Inflace v eurozóně minulý měsíc klesla pod cíl Evropské centrální banky, jak ukázaly úterní údaje, což podpořilo očekávání dalšího snížení úrokových sazeb v tomto týdnu, i když globální obchodní napětí vyvolává dlouhodobější cenové tlaky.

Inflace spotřebitelských cen ve 20 zemích eurozóny se v květnu zpomalila na 1,9 % z 2,2 % v předchozím měsíci, což je pod očekáváním 2,0 % díky poklesu cen energií a prudkému poklesu inflace služeb.

Podle statistického úřadu EU Eurostat se mezitím zpomalil i pozorněji sledovaný údaj o jádrové inflaci, tedy inflaci bez cen volatilních paliv a potravin, a to z 2,7 % na 2,3 % v důsledku zpomalení růstu cen služeb z 4,0 % na 3,2 %.

ECB od loňského června sedmkrát snížila úrokové sazby a další krok ve čtvrtek je téměř zcela započítán v cenách vzhledem k mírnému růstu mezd, poklesu cen energií, silnému euru a vlažnému hospodářskému růstu, což jsou faktory, které všechny směřují k uvolnění inflace.

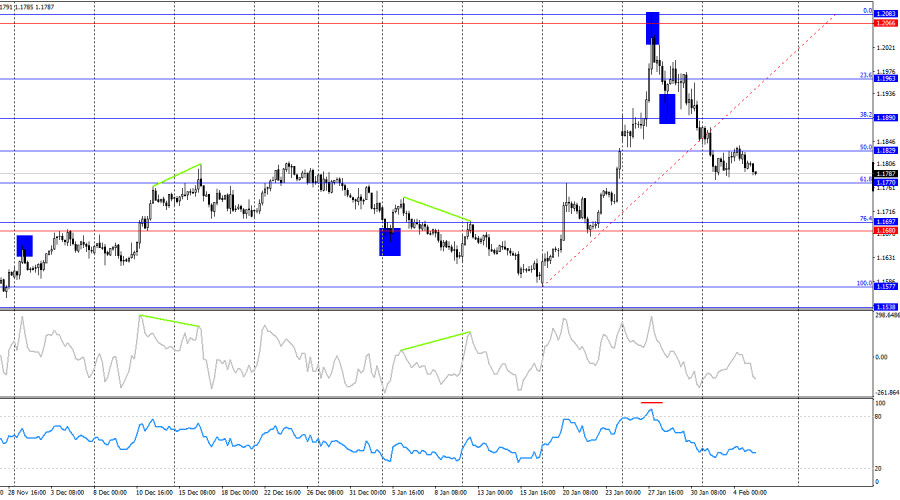

Throughout Wednesday, the EUR/USD pair continued to trade within the range of 1.1769–1.1829. Therefore, I would consider new trades only after quotes break out of this range. A consolidation of the pair below the Fibonacci level of 61.8% at 1.1769 would favor the U.S. dollar and a continuation of the decline toward the levels of 1.1696 and 1.1645. A consolidation above the 50.0% corrective level at 1.1829 would allow expectations of a resumption of growth toward the levels of 1.1888 and 1.1963.

The wave situation on the hourly chart remains straightforward. The last downward wave did not break the low of the previous wave, while the last upward wave broke the previous peak. Thus, the trend remains bullish. The bulls have taken a short pause within a large-scale offensive that might not have happened without Donald Trump. Trump has heated up the situation in the world and within the United States to the limit, and markets continue to react by fleeing from the risky U.S. currency with uncertain economic prospects.

On Wednesday, the economic background caused no emotional reaction among traders, despite the importance of the published ADP and ISM reports in the U.S., as well as inflation data in the EU. It is precisely the inflation report that is making bullish traders hesitant ahead of the ECB meeting, which will take place today in just a few hours. Consumer price inflation in the euro area continues to slow, which could bring back a monetary easing program. This is what Christine Lagarde is expected to tell the markets today. If the ECB president focuses on weak inflation and the strength of the European currency, traders may interpret this as hints of future interest rate cuts. In that case, bears would certainly launch new attacks. However, in my view, bulls still have a more attractive foundation for their advance. It seems that the pause in the dollar's decline will be temporary. Weakness in the U.S. labor market shown by this week's ADP report may also force the Fed to return to monetary easing.

On the 4-hour chart, the pair rebounded from the 50.0% corrective level at 1.1829 and resumed its decline toward the corrective levels of 61.8% at 1.1770 and 76.4% at 1.1697. A rebound from the 1.1770 level today would favor the European currency and some growth toward 1.1829 and 1.1890. No emerging divergences are observed today on any indicator.

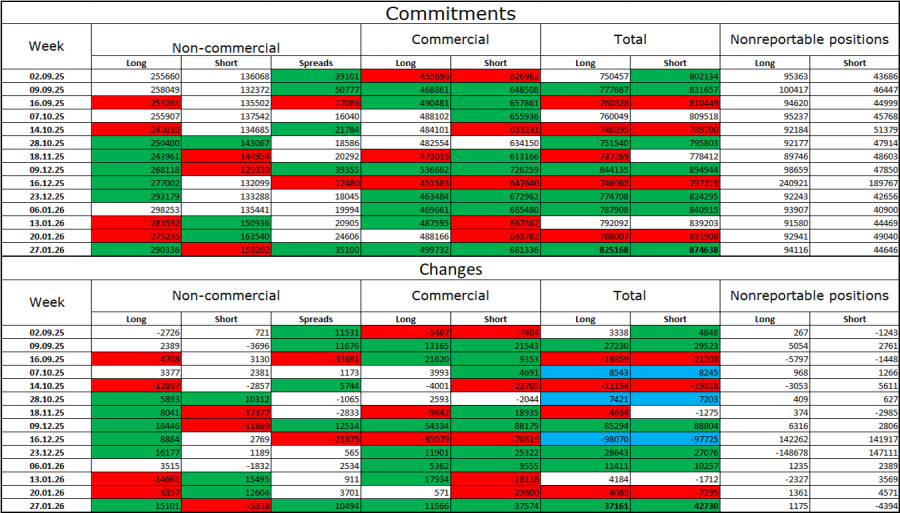

Commitments of Traders (COT) Report:

During the last reporting week, professional market participants opened 15,101 long positions and closed 5,338 short positions. Sentiment in the "Non-commercial" group remains bullish thanks to Donald Trump and his policies, and continues to strengthen over time. The total number of long positions held by speculators now stands at 290 thousand, while short positions amount to 158 thousand. This is almost a twofold advantage for the bulls.

For thirty-three consecutive weeks, large players were getting rid of short positions and increasing long positions. Then the "shutdown" began, and now we are observing the same picture: professional traders continue to build long positions. Donald Trump's policies remain the most significant factor for traders, as they create numerous problems that will have long-term and structural consequences for the United States—for example, deterioration in the labor market and a decline in global reputation. Traders also fear a loss of the Fed's independence in 2026 and Donald Trump's geopolitical ambitions.

News Calendar for the U.S. and the European Union:

On February 5, the economic events calendar contains four entries, among which Christine Lagarde's speech after the ECB meeting stands out. The impact of the news background on market sentiment on Thursday may be present.

EUR/USD Forecast and Trading Advice:

Selling the pair is possible today if it closes below the 1.1769 level on the hourly chart, with targets at 1.1696 and 1.1645. Buying will become possible if it closes above the 1.1829 level on the hourly chart, with targets at 1.1888 and 1.1963.

Fibonacci grids are built from 1.1805–1.1578 on the hourly chart and from 1.1577–1.2083 on the 4-hour chart.

ລິ້ງດ່ວນ