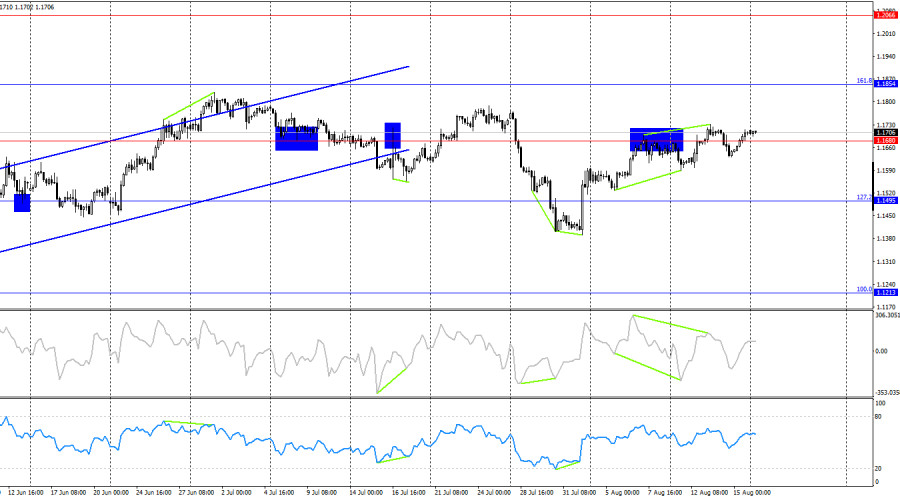

The wave structure on the hourly chart remains simple and clear. The last completed upward wave broke above the peak of the previous one, while the last downward wave failed to break the prior low. Therefore, at this time the trend can be considered bullish, though it has been changing too often lately due to the news background. Recent labor market data and shifting Fed monetary policy expectations support the bulls.

On Friday, the news background was noteworthy, but traders preferred to focus on the talks between Vladimir Putin and Donald Trump in Alaska. On Monday morning, it can be said that the parties reached some agreements, though no details are known. Both the U.S. and Russian leaders stated that progress had been made toward resolving the conflict, but more time and Ukraine's participation in negotiations are needed to achieve lasting peace. To accomplish this, the root causes of the conflict must be addressed. Thus, high-level international meetings with the participation of EU, Ukrainian, Russian, and U.S. leaders will continue. Traders, however, are in no rush to draw conclusions or make trading decisions. It is still hard to say how the negotiations will end. If peace is achieved, it would be a positive factor for emerging and second-tier currencies. For now, the dollar remains a "safe-haven asset," drawing interest when geopolitical tensions rise. At this moment, the reverse may occur.

On the 4-hour chart, the pair formed another reversal in favor of the euro and consolidated above the 1.1680 level. This level has been crossed too often lately, so I would not recommend relying on it. The picture on the hourly chart is much more informative and clear. No divergences are forming today on any indicators.

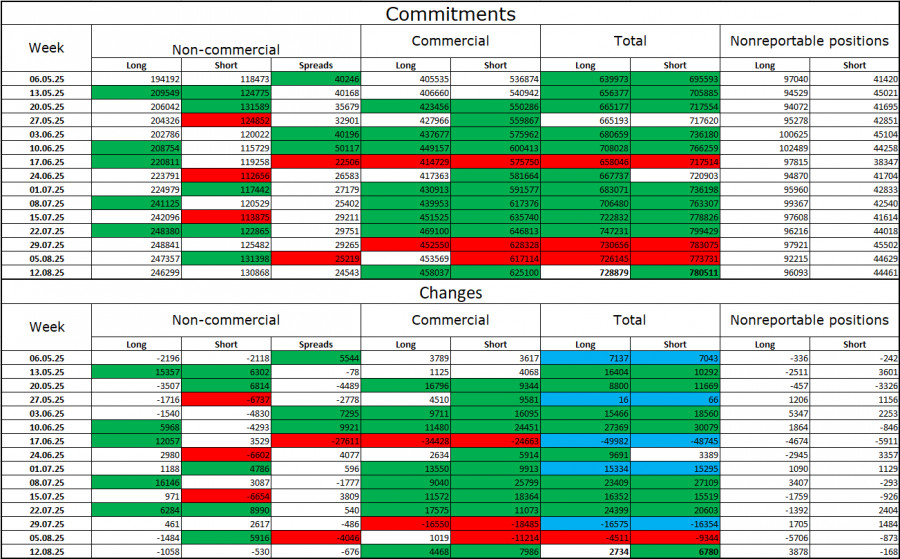

Commitments of Traders (COT) Report:

During the last reporting week, professional traders closed 1,058 long positions and 530 short positions. The sentiment of the "Non-commercial" group remains bullish thanks to Donald Trump and continues to strengthen over time. The total number of long positions held by speculators is now 246,000, while short positions number 131,000. The gap is nearly twofold. In addition, note the number of green cells in the table above: they indicate strong position-building in the euro. In most cases, interest in the euro is rising while interest in the dollar is falling.

For twenty-seven consecutive weeks, large players have been reducing short positions and building long ones. Donald Trump's policies remain the most significant factor for traders, as they could create numerous problems of a long-term and structural nature for the U.S. Despite the signing of several important trade agreements, some key economic indicators continue to show declines.

News Calendar for the U.S. and the EU:

On August 18, the economic calendar contains no noteworthy entries. The news background will not affect market sentiment during Monday.

EUR/USD Forecast and Trading Tips:

Selling the pair is possible today if the hourly close is below 1.1695, with targets at 1.1637–1.1645 and 1.1590. Buying could have been opened on Friday on a rebound from the 1.1637–1.1645 zone on the hourly chart, with targets at 1.1695 and 1.1789. These positions can be kept open today.

Fibonacci grids are built from 1.1789–1.1392 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.