A test of the 149.97 level occurred at a time when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upside potential.

The U.S. dollar regained part of its ground against the Japanese yen; however, the overall trend remains in favor of yen strength. The fact that the Federal Reserve plans to continue aggressively cutting interest rates puts pressure on the dollar and supports demand for the yen, which is currently of particular interest to traders.

Considering the macroeconomic situation in the United States and statements from the Federal Reserve, the dollar is unlikely to regain lost ground in the long term. The absence of fresh U.S. economic data due to the ongoing government shutdown is adding to market uncertainty. Meanwhile, the yen continues to attract investor interest as a safe-haven asset amid global instability.

Overall, the outlook for the USD/JPY pair remains bearish and is largely dependent on numerous factors, including the monetary policy stance of the Federal Reserve and the Bank of Japan, the economic situation in both countries, and political risks surrounding Japan's new prime minister.

For intraday trading, I plan to rely primarily on Scenarios 1 and 2.

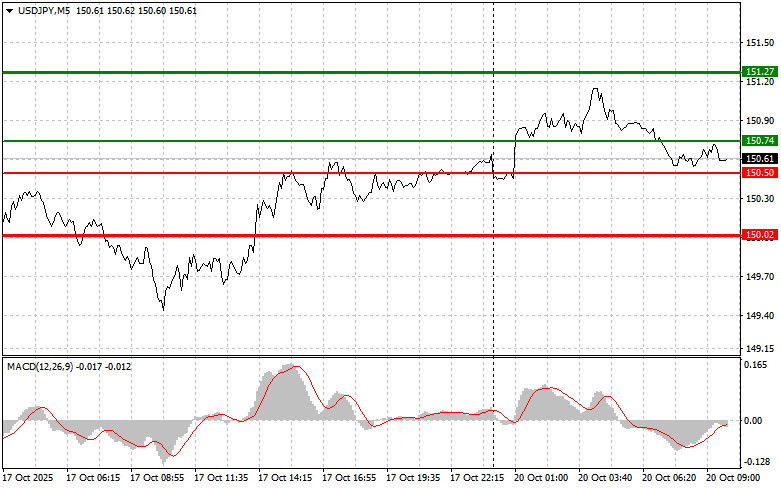

Scenario 1: I plan to buy USD/JPY today upon reaching the entry point around 150.74 (green line on the chart), targeting a rise to 151.27 (thick green line on the chart). Near the 151.27 area, I intend to exit long positions and open shorts in the opposite direction, aiming for a 30–35 pip corrective movement from that level. It's best to return to buying the pair during corrections and on significant pullbacks. Note: Before buying, make sure that the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario 2: I also plan to buy USD/JPY today if there are two consecutive tests of the 150.50 level while the MACD is located in the oversold zone. This setup will likely limit downside potential and trigger a reversal to the upside. Expected targets are 150.74 and 151.27.

Scenario 1: I plan to sell USD/JPY only after a breakout below 150.50 (red line on the chart), which could trigger a rapid decline in the pair. The key target for sellers will be the level of 150.02, where I plan to exit shorts and immediately open long positions in the opposite direction, aiming for a 20–25 pip bounce. The higher the sell entry, the better. Note: Before selling, confirm that the MACD is below the zero mark and just beginning to decline.

Scenario 2: I will also consider selling USD/JPY today if the price tests the 150.74 level twice in a row while the MACD is in overbought territory. This restricts the pair's upside potential and could lead to a reversal downward. Expected targets are 150.50 and 150.02.

Important Notice for Beginner Traders:

Beginner Forex traders must be extremely cautious when entering the market. It is best to stay out of the market before the release of important fundamental reports to avoid sharp price moves. If you choose to trade during news events, always place stop-loss orders to minimize losses. Without stop-loss protection, you risk quickly losing your entire deposit—especially if you lack proper money management and use large trade volumes.

Always remember that successful trading requires a clear trading plan, such as the one presented above. Making spontaneous trading decisions based on the current market situation is a losing strategy for intraday traders.

PAUTAN SEGERA