Praha – Ve třetím pilíři penzijního připojištění na konci letošního prvního čtvrtletí spořilo a investovalo přes 3,948 milionu účastníků, což bylo o 34.000 méně než na konci roku. ČTK po tom informovala Asociace penzijních společností ČR. V doplňkovém penzijním spoření podle ní investovalo 2,038 milionu účastníků, o 38.000 více než na konci roku 2024. Ve starém penzijním připojištění, do kterého se více než deset let nedá vstoupit, zůstalo 1,91 milionu lidí. Letošní pokles činí 72.000 účastníků.

America made a mistake when it initiated a trade war against China. China made a mistake when it not only chose to defend itself but also adopted an aggressive approach. Is this accurate, and who is more right in this situation?

In reality, China's retaliatory measures, aimed at strengthening Beijing's negotiating position in its confrontation with Washington, cannot be deemed incorrect. They are logical and consistent. China did not want to follow the path of the European Union, which silently agreed to a "captive" deal that favored the US while leaving Europe with nothing. The well-fed and peaceful EU, which excels at "expressing concern" and "strongly condemning," wanted to avoid conflict with Donald Trump. In China, it is understood that they need to play on equal footing with America and respond to aggression with aggression.

Therefore, several months ago, Beijing decided to impose restrictions on the export of rare earth metals, on which almost all technological production worldwide depends. It remains unclear against whom exactly these export restrictions were intended: against everyone or just the US? I lean toward the latter option, as why would China want to sour relations with Europe for no reason? However, the media presented this information as a "general ban," and the White House, which loves to use other countries as cover in any confrontation, reinforced this narrative in investors' minds.

According to the White House, China has challenged the entire world and started to blackmail it, while it was Washington that "squelched these godless attempts to dictate terms." But if China and the US have come to an agreement, what about the other countries? Will the "export control of rare earth metals" be enforced against them? There is no information on this from the media, so I tend to believe that the restrictions were meant to affect only America.

The US Treasury Secretary stated this week that Beijing made a significant error by threatening to halt rare earth metal supplies. According to him, this issue will hang over America for 12-24 months, after which the country will secure alternative supplies. Remember that Trump's and his followers' words should be somewhat downplayed to understand the actual state of affairs? China controls up to 90% of all rare earth metal production in the world. Which countries does America plan to use to fill the "Chinese gap"?

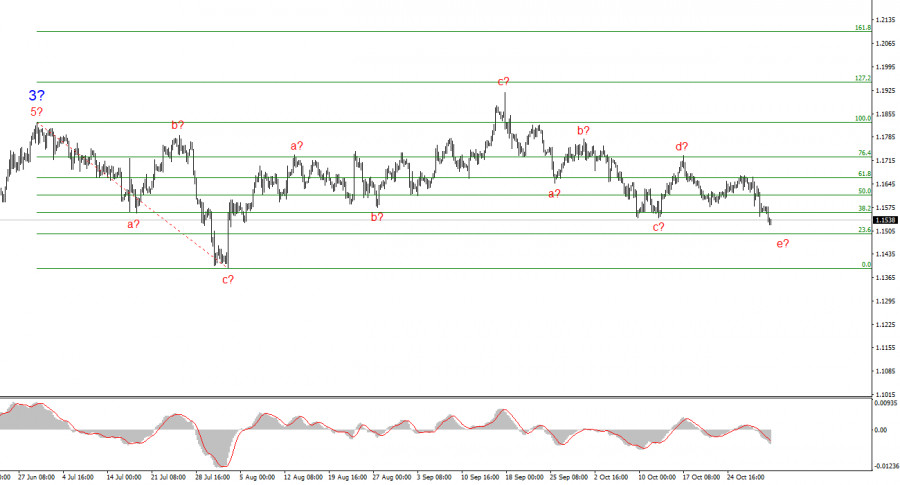

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to develop an upward segment of the trend. Currently, the market is in a pause, but Donald Trump's policies and the Fed's remain significant factors in the future depreciation of the American currency. The targets for the current segment of the trend could reach the 25-figure. At present, we can observe the formation of corrective wave 4, which is taking on a highly complex, elongated form. Therefore, in the near term, I will continue to consider only buys, as any bearish structures appear corrective. The last structure – a-b-c-d-e – may be nearing completion.

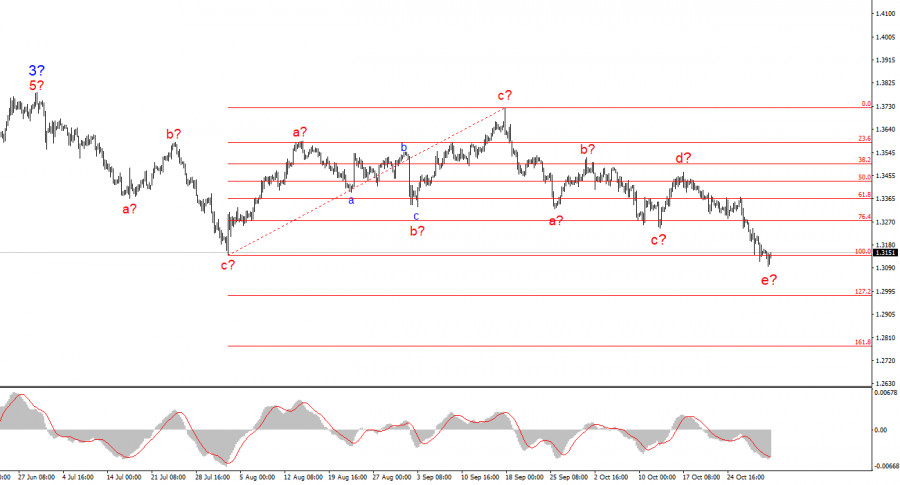

The wave structure of the GBP/USD instrument has changed. We continue to deal with an upward, impulsive part of the trend, but its internal wave structure is becoming more complex. Wave 4 exhibits a three-wave structure and is significantly more extended than wave 2. Another bearish corrective structure is nearing completion. I continue to expect the main wave structure to resume construction, with initial targets around the 38 and 40 figures, and I believe this could happen as early as the beginning of November.

فوری رابطے