The test of the 150.24 level coincided with the MACD indicator just beginning to move downward from the zero line, which confirmed a valid entry point for selling the dollar and led to a drop in the pair of more than 200 pips.

Weak U.S. Nonfarm Payrolls data for July caused a sharp decline in the dollar and a strengthening of the Japanese yen. Investors interpreted the slowdown in U.S. job growth as a signal of potential monetary policy easing by the Federal Reserve. The Japanese yen, which had long been under pressure due to the Bank of Japan's ultra-loose policy, received solid support. Expectations that the Fed will actively cut rates have reduced the appeal of dollar assets while increasing interest in the yen, which is viewed as a safe-haven currency during times of economic uncertainty. The key factor influencing the USD/JPY pair remains the interest rate differential between the U.S. and Japan. Currently, this spread remains significant, but based on recent data, a narrowing could occur as early as this fall—something yen buyers are already anticipating. Going forward, the dynamics of USD/JPY will depend on economic data from both countries, statements from Fed and BOJ officials, and global risk factors.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

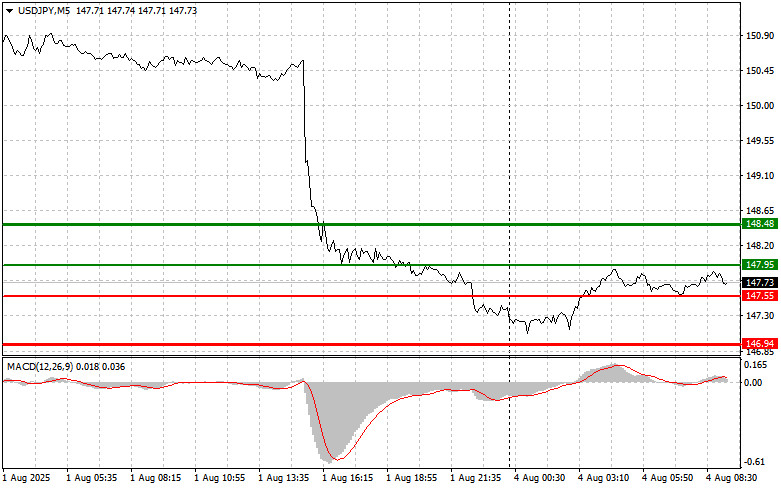

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point around 147.95 (green line on the chart), targeting a rise to 148.48 (thicker green line). Around 148.48, I plan to exit long positions and open shorts in the opposite direction, aiming for a 30–35 pip retracement. It's best to return to buying the pair on corrections and significant dips in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 147.55 level while the MACD indicator is in oversold territory. This would limit the downside potential and lead to an upward market reversal. Growth toward the opposite levels of 147.95 and 148.48 can be expected.

Scenario #1: I plan to sell USD/JPY today only after a breakout below 147.55 (red line on the chart), which would likely trigger a sharp drop in the pair. The key target for sellers will be 146.94, where I plan to exit short positions and immediately open long trades in the opposite direction, aiming for a 20–25 pip pullback. Strong downward pressure on the pair is expected to persist today. Important! Before selling, ensure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 147.95 level while the MACD indicator is in overbought territory. This would limit the upside potential and lead to a downward market reversal. A decline to the opposite levels of 147.55 and 146.94 can be expected.

ລິ້ງດ່ວນ