Vedení společnosti Mercedes v pondělí oznámilo, že společnost rozšíří výrobu SUV GLC pro severoamerický trh ve svém závodě v Tuscaloose v Alabamě.

Na začátku tohoto měsíce německý výrobce automobilů oznámil, že v roce 2027 uvede do alabamského závodu nový model, který „prohloubí náš závazek vůči USA“.

Zahraniční automobily jsou hlavním terčem globální obchodní války prezidenta Donalda Trumpa. Na začátku dubna zavedla Trumpova administrativa 25% cla na dovoz vozidel.

Mercedes GLC se vyrábí v závodě v německém Brémách, kde se celkově vyrábí 10 modelů.

Mluvčí Mercedesu v pondělí uvedl, že „ve střednědobém horizontu se neočekávají žádné významné změny v průměrných celkových výrobních číslech v Brémách. Brémy budou i nadále vyrábět model GLC pro zbytek světa“ a závod v Alabamě „bude lokalizovat výrobu modelu GLC pro poptávku v Severní Americe“.

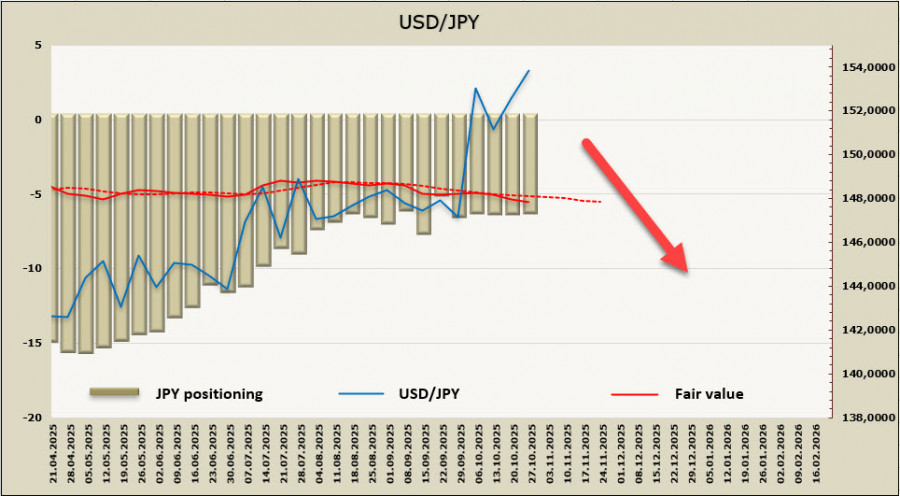

The Bank of Japan, as expected, made no changes to its monetary policy during the meeting that concluded on October 30, and the yen weakened against the dollar.

The explanations for this indecision were the same as before – uncertainty in the US economy due to a lack of data from the shutdown, as well as the complexities of wage negotiation assessments. All of this has long been factored into the markets, and the real reason for the pause in rate hikes, especially against the backdrop of a noticeable rise in inflation in October, appears to be more complex. Bank of Japan Governor Ueda needs more time to align monetary policy with the position of the Takahichi government, and it seems that the Bank ran out of time. Ueda did not provide any guidance about future actions during the press conference and avoided direct comments regarding Prime Minister Takahichi's stance on monetary policy or the timing of a meeting with her, limiting himself to general statements about the importance of maintaining close dialogue.

The market interpreted Ueda's comments as dovish, which logically led to a decline in the yen's exchange rate against the dollar.

Now, expectations for the rate will shift to December, and there is still time to align the BoJ and the government's positions. The economy appears confident, with industrial production in September remaining at high levels despite the US imposing higher tariffs, while inflation is again on the rise and demands a response. The nationwide index rose in September from 2.7% year-on-year to 2.9%, and the core index excluding food prices also increased. Right after the BoJ meeting, inflation data for the Tokyo region for October was published, showing an even more significant rise from 2.5% to 2.8% year-on-year, with all indicators, both core and basic, increasing.

The calculated price in the absence of CFTC data is directed downwards, but this indicator can be trusted only conditionally, as it is based on incomplete data. Nevertheless, it can be assumed that there is no basis for a rapid rise in USD/JPY yet, and the increase in October is close to a correction.

A week earlier, we noted that the BoJ might postpone raising rates, while the Federal Reserve could adjust its rate-cut schedule, which could lead to a weakening of the yen. This is precisely what happened, and the yen reached strong technical resistance at 154.00/20, which it has not yet managed to break through. If growth does continue, the yen could weaken all the way to 158.80, as there are no significant resistances until that level. However, this scenario appears less likely than a decline to the support zone of 150.80/151.20, as Japan seems to be unable to avoid further inflationary growth. If the BoJ continues its wait-and-see policy, market confidence in a rate hike in December will strengthen in the coming days.

ລິ້ງດ່ວນ