Today, the pound and the Australian dollar were traded using the Mean Reversion strategy. I tried to trade the yen through Momentum, but the result was mediocre.

The released data showing a decline in the Consumer Price Index in the eurozone put pressure on the euro. However, falling inflation is not an unconditional signal for policy easing. Observers note that the slowdown in consumer price growth may be driven not only by the ECB's effective measures but also by weaker economic growth in the region and external factors such as lower energy prices. In this context, a premature rate cut could lead to undesirable consequences, something some ECB representatives have recently emphasized.

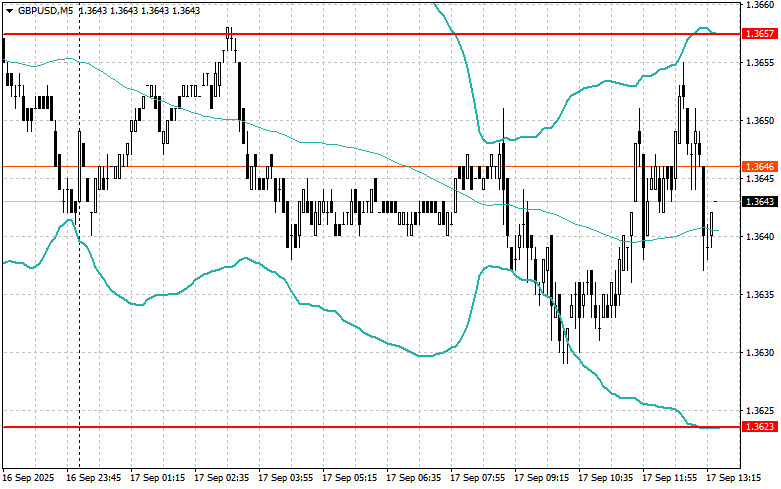

UK inflation data also did not change the balance in GBP/USD, as the results matched economists' forecasts.

In the second half of the day, the Fed is expected to cut the interest rate, most likely by a quarter point. But more important are the projections to be published. The rate cut, though anticipated, is only a small part of the complex puzzle traders have to solve. The true key lies in the details—in the carefully worded statements in the minutes, in subtle hints about future actions, and in the individual forecasts of committee members. Every word from Chair Powell will be examined under a microscope, and every change in the economic projections will trigger speculation. The market seeks clarity: does the Fed intend to continue a dovish easing policy, or was this a one-off step?

In addition, it is important to consider the geopolitical environment. Trade wars, political instability, and the unpredictability of global economic processes add uncertainty, forcing the Fed to act cautiously and flexibly. Will the U.S. regulator be able to balance domestic economic needs and external shocks, or will its actions lead to undesirable consequences? It remains to be seen.

In the case of strong statistics, I will rely on the Momentum strategy. If the market shows no reaction to the data, I will continue to use the Mean Reversion strategy.

Momentum strategy (breakout) for the second half of the day:

For EUR/USD

For GBP/USD

For USD/JPY

Mean Reversion strategy (return) for the second half of the day:

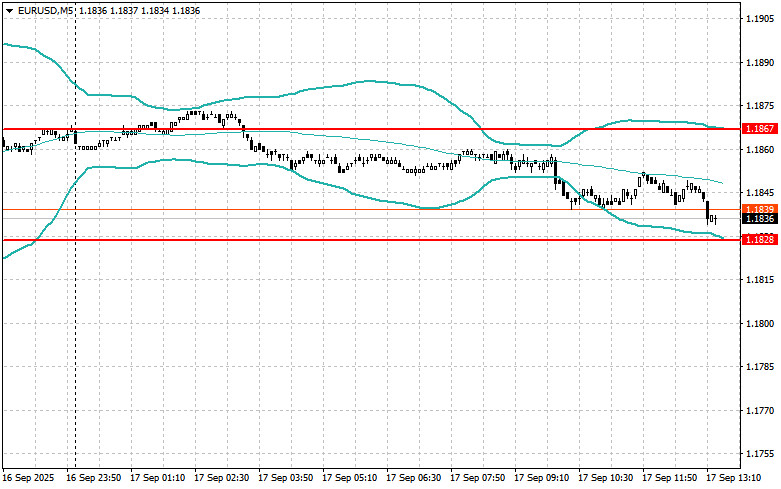

For EUR/USD

For GBP/USD

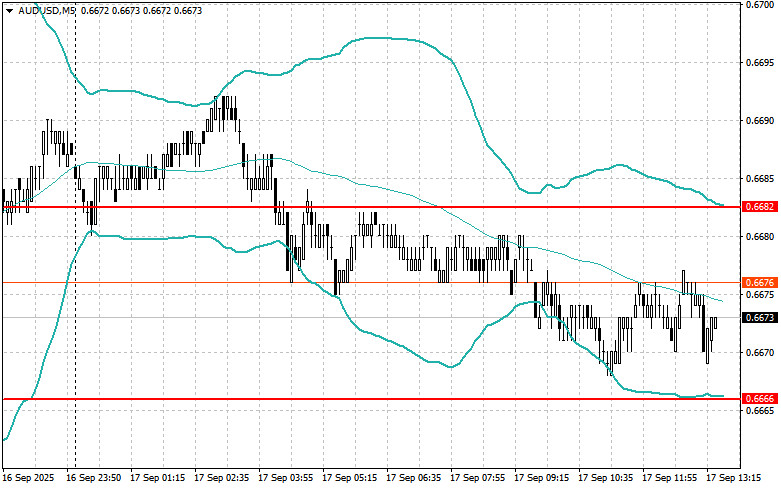

For AUD/USD

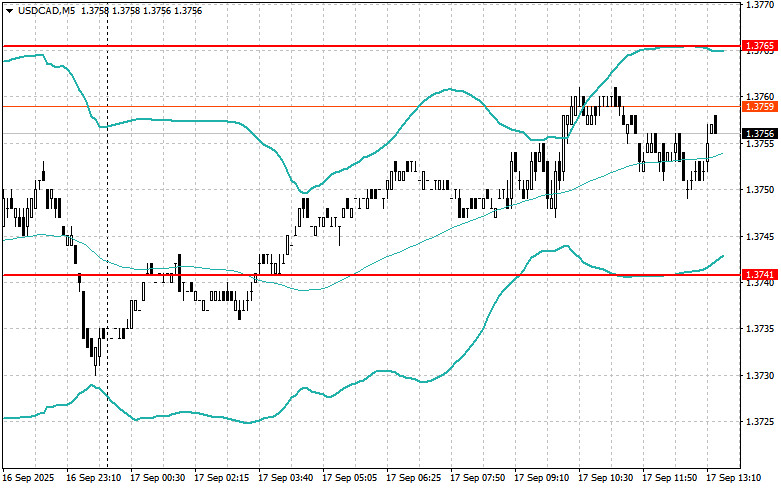

For USD/CAD

ລິ້ງດ່ວນ