On Monday, I wrote that America has shown its willingness to introduce new tariffs on imports from China and the European Union because these countries are buying oil and other energy resources from Russia—something the White House believes is prolonging the conflict in Ukraine. However, both Trump and Treasury Secretary Bessent have also made it clear that they are unwilling to proceed with new tariffs without Europe's participation. On one hand, Washington's position is logical. What's the point of sanctioning India and China if the European Union keeps buying oil from Russia? First, Europe must completely stop buying Russian oil and gas, and only then can tariffs be introduced, with the aim of stopping the war.

At least, that's how it should work in theory. In practice, the Kremlin has repeatedly stated that no new sanctions or tariffs will make it abandon its goals. Personally, I doubt India and China will stop buying from Russia. Russia is a close neighbor to both with vast natural resources—why should Beijing and New Delhi search the world for what's already next door, paying higher prices due to more complicated logistics?

As always, it will come down to money. If Europe and America introduce joint duties against India and China, the main consideration will be the balance sheet. If the loss from new tariffs outweighs the extra logistics costs of getting oil and gas elsewhere, then both countries might indeed agree to stop buying from Russia. But again, there are many weak links in this "genius plan."

When Trump started the trade war, many countries became "hubs" for imports to the US. How does that work? If Chinese goods face tariffs when entering the US, consider importing them through third countries labeled as non-Chinese origin. There are countless ways to circumvent sanctions. It's now known that China and Russia could maintain their trade with good old-fashioned barter.

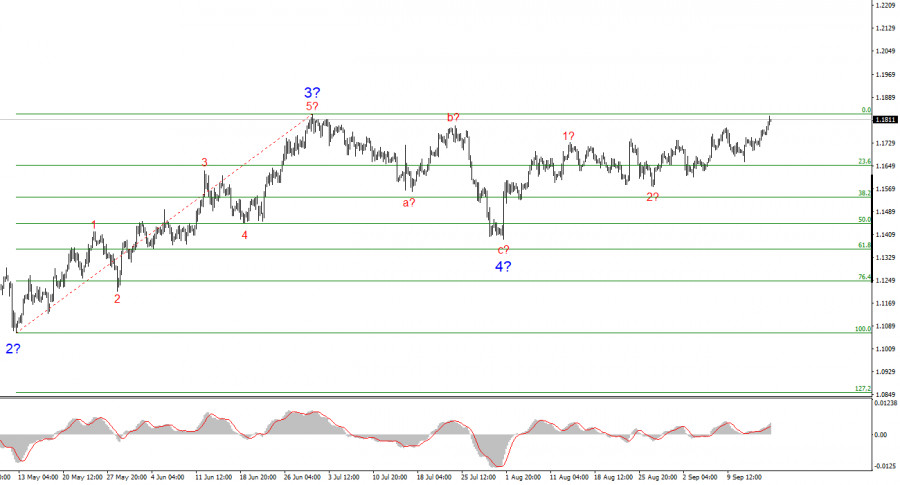

Based on my analysis, EUR/USD continues to build a rising section of the trend. The wave structure remains heavily influenced by the news background, particularly Trump's decisions and the new Administration's domestic and foreign policies. The targets for this trend could reach the 1.25 area. The news background remains unchanged; therefore, I continue to view 1.1875 (which corresponds to the 161.8% Fibonacci retracement) and above as the first upside targets.

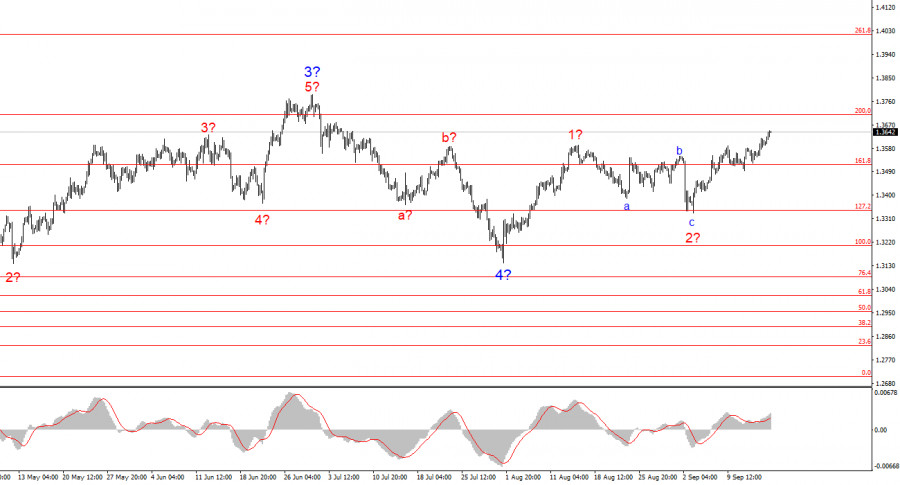

The GBP/USD wave structure remains unchanged. We're dealing with a bullish, impulsive trend leg. Under Donald Trump, markets could face many more shocks and reversals, possibly affecting the wave pattern, but for now, the core scenario is intact, and Trump's policy is consistent. The upside target for this trend leg lies around the 261.8% Fibonacci extension. I expect further price increases as part of wave 3 in 5, with a target of 1.4017.