The price test at 153.86 coincided with the MACD indicator just starting to move upward from the zero mark, confirming a good entry point to buy the dollar. As a result, the pair rose towards the target level of 154.24.

Good data from the US industrial sector and housing market prompted dollar purchases against the Japanese yen. This trend was not disrupted by figures showing a sharp increase in machinery and equipment orders in Japan. Traditionally, an increase in capital goods orders indicates heightened business investment activity and serves as a bellwether for future economic growth. It was expected that this could support the Japanese currency; however, the dollar seems to be in much greater demand. The fact that the Fed is not in a rush to lower interest rates, as evident from yesterday's meeting minutes, allows the dollar to continue demonstrating strength against the Japanese yen. Thus, even positive news from Japan could not compensate for this stronger dollar factor.

As for the intraday strategy, I will lean more towards implementing scenarios #1 and #2.

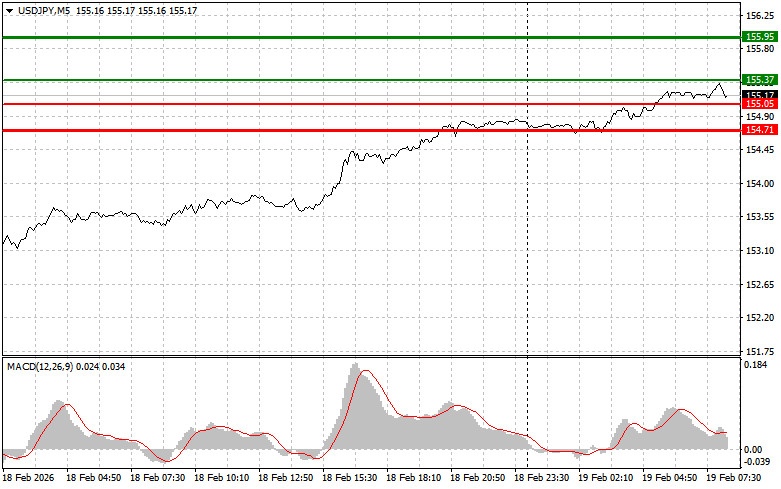

The thin green line represents the entry price at which one can buy the trading instrument;

The thick green line represents the approximate price where one can set Take Profit or secure profits, as further growth above this level is unlikely;

The thin red line represents the entry price at which one can sell the trading instrument;

The thick red line represents the approximate price where one can set Take Profit or secure profits, as further decline below this level is unlikely;

The MACD indicator: when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders in the Forex market should be very careful when making entry decisions. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, as outlined above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.