Today, the EUR/USD pair is trading in a narrow range, consolidating the recent strong rally toward the more-than-two-week high reached the day before. The US dollar is attracting active sellers, trading near the two-week low reached yesterday, Thursday, amid concerns about the possible economic consequences of a prolonged US government shutdown. This is the main factor supporting the rise of the EUR/USD pair. In addition, the contrasting policy approaches of the Federal Reserve and the European Central Bank are supporting the currency pair, confirming the likelihood of a continued two-week upward trend.

An increasing number of Fed officials are expressing caution regarding further monetary easing given the lack of new economic data. However, traders still split the risks roughly 50/50 on the probability of a rate cut in December.

In contrast, most analysts expect that the ECB will leave the deposit rate unchanged this year and do not plan to adjust its policy until the end of next year. These expectations contribute to a positive outlook for EUR/USD, though bulls would ideally wait for a breakout above the confluence of the 50-day simple moving average (SMA) and the 100-day SMA to strengthen their positions.

Meanwhile, according to a senior White House official, the main economic reports for October — employment and inflation data — may not even be published. Therefore, attention should be paid to comments from influential FOMC members to understand the direction of future Fed policy decisions, and consequently, the direction of the US dollar.

Additionally, the release of preliminary eurozone GDP data for the third quarter may create momentum for the euro and generate additional trading opportunities for the EUR/USD pair.

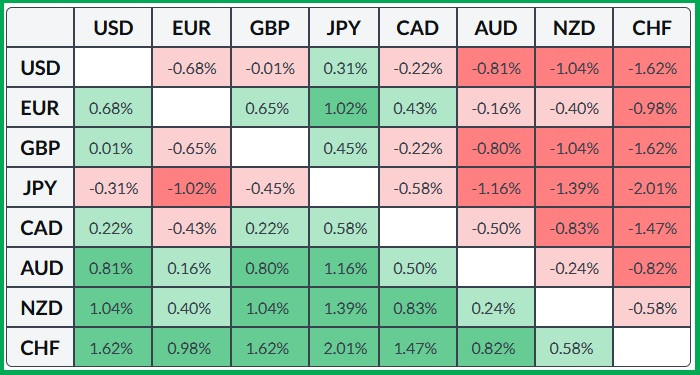

From a technical standpoint, the oscillators on the daily chart are mixed, so buyers should remain cautious. Prices have found support at the 1.16250 level, with resistance at 1.1650. However, to confirm the positive outlook, prices need to overcome the confluence of the 50-day and 100-day SMAs located at 1.1666. Below is a table showing the movement of the US dollar relative to major currencies for the current week. The greatest strength of the dollar has been recorded against the Japanese yen.