For gold enthusiasts, the glass is always half full. When asked why the precious metal hasn't yet surged to $4,000 per ounce, they turn the question around: why hasn't it fallen below $3,000? The insatiable appetite of central banks for bullion, the Federal Reserve's eventual need to cut the federal funds rate, a cooling U.S. economy, and a weaker dollar allow XAU/USD bulls to keep hoping for a comeback.

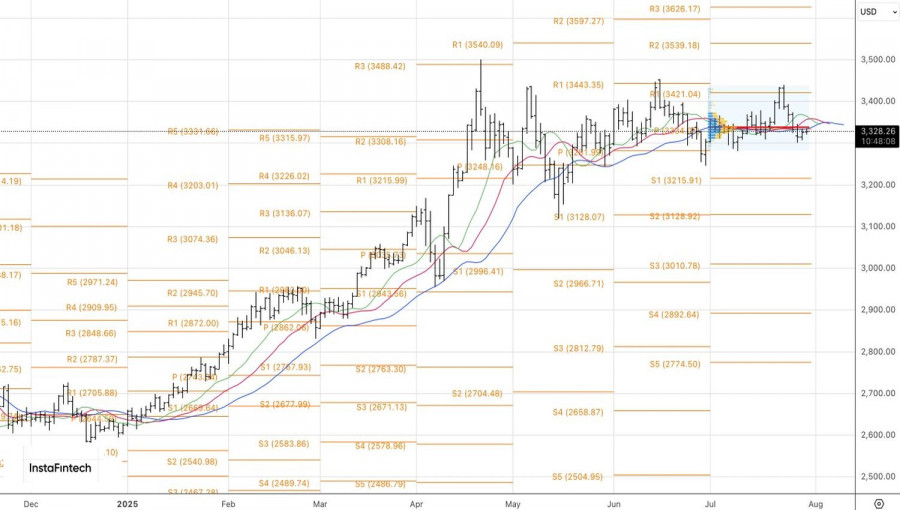

Despite gold's inability to hold above the upper boundary of its medium-term consolidation range of 3,250–3,400 dollars per ounce and its retreat toward the lower boundary, asset managers have increased net long positions in the precious metal to their highest levels since April. According to Fidelity International, XAU/USD quotes could climb to 4,000 by the end of next year. The firm notes that although doomsday scenarios like a U.S. recession have been avoided, the outlook for the American economy remains gloomy.

Tariffs are taxes—specifically, taxes on American consumers. History shows that they always have a negative impact on the economy. As a result, markets will eventually return to the idea of selling the U.S. dollar and expecting lower federal funds rates. The real question is: how long can the U.S. economy remain resilient?

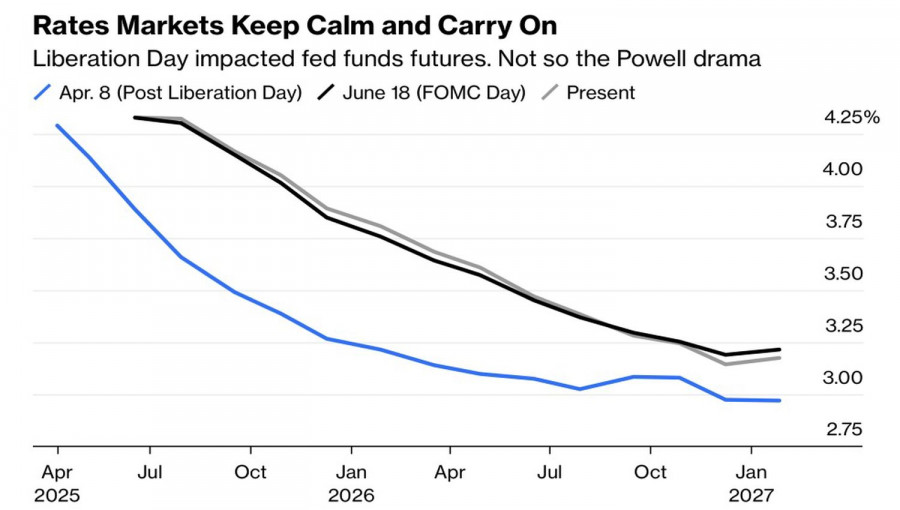

For now, things are going well, and Donald Trump is perceived as the victor in the trade wars. As such, the USD index will continue to rise. Especially since the deepest rift within the FOMC since 1993 is unlikely to push the central bank toward resuming a cycle of monetary easing. Even if Trump-appointed officials like Christopher Waller and Michelle Bowman vote for a rate cut, the others likely won't support it. Futures markets currently expect two Fed rate cuts in 2025, but these expectations may be overblown.

Let's not forget about trade wars—Trump has managed to avoid them for now. But how long will this trade peace last? If the conflict escalates, it would provide support for gold.

Thus, the short-term outlook for gold appears bearish, but in the medium term, the precious metal may rise from the ashes. If U.S. GDP for Q2 does indeed expand by the 2.9% forecast by the Atlanta Fed's leading indicator, and the Fed signals no rate cuts in September, the U.S. dollar will strengthen—bad news for XAU/USD.

Technically, on the daily chart, gold remains within the 3,250–3,400 dollar consolidation range. There is a fierce battle underway for the fair value of 3,335 dollars. A rejection followed by a drop below support levels, including moving averages, would justify selling the metal. Conversely, a breakout would keep it trading within the range.

LINKS RÁPIDOS