The GBP/USD pair "treated" traders to volatility on Wednesday as well. During the first 14 days of the new year, so many events have occurred worldwide that they would have sufficed for several months. Yet the FX market seems to still be celebrating the New Year and Christmas, so there is virtually no movement. Zooming in on the hourly TF, it is clear that the movement in recent weeks has been sideways. Yesterday, the pound's volatility was 46 pips. In the US, the Producer Price Index for November and retail sales were published. The PPI rose to 3% year-on-year, and now this indicator is higher than inflation, which is somewhat illogical. In any case, higher inflation reduces the probability of further Fed easing, which is positive for the dollar. Retail sales in November increased by 0.6%, beating expert forecasts. Thus, the two US reports could have supported the US dollar. But once again, we saw no market reaction to these fairly important events.

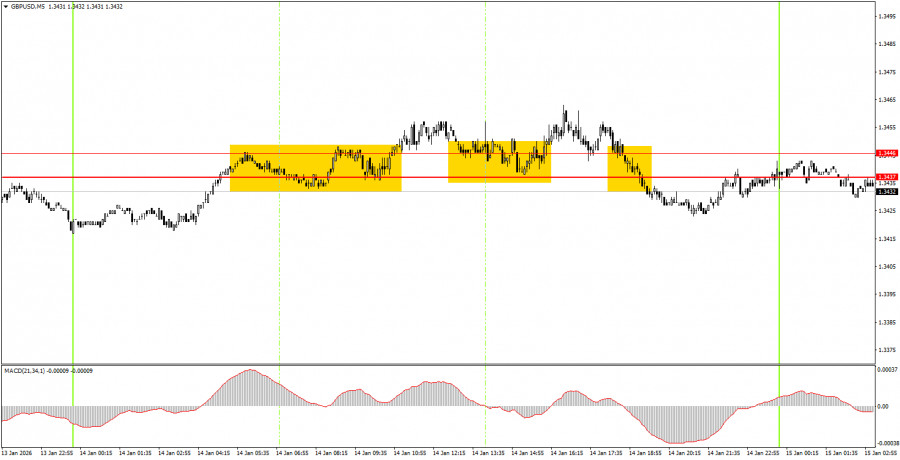

On the 5-minute TF on Wednesday, the pound moved largely sideways, ignoring technical obstacles. Three trading signals were generated in the 1.3437–1.3446 area, and none provoked any trader reaction. Overall, we continue to warn novice traders that market moves are currently extremely weak and the logic behind moves is scant.

On the hourly TF, the GBP/USD pair settled below the trendline; we see no clear downtrend at the moment. Rather, another flat. There are no global reasons for medium-term dollar strength, so we expect movement only to the north. In general, we also expect the resumption of the 2025 global uptrend, which could bring the pair to 1.4000 within the next couple of months.

On Thursday, novice traders may consider new short positions targeting the 1.3319–1.3331 area if the price bounces off the 1.3437–1.3446 area. A close above 1.3437–1.3446 would make longs relevant with a target of 1.3529–1.3543.

On the 5?minute TF, you can trade using the levels 1.3043, 1.3096–1.3107, 1.3203–1.3212, 1.3259–1.3267, 1.3319–1.3331, 1.3437–1.3446, 1.3529–1.3543, 1.3574–1.3590, 1.3643–1.3652, 1.3682, 1.3763. On Thursday, the UK will publish its monthly GDP and industrial production. Given how many events and releases the market has already ignored in the first two weeks of the year, we do not expect a strong reaction to these two reports.

Support and resistance price levels — levels that serve as targets when opening buys or sells. Take Profit can be placed near them.

Red lines — channels or trendlines that reflect the current tendency and show which direction is preferable to trade now.

MACD indicator (14,22,3) — histogram and signal line — an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always listed in the news calendar) can strongly affect a currency pair's movement. Therefore, during their release, trading should be done with maximum caution, or positions should be closed, to avoid a sharp price reversal against the preceding move.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and effective money management are the keys to long-term trading success.