Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

Globální obchodní válka, kterou vyvolal americký prezident Donald Trump, se začátkem tohoto měsíce zintenzivnila poté, co oznámil zavedení rozsáhlých cel na většinu amerického dovozu, což vyvolalo obavy z recese, způsobilo nervozitu na světových finančních trzích a vyvolalo odsouzení ze strany lídrů po celém světě.

Dne 2. dubna, který Trump nazval „Dnem osvobození“, představil svůj plán zavést základní 10% clo na veškerý dovoz do Spojených států a také vyšší „reciproční“ cla na některé z největších obchodních partnerů země.

Základní 10% cla vstoupila v platnost 5. dubna, zatímco vyšší reciproční sazby budou účinné od 9. dubna.

Nová americká cla představují nejvyšší obchodní překážky za více než sto let.

US stock indices closed lower yesterday, extending recent losses. The S&P 500 dropped by 0.79%, while the Nasdaq 100 fell 0.92%. The industrial Dow Jones index retreated by 0.94%.

Asian indices showed modest gains after President Donald Trump signaled a willingness to continue trade negotiations, providing a brief reprieve to markets following the imposition of new tariffs on several countries. Investors welcomed the hint at a diplomatic solution, though caution persists due to the unpredictability of US trade policy. This fleeting optimism, however, should not obscure the broader picture: the newly imposed tariffs are already disrupting global supply chains and weighing on economic growth. Companies are reevaluating their strategies and seeking alternative suppliers, injecting further uncertainty into the market environment.

In the short term, investors will closely monitor any signals indicating progress in trade talks. Positive developments may trigger a relief rally, while signs of stalemate could reignite another wave of selloffs.

Indices in Japan and South Korea, both of which were hit by increased tariffs yesterday, managed to rise, while the broader Asian index climbed 0.3%. The South Korean won strengthened, and the US dollar index declined by 0.2%. The euro gained 0.3% amid expectations that the US will propose a tariff deal to the European Union with a baseline rate of 10%.

Late Monday night, President Trump reiterated his openness to continued negotiations and announced a delay in tariff hikes at least until August 1, easing some of the market's anxiety. Clearly, investors are now treating the latest tariff declarations as a negotiation tactic rather than a final policy stance.

The current spotlight is on the European Union, which is racing to reach a preliminary trade agreement with the US by the end of the week. Such a deal would lock in a 10% tariff rate after the August 1 deadline. According to media reports, the US proposal includes maintaining the 10% base rate while offering exemptions for sensitive sectors.

This offer marks a clear step forward compared to the looming threat of a full-scale trade war that has been casting a shadow over the European economy. However, the key issue remains: which sectors will be deemed "sensitive" and thereby exempt from the new tariffs? The answer will directly determine the agreement's impact across various European industries. Agriculture, automotive manufacturing, and metallurgy are traditionally among the most vulnerable sectors in trade disputes and will be closely scrutinized by market analysts.

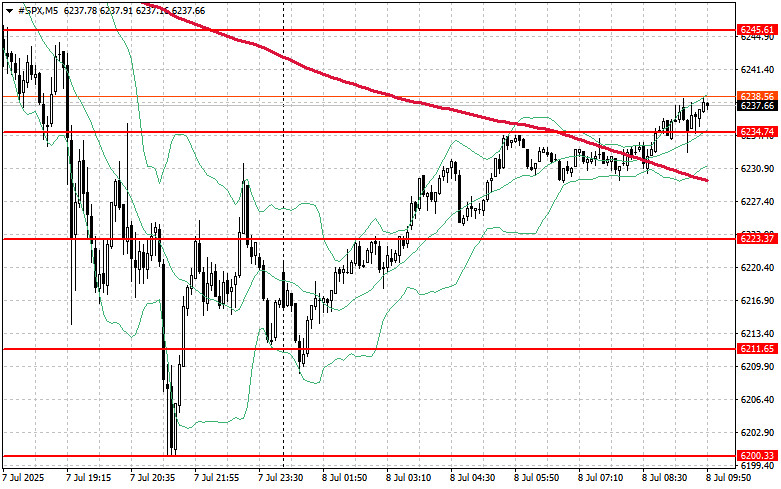

As for the technical outlook on the S&P 500, buyers face a clear objective today: to break above the immediate resistance level of $6,245. Achieving this could pave the way for a push toward $6,257. Another critical milestone would be gaining control over $6,267, which would further strengthen the bullish case. On the downside, if risk appetite weakens and the index drops, bulls must assert themselves near the $6,234 level. A break below that could quickly send the index down to $6,223, opening the door to a further decline toward $6,211.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

فوری رابطے