bringing clarity. What could be better for the S&P 500? Perhaps a fireworks display of corporate earnings that investors expect from the Magnificent Seven and other companies. Wall Street analysts have set the bar very low—just 2.8% earnings growth in Q2, the lowest since 2023. Thanks to bank stocks, that figure has already risen to 3%. And the best may still be ahead.

According to a majority of over 100 investors surveyed in the MLIV Pulse poll, corporate earnings matter more for the S&P 500 than tariffs. Still, without clarification on import duties, it would be difficult to count on strong performance from U.S. companies. In that respect, Donald Trump deserves applause. With his signature whirlwind of activity, the U.S. president managed the seemingly impossible—striking numerous trade deals in a short time. Typically, such agreements take years to finalize.

Following Japan, the European Union is now ready to agree to a 15% tariff. Brussels will push to lower auto import tariffs from 25% to 15%, following Tokyo's lead. Japan had to invest around $550 billion in the U.S. economy. What will the EU be willing to offer? Either way, America's major trading partners have either finalized deals or are on the verge of doing so. Meanwhile, the U.S. is resuming talks with another global heavyweight—China. Trump announced he would meet with Xi Jinping, and markets are brimming with optimism.

Clarifying the tariff situation paves the way for the Federal Reserve to resume its monetary easing cycle. Jerome Powell and his colleagues have repeatedly stated that import duties make forecasting and decision-making more difficult for the central bank. Without tariffs, inflation would likely be anchored near 2%, and monetary easing would continue. Now it's time to deliver on those words.

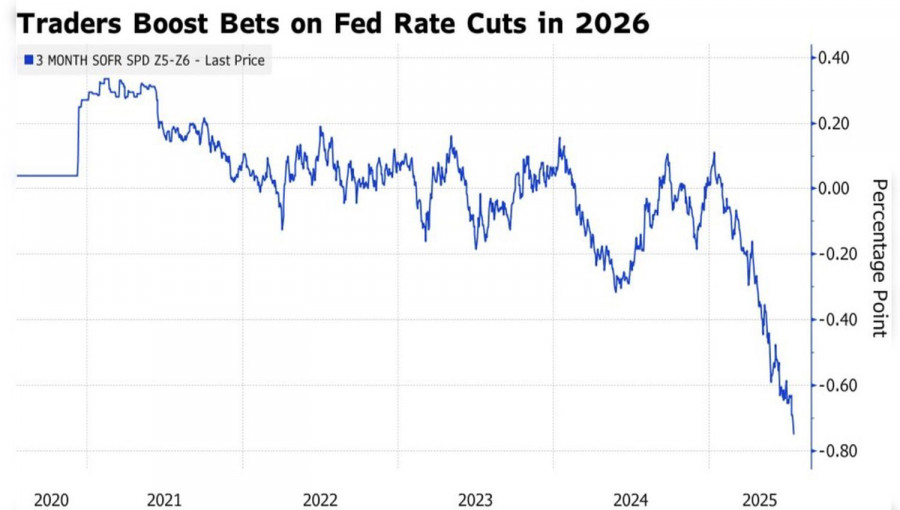

The futures market has raised its forecast for the Fed's monetary easing in 2026 from 25 basis points in April to 75 basis points. This is primarily due to expectations of a leadership change at the Fed. A chair more sympathetic to Trump's call for a 300-basis-point rate cut could turn the FOMC into a "dovish stronghold." Good news for U.S. equities.

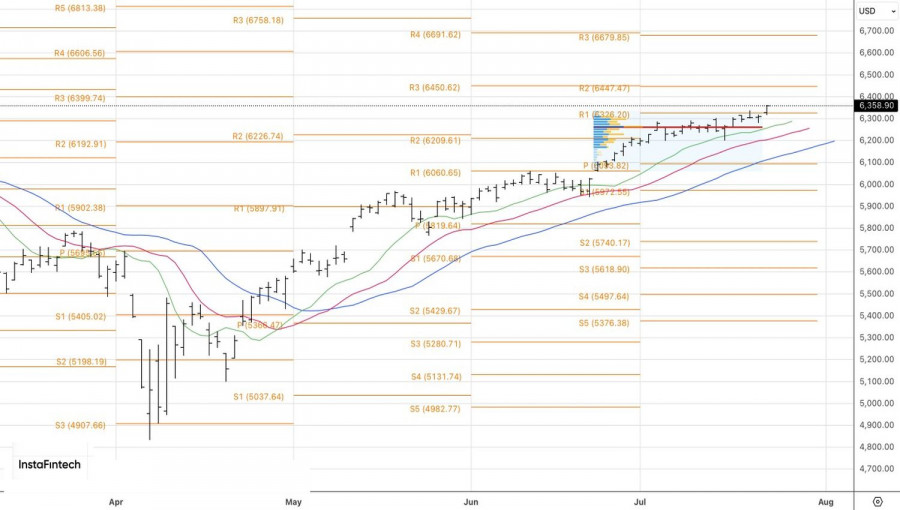

Thus, a strong economy, optimism around corporate earnings, expectations of Fed monetary easing, and clarity on tariffs are all enabling the broad stock index to reach new all-time highs.

Technically, on the daily chart, the S&P 500 has already hit the first of two previously defined targets—6325 and 6450—based on long positions from 6051 and 6270. As long as the broad equity index holds above the pivot level of 6325, the focus should remain on buying. A move toward 6700 is not out of the question.