On Friday, the EUR/USD currency pair made a sharp "surge," turning the trend upward. The market had been waiting all week for Jerome Powell's speech at the Jackson Hole symposium, and when it finally happened, traders could not ignore the event. As we mentioned earlier, the Federal Reserve Chair did not deliver any unexpected or sensational information. In his remarks, Powell managed both to allow for a rate cut in September (which the market was already expecting without him) and to cast doubt among participants about the central bank's readiness to lower the rate in September. Powell made it clear that inflation remains the Fed's key indicator, not the labor market. Thus, if inflation continues to rise, the focus will likely be on keeping the key rate unchanged. For this reason, the collapse of the U.S. dollar looks rather strange. However, as we have said many times, the dollar doesn't need much for a new decline. The market receives a formal reason to sell the U.S. currency and seizes it fully. The uptrend of 2025 remains in place, so further dollar weakness should be expected.

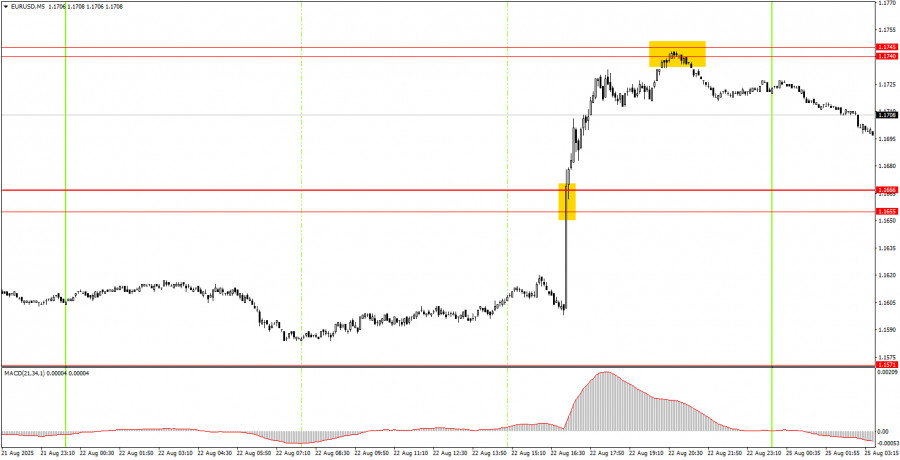

On the 5-minute timeframe on Friday, two good trading signals formed. First, the pair confidently broke through the 1.1655–1.1666 area, and then it accurately tested and rebounded from the 1.1740–1.1745 area. Thus, novice traders could easily work through both signals. Both trades would have been profitable.

On the hourly timeframe, the EUR/USD pair has every chance to continue the uptrend that has been forming since the start of this year. The flat phase is over, and a new upward movement is forming, while the fundamental and macroeconomic background remains unfavorable for the U.S. dollar. Therefore, as before, the dollar can only count on technical corrections.

On Monday, EUR/USD may trade with low volatility since there will be few events today. Thus, trading today should be based solely on technical factors from nearby price areas.

On the 5-minute timeframe, the following levels should be considered: 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1552–1.1563–1.1571, 1.1655–1.1666, 1.1740–1.1745, 1.1808, 1.1851, 1.1908. No important reports are scheduled in the Eurozone or the U.S. for Monday. There will be nothing significant to focus on today.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

LINKS RÁPIDOS