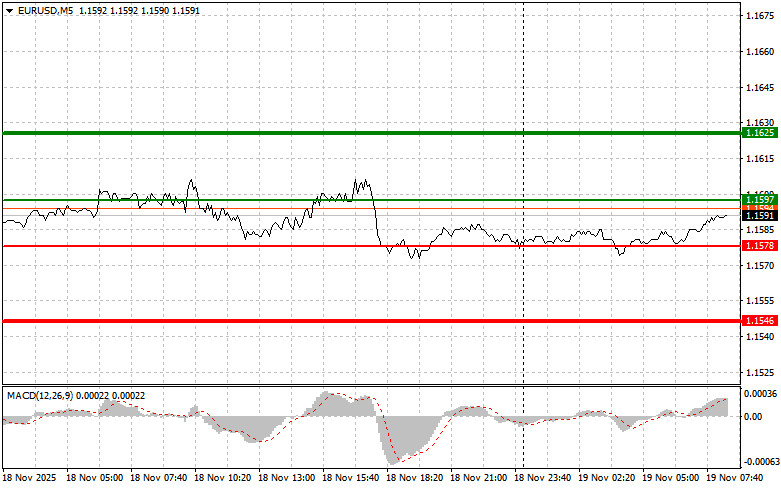

The test of the price at 1.1597 occurred when the MACD indicator had moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy euros, and it turned out to be the right decision.

Improvement in durable goods orders in the U.S. and cautious comments from Federal Reserve officials supported the U.S. dollar in the second half of the day. The rise in manufacturing orders indicates a revival in industry and an increase in economic growth. This, in turn, reduces the likelihood of further Fed interest rate cuts. The Fed's conservative tone, emphasizing the dependence of future decisions on incoming economic data, also helps strengthen the dollar. Market participants perceive this as a signal that the central bank will not rush to transition to a loose monetary policy, increasing the investment attractiveness of the U.S. currency.

As for today, market influence will come from the Eurozone Consumer Price Index data and the core Consumer Price Index for October this year. If the figures exceed forecasts, it could prompt the European Central Bank to adopt a more aggressive stance on interest rates. Conversely, if inflation remains around the target level of 2.0%, the ECB will continue to adopt a wait-and-see stance; however, the euro may react with a decline.

Regarding intraday strategies, I will mainly rely on implementing scenarios #1 and #2.

Scenario #1: Today, I will buy euros at a price around 1.1597 (green line on the chart), with a target of reaching 1.1625. At point 1.1625, I plan to exit the market and also sell euros in the opposite direction, targeting a movement of 30-35 pips from the entry point. An increase in the euro can only be expected after good data. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning an upward move from it.

Scenario #2: I also plan to buy euros today if the price tests 1.1578 twice, when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. An increase can be expected toward the opposite levels of 1.1597 and 1.1625.

Scenario #1: I plan to sell euros once the price reaches 1.1578 (red line on the chart). The target will be the level of 1.1546, where I plan to exit the market and buy immediately in the opposite direction (targeting a movement of 20-25 pips in the opposite direction from the level). Pressure on the pair will return after breaking important support levels. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning its downward movement from it.

Scenario #2: I also plan to sell euros today if the price tests 1.1597 twice in a row, when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal downward. A decrease can be expected toward the opposite levels of 1.1578 and 1.1546.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.